Mark Dynamics Indonesia: An Attractive Investment?

"Pandemic-Fueled Growth"

Table of Contents

- 1 Setting The Stage

- 2 Enter: Mark Dynamics

- 3 Highlights

- 4 Risks and Challenges

- 5 What Factors will Increase MARK's Earnings?

- 6 Price and Valuation

- 7 Closing Remarks

- 8 Stock Research And Analysis

- 9 Financial Statements

- 10 Disclaimer & Disclosure

Let’s delve into what has been driving the stellar performance of Mark Dynamics Indonesia, as well as the risks and challenges the company faces. Then, we’ll look at the factors that can increase earnings in the future, and finally derive the intrinsic value of the company.

Setting The Stage

As a result of the COVID pandemic, everyone around the world has experienced a multitude of problems. Travel restrictions, lockdowns, and Zoom meetings have become the norm in society.

Factories shutting down production and supply chain issues have caused shortages of a wide range of products, from computer chips to various medical supplies such as PPE, ventilators, and oxygen tanks. Masks were notoriously difficult to get in the early months of the outbreak.

Another medical item — an essential one for medical workers treating patients — were gloves, which have been in short supply around the world.

MARGMA, (Malaysian Rubber Glove Manufacturers Association) estimates that in 2020, the global demand for gloves hovered around 460 billion pieces, while manufacturers were only able to supply 360 billion pieces.

As gloves are a necessity for medical workers (with many using two pairs at once and switching the outer pair with every new patient), demand for gloves have continued to increase greatly in 2021 and will likely continue to increase at a similarly high rate until the pandemic subsides.

While the COVID pandemic may soon transition to an endemic, there remains the possibility for new strains of the virus to emerge. As we have seen with Delta and Omicron, new variants have a chance of triggering more waves of infections, which would induce spikes in demand for PPEs.

Similarly, experts predict that the use of gloves will rise not just in the medical space, but also in cafes and restaurants as hygiene has become more important than ever. Thus, protective measures such as wearing masks and disposable gloves would probably continue to be implemented indefinitely.

Enter: Mark Dynamics

PT. Mark Dynamics Indonesia Tbk. is a manufacturer of ceramic hand formers and was established in 2002, initially operating a single factory with an output of 50,000 units per month.

These hand formers are molds needed to produce gloves and MARK is the sole manufacturer of hand formers in Indonesia. Since its founding, the company has grown to be the largest producer of hand formers in the world, with a 50% market share in nitrile glove hand formers.

As of August 2021, MARK operates three factories: one with an output of 610,000 units per month, a second with an output of 590,000 units per month, and a third that can currently produce 400,000 units/m. The company is expanding this third site and plans for it to reach an output of 610,000 units/m.

Each of the ceramic hand formers that MARK produces can be used to manufacture around 10,368 gloves, meaning that glove manufacturers must keep buying hand formers to continue making gloves.

Highlights

Growing Revenues, Profits, and Margins

While many other companies have been struggling due to travel and social restrictions during the pandemic, Mark Dynamics Indonesia has benefited greatly as demand for medical gloves, and by extension hand formers, exploded and grew around 25-35% in 2020, according to MARGMA (Malaysian Rubber Glove Manufacturers Association).

Pre-Pandemic, the annual growth rate for the glove industry had been 8-10%.

Driven by shortages and rising ASPs, Mark Dynamics reported record high revenues and profits in 2020. That year, revenue grew by 56.4% YoY to IDR 565.4 billion, while net profit rose by 63.85% to 144.2 billion. Compared to 2019, where revenues grew by only 11% and net profit by just 7.44% YoY, the company’s performance in 2020 represented a vast improvement in growth.

Over the last 5 years, Mark Dynamics has performed incredibly well. Revenues grew at a 5Y CAGR of 22.23%, while its 5Y CAGR for net profits stands at an impressive 49.07%.

Continuing that performance in Q3 2021, the company’s revenue increased by 141.57% to IDR 832.1 billion, while profits increased by 203.68% YoY to 276.2 billion. According to their Public Expose, management predicts that revenues will grow by 100% and profits by 127% for the year 2021.

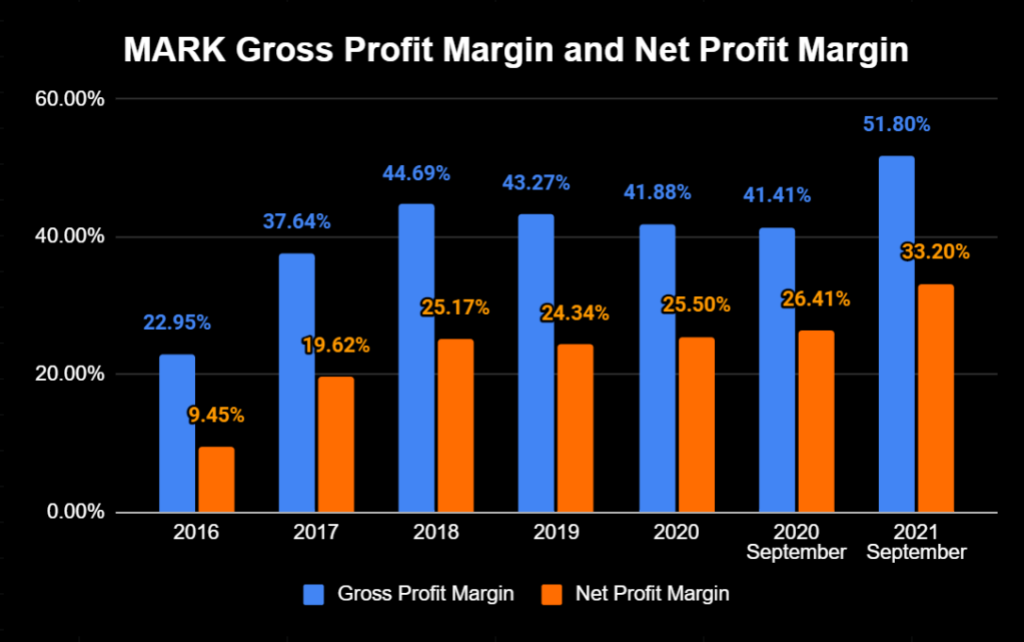

In addition to its growth in revenues and profits, the company’s margins have also risen thanks to the rising demand for PPEs during the pandemic. Gross profit margin increased to 51.8% in Q3 2021, while net profit margin rose to 33.2%.

Prior to the pandemic, the company’s margins were already great.

Although in 2016 its Gross profit margin was just around 22% and its net profit margin was a little under 10%, the company made significant advances. From 2017 to 2020, the company’s margins were consistently high. Gross profit margin ranged from 37.6% to 44.69%, while net profit margin ranged from 19.6% to 25.5%.

COVID's Positive Impact

Demand Spike Led to Shortages

As previously stated, the global demand for gloves, especially medical gloves, has risen sharply as a result of the COVID pandemic. In 2020, MARGMA estimated that global demand was around 460 billion gloves, but supply was only around 360 billion. Thus, there was a shortage of 100 billion gloves, even with many companies rushing to ramp up production.

In 2021, it is estimated that global demand would be around 500 billion gloves, with a shortage of 80 billion, as glove manufacturers are still struggling to fulfill demand. Gloves currently in production have already been bought and paid for by customers, and there is a long waiting line, despite manufacturers producing at 100% capacity.

Notably, experts estimate that the shortages experienced in the glove industry will only subside after 2022. Even after the pandemic is over, demand for gloves is expected to grow at a rate of 12-15% per annum, higher than pre-pandemic rates of 8-10%. Among the factors that would drive this higher growth rate is the likely increase in glove usage for businesses such as Cafes and Restaurants.

More recently, MARGMA has clarified that it expects demand for gloves in 2022 and 2023 to be 10-15% higher than during pre-COVID levels, but states that demand in 2020 and 2021 “was extraordinary.” Additionally, it expects glove ASPs to stabilize in Q2 2022.

For Mark Dynamics Indonesia, this demand spike for gloves has also meant increased demand for hand formers, which are the molds used to produce gloves. As a prominent manufacturer of hand formers, Mark Dynamics was well positioned to benefit from the sudden growth in demand in 2020 and 2021.

High Demand Increased Average Selling Prices

According to their 2020 Annual Report, MARK’s ASP for their hand formers rose by around 15% in 2020 due to the increased demand caused by COVID. This demand was not limited to exports, as domestic sales in 2020 went up by 494% YoY from IDR 21.5 billion to IDR 127.6 billion (though this figure also includes sales from MARK’s subsidiaries, which do not sell hand formers).

Largest Production Capacity in the World

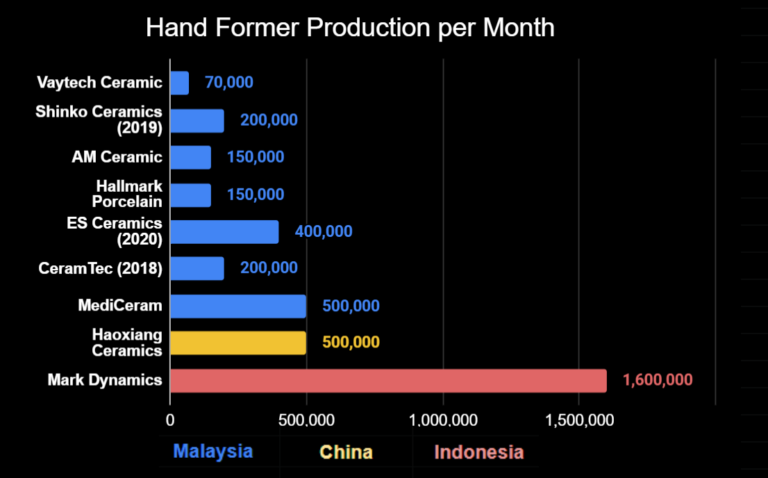

[the graph above shows some of the largest companies in the industry, by production capacity. There are Malaysian SME manufacturers not listed on the graph, each with estimated production capacities of 10,000 to 100,000 per month, however it’s hard to say how many of these companies there are. ]

To capitalize on the COVID-induced demand boom for hand formers, Mark Dynamics rapidly increased its production capacity by expanding its factories during the pandemic. Previously, the company already had an impressive production capacity of 740,000 units per month in 2020.

Being the largest company in the industry, Mark Dynamics now has a production capacity of 1.6 million hand formers per month, as of late 2021. Moreover, It is targeting a capacity of 1.8 million pieces per month by the end of 2021.

As Mark Dynamics has a production capacity more than triple its closest competitor, along with 50% market share for nitrile glove hand formers, it’s reasonable that many glove manufacturers are likely to depend on MARK to supply hand formers.

[note: some of the data on Hand Former production capacity may be outdated, but they are the most recent figures publicly available.]

However, this rapid growth in production capacity could also be considered a double-edged sword. MARK has quickly expanded its factories and almost doubled its production capacity from last year. In order to expand so quickly in so little time, it’s likely that MARK needed to borrow money.

Dividend History

Since its IPO in 2017, Mark Dynamics Indonesia has paid out dividends every fiscal year. Issued in 2021, the dividends for fiscal year 2020 were IDR 15 per share, representing a payout ratio of 40% and a yield of around 1.4% at current market prices (as of February 24, 2022).

The increase in payout ratio from 30% in fiscal year 2019 to 40% in fiscal year 2020 probably reflects the high increase in revenues and growth that Mark Dynamics experienced during the first year of the pandemic. As the company is expected to report even higher earnings growth for 2021, it’s reasonable to expect a similarly high dividend payout ratio for the year.

Assuming that MARK issues dividends for fiscal year 2021 with a payout ratio of 40% and an estimated EPS of 96.93, dividend per share would reach IDR 38.77. This would imply a yield of 3.73% at the current price of IDR 1040 per share (February 24, 2022).

Risks and Challenges

Demand May Already Be Slowing

In a recent statement, Top Glove, the largest glove manufacturer in the world, stated that it expects raw material prices for its nitrile latex gloves to fall following continued decline in demand for nitrile gloves. It added that the price of natural rubber latex has already fallen, also due to slowing demand for gloves.

Additionally, Top Glove’s revenue for its most recent quarter (which ended in November 2021) declined significantly YoY, mostly as a result of declining average selling prices for gloves. The global vaccine rollout is estimated to be the driving factor behind the fall in demand for gloves, which then led to both lower sales volume and ASPs for Top Glove.

Currently, prices for gloves have fallen to near pre-COVID levels: ASPs now range between USD 25 to 30 per 1000 pieces, compared to roughly USD 21 before the pandemic.

Stronger competition from Chinese glove makers are expected to push glove ASPs even lower in 2022, and may even eliminate the demand-supply imbalance that has been prevalent in the glove industry since the pandemic started. Perhaps as a result of this, some glove buyers are no longer stockpiling gloves as they anticipate prices to continue to decrease.

For Mark Dynamics, the decline in both the demand and average selling price for gloves is likely to reduce demand for hand formers, especially from Malaysian glove manufacturers like Top Glove. However, as Mark Dynamics have recently acquired customers from other countries, such as China, India, and the US, the increase in demand from those countries may offset potential decreases in demand from Malaysian producers.

Increase in Production Costs

[according to the MARK’s 2021 Public Expose]

Increase in Cost of Raw Materials

As the raw materials needed to manufacture hand formers account for 48% of total production costs for Mark Dynamics, their cost is perhaps the most influential factor for the company’s earnings. Significant increases in the cost of raw materials represent a major risk for MARK.

For years 2018-2020, total raw materials used have risen at a CAGR of 35.64%. In 2020, total raw material used increased by over 105% YoY, while in Q3 2021 it increased by over 138% YoY.

Some sources have stated that the price of porcelain clay, the primary raw material used to produce hand formers, have consistently increased every year as a result of rising demand for disposable gloves. However, I have not been able to find any statistics for porcelain clay prices.

Increase in Wages

After Raw Materials, Wages comprise the next largest portion of production costs for Mark Dynamics at 29%. As with raw material cost, significant increases in wages will affect the company’s earnings.

For years 2018-2020, wages (COGS) have increased at a CAGR of 16.83%. In 2020, wages (COGS) rose by over 23% YoY, while in Q3 2021, wages (COGS) rose by 93% compared to Q3 2020.

Increase in Gas Prices?

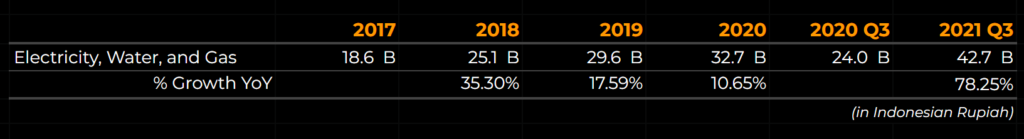

Compared to Arwana Citramulia, where energy costs accounted for 33% of production costs as of 2020, gas, water, and electricity costs form just 15% of total production costs for Mark Dynamics. Although not as influential for MARK as they are for ARNA, increases in gas prices will nevertheless affect the company’s earnings.

For years 2018-2020, electricity, water and gas costs have increased at a CAGR of 9.17%. In 2020, electricity, water and gas costs rose by 10.65% YoY, while in Q3 2021, electricity, water and gas costs increased by over 78% compared to Q3 2020.

According to this document, it seems that Mark Dynamics also benefit from the same government policy that reduced gas prices for Arwana Citramulia, as MARK also operates in the ceramics industry.

Per that document, the gas price at plant gate for Mark Dynamics is set at $6.43 USD/MMBTU for 2021-2022 and at $6.00 USD/MMBTU for 2023-2024. So barring any sudden policy changes, gas prices for Mark Dynamics should remain stable until after 2024.

Overexposure to Malaysian Market?

Malaysia - Largest Market

According to the company, around 95% of its hand formers are exported.

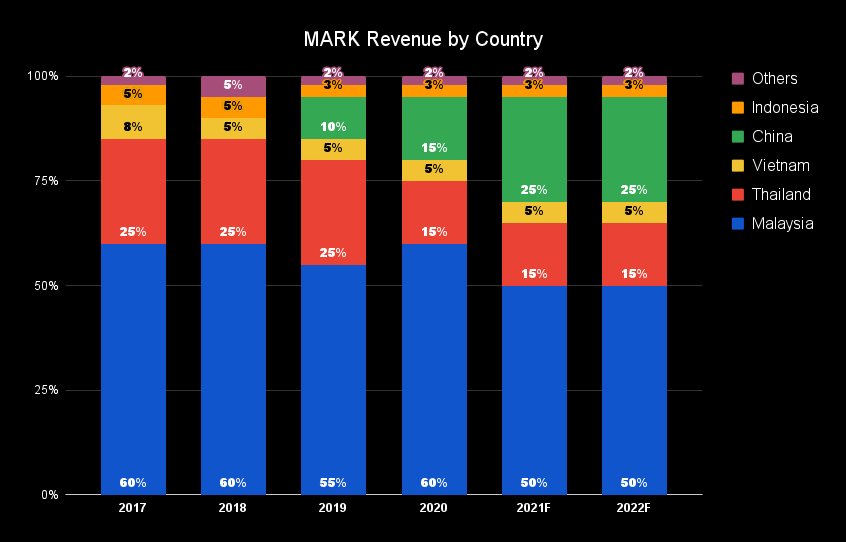

A majority of the demand for MARK’s hand formers come from Malaysia, the glove-making capital of the world and where many of MARK’s big customers are located in. The country represents 60% of MARK’s revenues in 2020, which is unsurprising considering Malaysia has around 67% market share in the gloves industry (2021).

Among the company’s Malaysian customers are Top Glove, Kossan, and Hartalega.

Top Glove, the largest glove producer in the world, holds 26% market share for rubber gloves globally and is able to produce 96 billion gloves per year (as of March 2021). Meanwhile, Hartalega is another large glove manufacturer with a production capacity of 44 billion per year (as of September 2021) and Kossan can produce 32 billion per year.

Largest Customers of Mark Dynamics

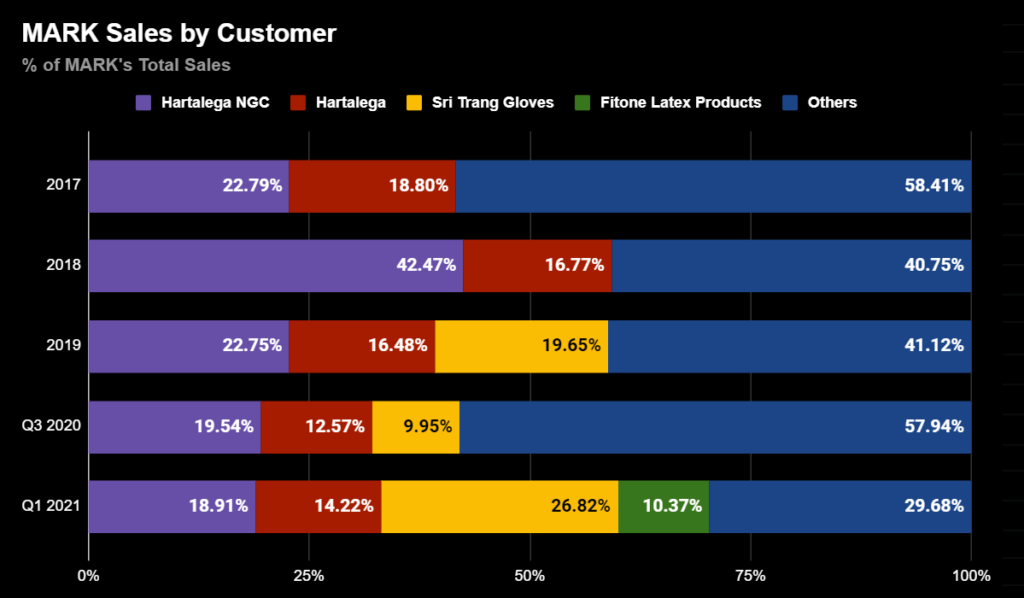

In 2019, MARK’s sales to Hartalega (Malaysian firm) comprised approximately 39% of total sales. Additionally, sales to Sri Trang Gloves (Thailand) formed 19.65% of total sales for that year.

As of Q1 2021, sales to Hartalega and Sri Trang comprised approximately 33% and 26.8% of total sales, respectively. Additionally, sales to Fitone Latex Products (China) accounted for 10.37% of total sales for that period.

As Hartalega and Sri Trang account for large parts of revenue for Mark Dynamics, the performance and health of those companies are likely to affect MARK’s earnings. Also, since Malaysia as a market represents 60% of total revenues for Mark Dynamics (as of 2020), the company’s earnings are also affected by the finances of its Malaysian customers.

US Investment Into its Domestic Glove Manufacturing Industry

In early 2021, news broke that the US will invest a substantial amount of money into its domestic personal protective equipment (PPE) manufacturing industry so that it would not need to rely on imports for its medical equipment needs.

One of the areas that it will invest into is glove manufacturing, with the US government planning to invest $500 million into setting up glove and rubber factories.

It’s important to note that while “the US is by far the biggest medical glove consumer in the world”, the country is also almost completely dependent on imports to fulfill domestic demand for gloves.

The government will subsidize the building of rubber and glove factories in the US and expects domestic manufacturers to be able to produce more than 1 billion gloves per month by the end of 2021.

Reportedly, the demand for medical gloves from the US healthcare sector is estimated to be around 24 billion gloves per year, and so the US plans for its domestic producers to be able to meet half of that demand in the future.

This news could potentially be a negative development for MARK, as it could mean less demand from the US for gloves produced by Malaysian manufacturers (and in turn, less demand for MARK’s hand formers). As stated before, Malaysian glove producers make up 60% of MARK’s revenues.

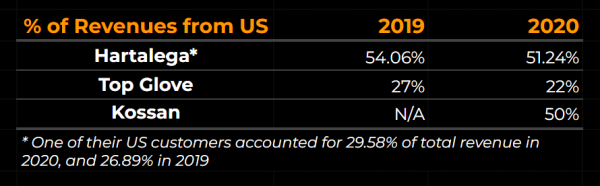

The table above shows the percentage of revenues from the US for some of the largest Malaysian glove producers, all of whom are customers of MARK. It is evident that the US is a vital market for these companies, especially for Hartalega and Kossan, and reduced demand from the US could significantly impact their revenues (and indirectly, MARK’s revenues).

Since about 51% of Hartalega’s revenues come from the US market (as of 2020) and Hartalega comprised 33% of MARK’s total revenues in Q1 2021, development of the US domestic glove industry represents an indirect risk to Mark Dynamics’ earnings.

Top Glove's import Battle with the US Government

Top Glove, an important customer of MARK, had been fighting an import battle with the US government.

On July 2020, US Customs and Border Patrol barred imports of gloves from Top Glove, saying that the company is engaging in modern-day slavery practices. Later on May 2021, US CBP began seizing gloves by Top Glove found at US ports.

In early 2021, London-based ethical trade consultant Impact Limited verified that there are currently no indications of forced labour at Top Glove, but as of May 2021, the import ban remains.

UPDATE: On September 2021, the US finally lifted the import ban on Top Glove, after the company showed that it has addressed the issues of forced labor alleged by the US CBP. However, the damage has been done, and the company’s reputation has been hit hard by the incident.

Additionally, its shares have dropped 40% since the ban and its glove production during the ban decreased. As stated before, the US market accounted for around 22% of Top Glove’s revenues in 2020, so it’s incredibly likely the ban had caused this drop in production.

It is unclear if MARK’s revenues was affected by this, and to what extent, but the event does highlight a potential risk for MARK of overexposure to Malaysian customers. If other Malaysian companies fall victim to similar import bans, it could potentially affect MARK’s revenues.

Fortunately, it seems that management is aware of this overexposure risk, as one of their current strategies is to pursue new clients in China, which would further diversify their customer base. The country is a market that represented 15% of revenues for MARK in 2020, and management expects that figure to grow to 25% in the next few years. Additionally, Mark Dynamics started exporting to the US and India in 2021, with the number of US clients set to increase from 3 to 13 in 2022.

Rising Bank Debt

As seen in the figures above, the level of debt on MARK’s balance sheet has dramatically increased in recent years, with its Debt-to-Equity Ratio rising from a low of 0.34 in 2018 to 0.76 in 2020, before falling slightly to 0.67 in Q3 2021.

The amount of bank debt rose to over IDR 162 billion in 2020, from IDR 44 billion in 2018. Then in Q3 2021, this figure increased again to IDR 183.3 B. It is in my opinion that MARK took on this debt in order to rapidly expand its production capacity during the pandemic to capture unfulfilled demand.

Additionally, MARK could have used the money it borrowed to finance the acquisitions of its new subsidiaries in 2020 and to purchase imported raw materials.

Its rapid expansions could also possibly cause minor short-term cash flow issues if the increase in revenues does not keep up with the increase in CapEx, which could lead the company to borrow more money.

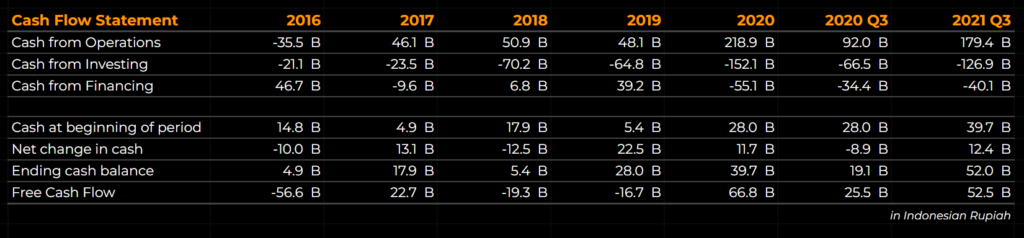

However, Mark Dynamics achieved a positive free cash flow of IDR 66.8 B in 2020, an improvement over 2018 and 2019. This was achieved despite a significant increase in CapEx.

In Q3 2021, the company has managed to reduce much of its debt, from 234 billion IDR in Q2 2021 to 183 billion in Q3, representing a reduction of 21.78%. As a result of this decrease in debt and an increase in assets, the DER has improved to 0.66x from 0.91x in Q2.

The company reported positive Free Cash Flow in Q3 of 52.5 billion IDR, a drastic improvement over previous quarters (-7 billion in Q1, and -16 billion in Q2) and YoY (25 billion IDR in Q3 2020). The company was able to achieve this despite doubling its capex, from 66.9 billion in Q3 2020 to 126.8 billion in Q3 2021.

Did MARK Expand Too Quickly?

Relevant Case Study: H1N1 and Prestige Ameritech

An interesting and relevant case study can be found in an article from FM Magazine:

“In 2009 at the height of the H1N1 flu pandemic, Texas-based Prestige Ameritech hired more workers and built new machines to increase surgical mask production. But the machines took months to complete, and by the time they were ready, the swine flu crisis had ended and demand had died out. To add to its woes, there was oversupply in the market, and hospitals didn’t buy for months. The manufacturer almost went bankrupt, NPR reported.

For many companies, production ramp-ups can be make-or-break moments. Winners are those that can act quickly to capitalise on the short but sharp demand spike.“

As previously discussed, MARK rapidly increased its production capacity during the pandemic, and it aims to be able to produce 1.8 million hand formers per month by the end of 2021. This number is around 3 times MARK’s production capacity in 2019.

But unlike Prestige Ameritech, MARK has ramped up production much more quickly and has already been reaping the rewards (In Q3 2021, the company’s revenue increased by 141% while net profit increased by 203% YoY). Additionally, demand for MARK’s hand formers remains high and the COVID pandemic has continued for nearly two years, with many uncertain as to when it will end.

It may be fair to say that MARK is one of the winners.

On the other hand, investors would be prudent to remember that the level of bank debt on MARK’s balance sheet has significantly increased during the pandemic, and those funds were probably used to finance its rapid expansions. While the debt has not ballooned out of control, it is a valid concern nonetheless.

As a reminder, bank debt increased by 41% from IDR 114.1 billion in 2019 to 162 billion in 2020. In Q2 2021, this figure increased again to 234 billion.

To its credit, MARK did manage to reduce its debt from 234 billion IDR in Q2 2021 to 183 billion in Q3, representing a reduction of 21.78%. As a result of this decrease in debt and an increase in assets, the DER has improved to 0.66x in Q3 2021 from 0.91x in Q2.

Moreover, although gloves are still in short supply, some experts believe there will be an oversupply of disposable gloves in the latter half of 2022 from Chinese manufacturers. In that case, demand for hand formers could shrink, which would most likely decrease revenues for Mark Dynamics.

As the company has succeeded in acquiring new customers from China, India, and the US, which should utilize MARK’s larger production capacity, it seems that right now its expansions were well calculated. Time will tell whether Mark Dynamics expanded too quickly.

Supply Chain Issues?

To produce its hand formers, Mark Dynamics Indonesia imports its raw materials from European countries such as the UK. Shipments of these raw materials take approximately 1 month to arrive in Indonesia.

As such, some may wonder whether the company fell victim to the supply chain woes that so many other companies experienced during this pandemic.

Fortunately, MARK’s management had been proactive during the early days of the pandemic in 2020, and increased the inventory of raw materials. Pre-pandemic, the company usually stockpiled 3 months worth of raw materials.

In anticipation of potential supply chain issues, management increased the company’s inventory to roughly 6-7 months worth of raw materials. This preventive measure has arguably saved the company from facing production halts due to insufficient materials.

Increase in Shipping Costs?

As shipping costs have risen considerably in 2021 and are expected to continue increasing this year, there is the possibility that Mark Dynamics could see its margins decrease as a result. The company pays shipping expenses to import raw materials as well as to export most of its goods to customers overseas.

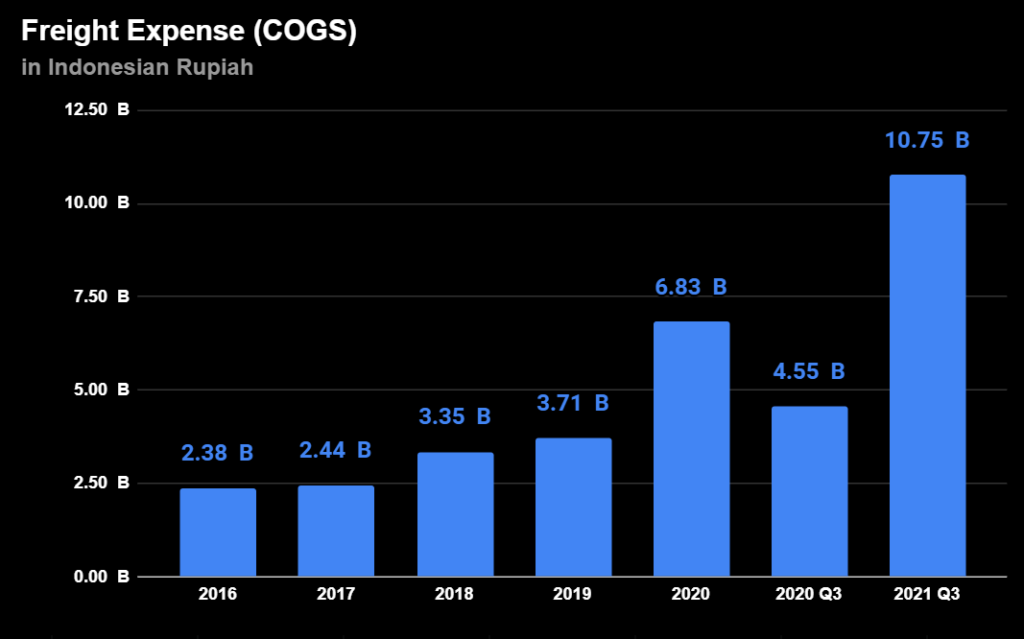

Shipping costs to import raw materials are listed in the financial statements as freight expense under COGS. Unsurprisingly, freight expenses for Mark Dynamics experienced significant increases in 2020 and in Q3 2021. In 2020, the cost increased by 84% YoY to IDR 6.83 billion, while in Q3 2021, freight expense increased by 136% YoY to 10.75 billion.

Although the rise in shipping costs likely caused some of the increase in freight expense, the increase in the amount of raw materials imported for both 2020 and 2021 (which were significant) should be taken into account.

Despite increasing significantly, freight expense form only a small part of production costs. As of Q3 2021, freight expense represents 2.63% of total production costs, far behind the largest expenses such as Raw Material Cost, Wages, and Electricity, Water, and Gas costs.

Under Operational Expenses, there are Ocean Freight Shipping and Ship Freight Forwarding. These are likely the shipping costs that the company bears to send its goods to overseas clients. While the company’s Ocean Freight Shipping costs decreased substantially in 2020 and Q3 2021, its Ship Freight Forwarding costs rose drastically.

Ship freight forwarding increased from IDR 1.29 billion in 2019 to 4.34 billion in 2020. In Q3 2021, it rose by 141.29% YoY to IDR 3.75 billion.

Similar to freight expense, ocean freight shipping comprise only 0.98% of operational expense in 2020 and just 0.3% in Q3 2021. On the other hand, the steep increases in ship freight forwarding meant that it represented 8.14% of total operational expense in 2020, up from just 3.87% in 2019.

If shipping costs continue to increase in 2022, it will likely hurt the company’s profit margins, but probably to a much smaller degree than if its larger expenses swell (raw materials, wages, etc.).

What Factors will Increase MARK's Earnings?

Expansions Overseas

Exports to China

In recent years, Chinese glove manufacturers have been switching from producing PVC gloves to making Nitrile gloves.

As one of MARK’s specialties is making hand formers for Nitrile glove production, this shift provided an opportunity for the company to expand into the Chinese market and further diversify its customer base. According to management, the company apparently won 3 new Chinese customers in 2020. Additionally, Mark Dynamics states that it has 50% market share in the hand former market for nitrile gloves.

As of 2020, China comprised 15% of revenues for MARK. Management is planning to attract more customers in China, and estimates that the country will represent around 25% of total revenues in the future.

Exports to United States

Reportedly, Mark Dynamics is set to increase its exports to the US in 2022, as it will fulfill orders from 13 US-based customers. MARK only started exporting to the US (and India) in 2021, fulfilling orders from 3 customers in that country last year.

Domestic Growth

As a result of the pandemic, Mark Dynamics had seen a tremendous growth in sales volume in 2020. COVID had driven growth in the Indonesian glove industry, which meant a sizable increase in local demand for hand formers.

In the first year of the pandemic, domestic sales had grown by 494% YoY from IDR 21.5 billion in 2019 to 127.6 billion.

In Q3 2021, exports increased to IDR 709.1 billion from IDR 300 billion in Q3 2020. This represents an increase of over 136% YoY. Meanwhile, domestic sales increased from IDR 45.7 billion in Q3 2020 to 127.6 billion in Q3 2021, growing by over 179% YoY. As such, exports formed 84.75% of total revenues.

Important Note: the figures above include sales from subsidiaries engaged in business activities other than selling hand formers. According to the management, although domestic sales of hand formers did increase significantly, exports still make up 95% of hand former sales.

Recent Acquisitions

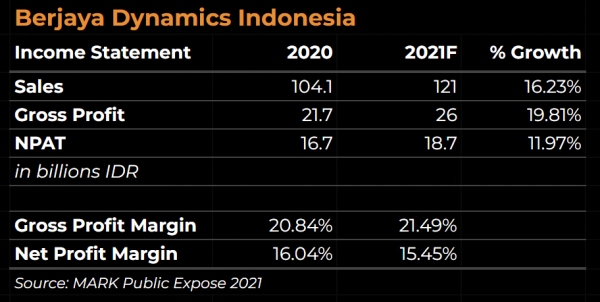

In addition to increasing their production capacity, Mark Dynamics has also recently founded a subsidiary, PT. Megah Raya Sumatera, in 2020. That same year, the company also acquired PT. Berjaya Dynamics Indonesia along with its subsidiary, PT. Agro Dynamics Indonesia.

Reportedly, the acquisition of BDI and ADI cost IDR 70 billion, while MRS cost IDR 10 billion.

MRS uses the waste generated by hand former production to manufacture goods such as toilets, while BDI distributes and markets these goods. Although ADI operates in an unrelated industry as it sells agricultural chemicals and tools, the subsidiary’s earnings growth has been fairly high in the past few years.

In fact, management hopes that these two subsidiaries will be the future of the company, as Mark Dynamics expects them to boost its growth.

Since the established/acquired subsidiaries are those that can support MARK’s main business of selling hand formers, it is in my opinion that these acquisitions make sense for the company.

Establishing MRS to manufacture toilets using waste materials from hand former production creatively kills two birds with one stone. The move allowed MARK to create a new revenue stream while also improving waste management.

Increase in Production Capacity

Although its current production capacity at 1.6 million units per month is now over 3 times that of its closest competitor, Mark Dynamics’ acquisition of new customers from countries such as China, India, and the US may prove that there is yet room left for Mark Dynamics to expand.

MARGMA estimates demand for gloves in 2022 and 2023 to be 10-15% higher than pre-COVID levels. To capture this potential increase in demand, Mark Dynamics may need to expand its production capacity even further in the future. This should translate to higher revenues and earnings.

In addition, the potential for outbreaks of other variants of the coronavirus still exist. Further outbreaks would likely increase demand for gloves, which could necessitate an increase in production capacity.

Increase in Average Selling Price

According to management, the average selling price for Mark Dynamics’ products rose by 15% in 2020, and then increased again by 15% in 2021. The increase in ASP has been cited as one of the major driving forces behind the high earnings growth that Mark Dynamics has been experiencing.

Due to the global supply shortage of hand formers, customers of Mark Dynamics have reportedly offered to pay higher prices to be placed in front of the long waiting line.

While it’s unclear if the company will increase its ASP again in 2022, especially given that demand and ASPs for Malaysian gloves have been declining, rising commodity prices may provide a reason for MARK to do so.

Cutting Costs

As raw materials form 50% of production costs for the company, reducing its cost can significantly boost earnings. In the past, Mark Dynamics has managed to cut costs by creating its own raw material mix, though I have yet to find exact numbers for how much money was saved.

There was one article on MARK’s website that stated the company reduced production costs by 15% through creating its own raw materials, but it seems that the article is no longer available.

Regardless, reductions in raw material costs, wages, and energy costs (the largest segments of Mark Dynamics’ production costs) will increase the company’s earnings.

Price and Valuation

As of February 24, 2022, MARK is priced at IDR 1040 per share.

Using annualized earnings per share for 2021 of IDR 96.93, the stock has an estimated PER of 10.73x at current market price.

If I were to value MARK using an estimate of its 2022 EPS (131.58 IDR/share), assuming that the company should trade at a forward PER multiple of 10x given its strengths and risks, then the stock should trade at a price of about IDR 1,316 per share.

I believe the stock’s intrinsic value to be around IDR 1344 per share, derived from a DCF analysis with fairly moderate inputs. This translates to a 29% potential upside at current price.

Closing Remarks

Mark Dynamics Indonesia is a fast-growing company and market leader with a strong catalyst for value realization. Although there are potential challenges that the company faces, its management team has proven capable of addressing them.

They have successfully ramped up their production capacity to meet unfulfilled demand as a result of COVID and further diversified their customer base by expanding to China and most recently, the US.

Addressing a potential supply chain issue, management proactively increased its supply of raw materials early in the pandemic and possibly sidestepped a major hurdle now facing many companies.

They have even developed a new revenue stream by using waste materials to create new products and acquired a subsidiary specializing in selling those products. Additionally, they have reduced production costs by creating their own raw material mix.

Although it is incredibly unlikely for the company to repeat its sky-high growth levels in 2020 and 2021 (barring the emergence of a deadlier COVID variant), its earnings should still grow at a fast rate in 2022, and at a decent rate in 2023 and beyond. An investment into MARK would not be one without risks, but I believe its management is capable of overcoming them.

Key Risks include: potential decline in demand for hand formers, increase in production costs, and possible overexposure to Malaysian glove producers.

Financial Statements

Arwana Citramulia [ARNA] Q4 And Full Year 2021 Results

United Tractors [UNTR] Q4 Full Year 2021 Financial Statements

Vale Indonesia [INCO] Q4 Full Year 2021 Financial Statements

Indo Tambangraya Megah [ITMG] Q4 Full Year 2021 Financial Statements

Industri Jamu Dan Farmasi Sido Muncul [SIDO] Q4 Full Year 2021 Financial Statements

Disclaimer & Disclosure

As of February 25th, 2022, I own a small number of shares in MARK.

Although I try to be as objective as possible in my analysis, some bias may nevertheless be present.

Please seek advice from a finance professional before making any investment decision.

Readers are fully responsible for their own investment decisions, and must do their own due diligence.

I take no responsibility for any losses you may incur based on the information provided.