Would Arwana Citramulia be a good investment?

Let's find out

Arwana Citramulia

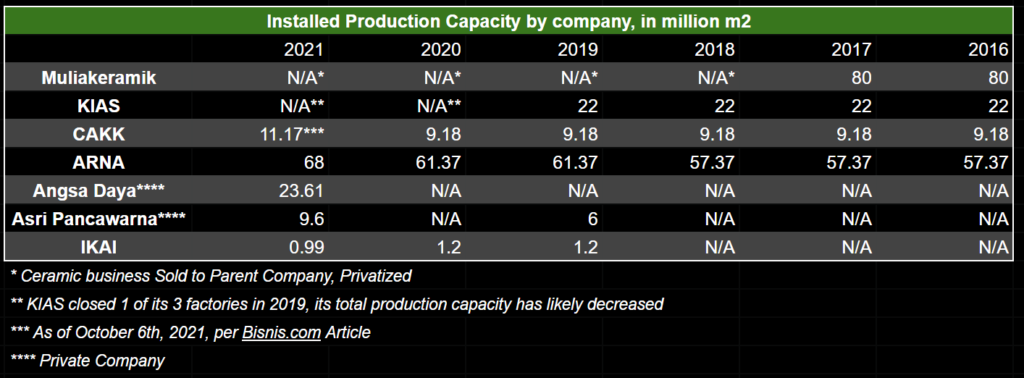

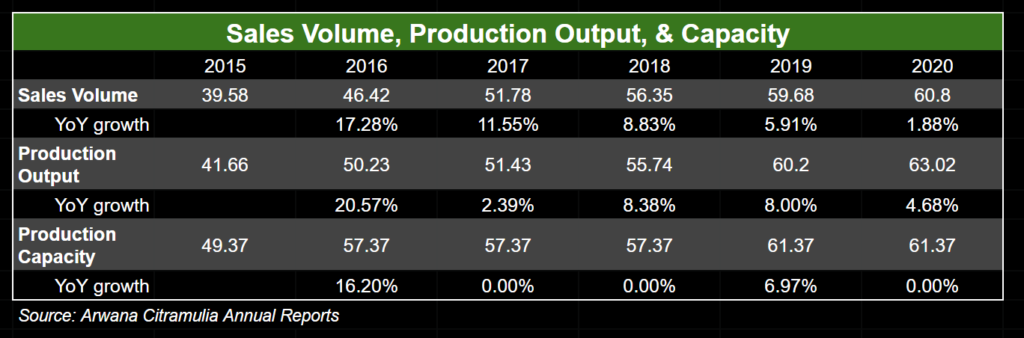

PT. Arwana Citramulia Tbk. is a manufacturer of ceramic tiles, established in 1993. Since it was established, Arwana has grown to be one of the largest companies in the industry, as well as one of the most profitable. Continuously growing since it was founded, the company now has 5 plants in Indonesia, with a production capacity of 61.37 million m2 of tiles per year as of 2020.

Highlights

Consistently Growing Profits and Margins

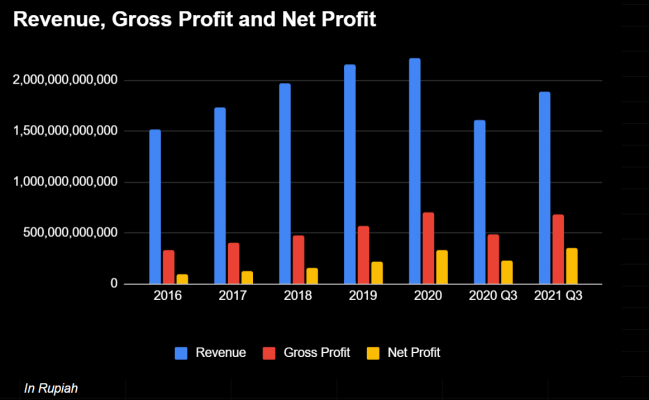

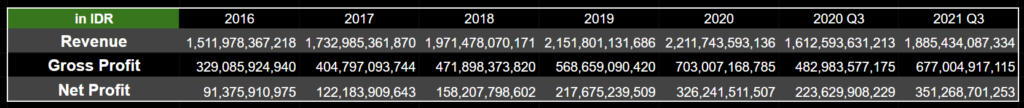

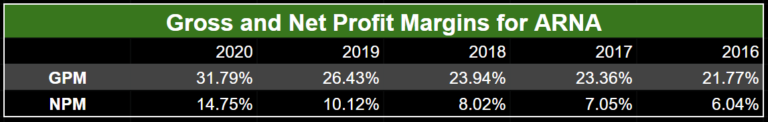

From 2016 to 2020, Arwana Citramulia’s gross profits grew from around IDR 329 billion to roughly IDR 703 billion, at an average rate of around 20% per year.

Additionally, in the same period its net profits increased at an average rate of 37% annually, growing from roughly IDR 91 billion in 2016 to IDR 326 billion in 2020.

While its gross and net profit experienced high growth from 2016-2020, Arwana’s revenue growth was much smaller (though still decent) and averaged 10% per year.

Compared to the rest of the Indonesian ceramic tile industry, Arwana Citramulia’s profit margins have been among the highest and have continued to improve over time. Their performance has also been more consistent, whereas other companies often had bad years.

Among the multiple factors that have been driving the company’s growth and performance for the past 5 years are: the company’s cost-cutting efforts, a shift in focus to more expensive products, and favorable government policies.

A large part of the growth in gross profit was a result of the company’s increasing efficiency in manufacturing: in 2020, the company was able to reduce cost of goods sold by 6% (IDR 26,525 to 24,825) and gas cost per sqm by 21% (IDR 7952 to 5998). Additionally, the company was able to reduce the amount of glaze used in production by 3.34%.

Favorable government policies also undoubtedly helped the company, and the ceramic tile industry in general: the government reduced gas prices for the ceramic industry and implemented import tariffs on ceramic goods coming from China, India, and Vietnam among others.

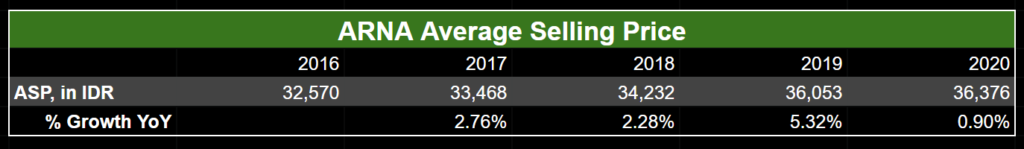

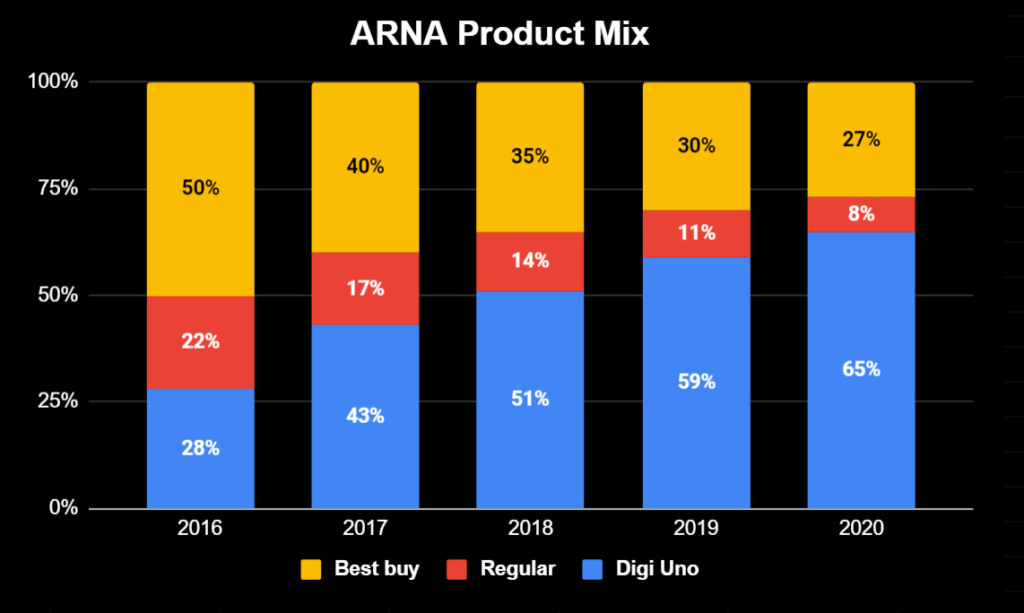

Stiff competition from both domestic manufacturers and foreign companies has likely influenced the company to shift its focus to selling more expensive products. As it has probably become less profitable for the company to compete in offering the cheapest product, Arwana Citramulia now mostly markets products to the middle-upper segment.

This shift allowed the company to offer higher-quality ceramic tiles at a higher selling price, which in turn meant higher profit margins per sqm of tile. As a result of this change, the company was able to increase its average selling price by 5.23% YoY in 2019.

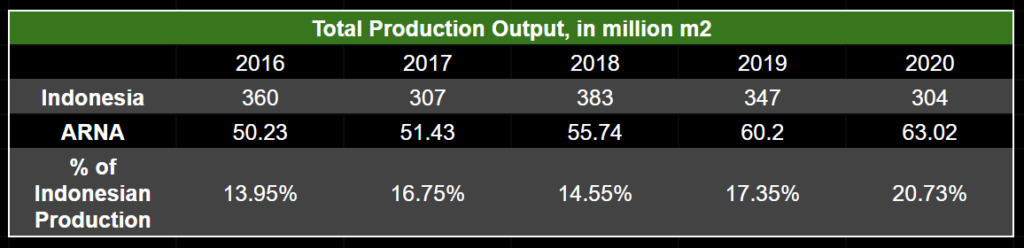

Growing in a Shrinking Industry

In 2020, while Indonesian ceramic tile output decreased by about 12.4%, Arwana Citramulia’s output increased by about 4.68%. In fact, except for 2015, ARNA’s production output has increased every year from 1996 to 2020.

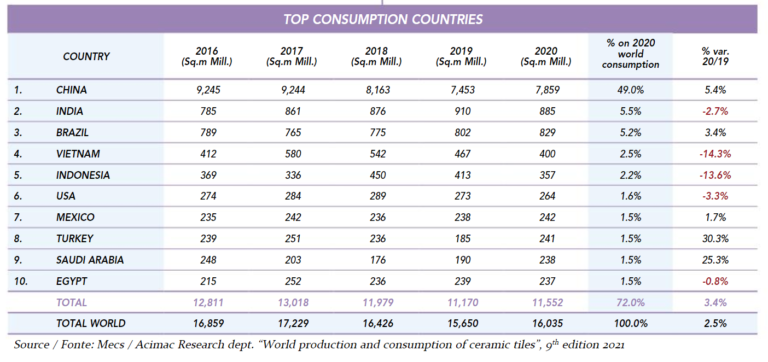

Similar to national output, Indonesian consumption of ceramic tiles also decreased by around 13.6% in 2020 (although it’s estimated that output and consumption increased in 2021).

Considering these downtrends experienced by the domestic ceramic tile industry, it’s rather impressive that Arwana has been able to not just maintain, but actually grow its revenues and earnings over the past 5 years.

One of the Largest Ceramic Tile Producers in Indonesia

Able to produce 68 million m2 of tiles per year (as of November 2021), Arwana is one of the largest ceramic tile manufacturers in Indonesia, and the largest among publicly traded companies in the industry.

Owing to increasing demand for its products, its production capacity, output, and sales volume has consistently increased since 1996.

To see how Arwana Citramulia compares to its Indonesian competitors, click here.

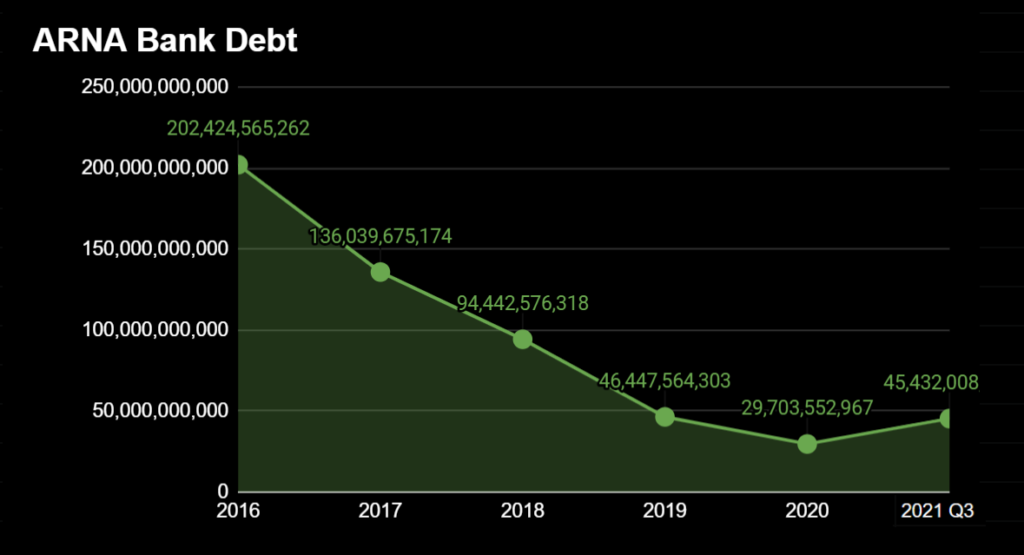

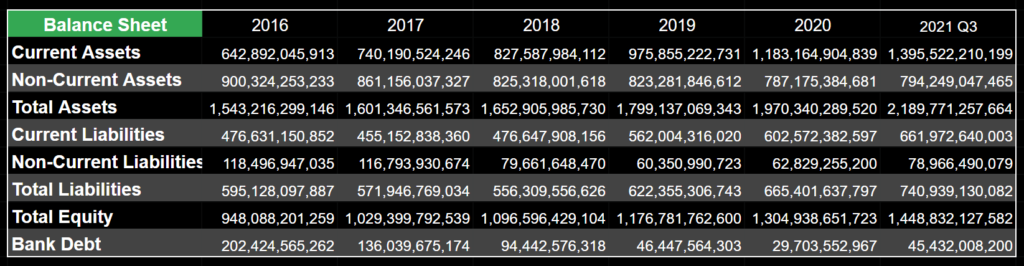

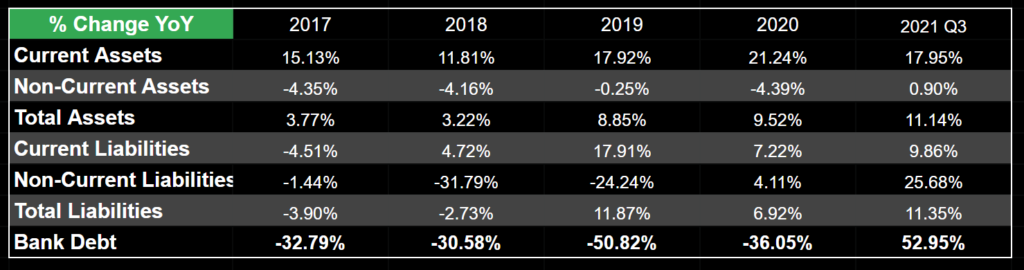

Decreasing Bank Debt

From 2016-2021, Arwana Citramulia has steadily decreased the amount of bank debt on its balance sheet: from around 202 billion in 2016, to 45 billion in Q3 of 2021. Its DER has also gradually improved to 0.51x in Q3 2021, from 0.63x in 2016. The improvements in its balance sheet is an additional sign that Arwana is one of the better managed companies in the ceramic tile industry.

Healthy, Consistently Positive Free Cash Flows

In addition to a good balance sheet and high growth in profits, Arwana’s cash flows have also been consistently healthy since 2017. Cash from operations have grown from 96 billion in 2016 to over 419 billion in 2020, while CapEx has risen at a much slower rate.

This has resulted in large positive free cash flows, some of which has likely been used to reduce the amount of bank debt on the balance sheet. Another benefit is that the company currently has a relatively high amount of cash on hand, which gives it the ability to fund future expansions internally rather than relying on bank loans.

Insider Ownership

President Director Tandean Rustandy owns 37.32% of the company, more than the parent company Suprakreasi Eradinamika (14.13%). A member of management owning such a large part of the company is usually a good sign, a vote of confidence that the company has been performing well and will continue to do so.

Risks and Challenges

Flood of Cheap Imports (China, India, Vietnam, etc.)

For the past several years, Indonesian ceramic tile producers have had to grapple with an onslaught of cheap imports, mainly from China, India, and Vietnam. As of 2020, these three countries account for nearly 100% of imported ceramic tiles in Indonesia.

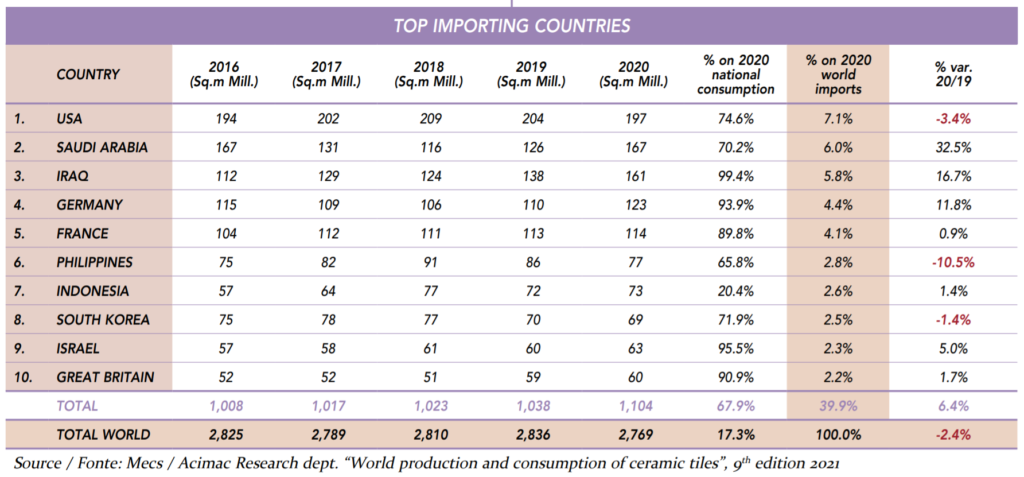

Despite imports making up only 20.4% of national consumption in 2020, Indonesia ranked 7th globally in terms of ceramic tile imports.

Source: Ceramic World Review 143/2021

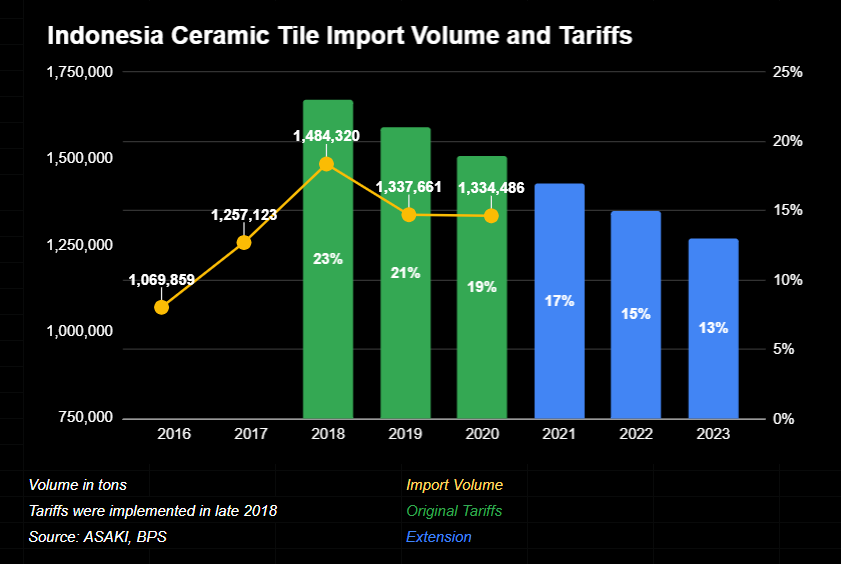

As stated before, the government addressed the issue by enacting import tariffs on ceramic goods. These tariffs, along with reduced gas prices, helped the domestic ceramic industry compete with cheaper imports. Specifically, the tariffs contributed to the decrease in import volume from 2018-2019.

While the tariffs were successful in reducing imports from China, they inadvertently led to a massive growth of imports from India and Vietnam (these countries were not originally affected by the import tariffs).

India’s market share for imported Indonesian ceramic tiles rose from below 3% to 22% by 2020, while Vietnam’s market share increased to about 7%. As a result, in 2020 the government began levying the import tariffs against imports from India and Vietnam, as well. This was expected to slow down the growth in imports.

However, when the import tariffs were lowered in 2021 to 19% from 21% in 2019 and 23% in 2018 (as originally planned), Indonesia saw an explosion in the growth of ceramic imports.

For the period of January to August 2021, imports of ceramic goods as a whole grew by 60% YoY. Meanwhile, imports from China grew by 105% YoY, and those from India increased by around 20% YoY.

Originally the import tariffs were supposed to last until 2021, but perhaps after reviewing the situation, the government decided to extend the tariffs for another three years. The rate of the tariffs, though, has been noticeably reduced from before.

From what we’ve seen in the period of January to August 2021, a reduction in import tariffs is likely correlated with an increase in imports. So we can assume that imports will likely increase in the next few years, and there may be a risk that Arwana Citramulia’s revenues (and the revenues of other companies within the industry) will be affected.

Although, for at least another three years, the import tariffs will continue to cushion the impact of a rise in imports on the ceramic industry, along with other favourable government policies like the reduction in gas prices (the government has committed to both of these policies until 2024).

Expensive Gas Prices

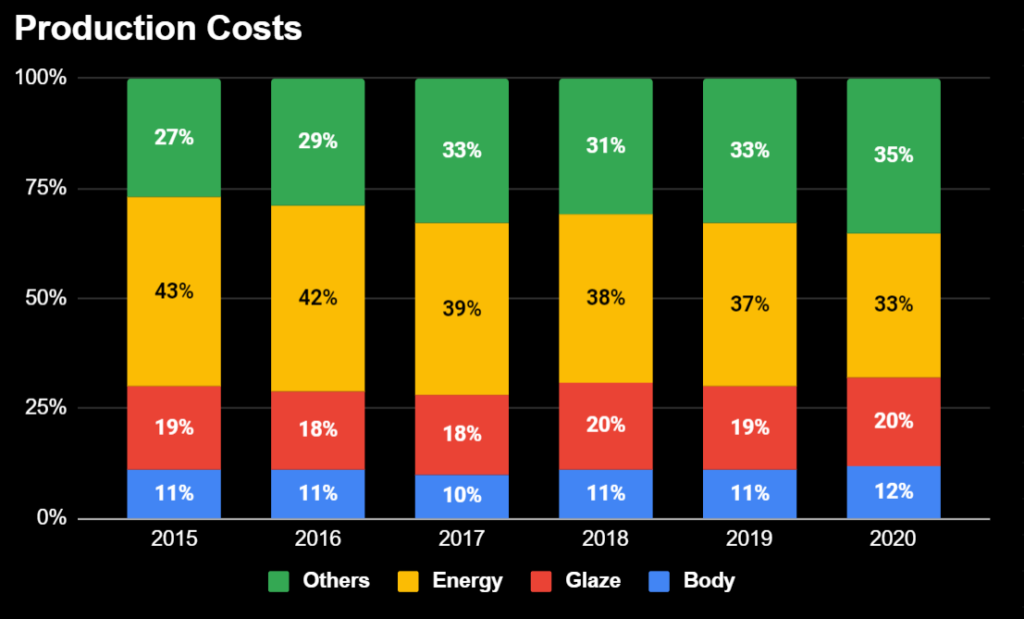

Speaking of gas prices, they have considerable influence on the profitability and competitiveness of domestic ceramic goods, as energy costs constitute a large part of total production costs.

For Arwana Citramulia, energy costs accounted for a significant chunk of total production costs, around 33% in 2020.

A vital reason that domestic tile manufacturers have been facing problems in competing with foreign imports is that domestic companies paid higher gas prices in Indonesia than foreign companies did in their own countries.

Reportedly, Indonesian companies paid USD $7-10 per mmbtu for gas, while foreign competitors in the region had to pay only USD $4-6 per mmbtu.

This higher gas price is likely not just a problem when Indonesian tile manufacturers have to compete with imports, but it may also pose an issue when they attempt to export their goods, as it reduces their competitiveness in potential export destinations.

Being locked to the domestic tile market has probably stunted the growth of Indonesian companies, as it denies them access to higher prices and increased sales volume that comes from exporting.

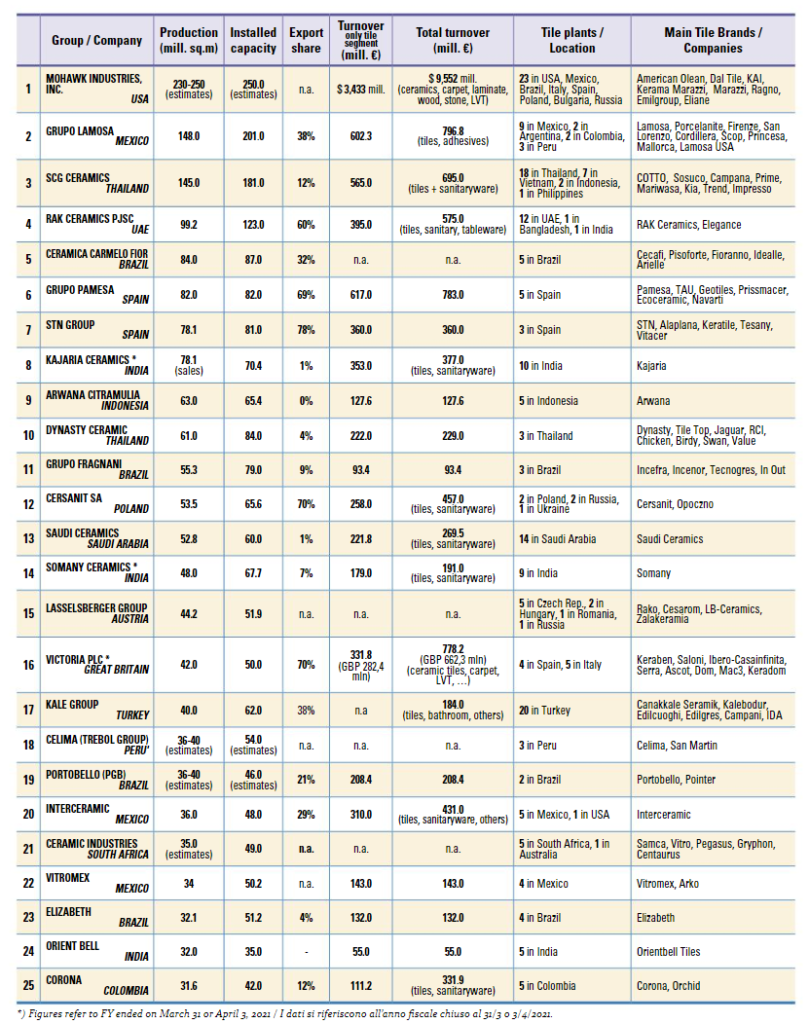

For example, Arwana Citramulia ranked 9th globally in terms of production output, but it had one of the lowest total turnover out of all the companies on the list. This likely is because ARNA relies almost completely on domestic sales.

In 2020, The government reduced gas prices for the ceramic industry to USD $6 per mmbtu, which should help domestic producers to better compete with imports. (But it may not be enough, considering that gas prices in India were reduced to USD $2.5 per mmbtu).

Since the government plans to reduce gas prices until 2024, it’s reasonable to assume that ARNA will be able to at least maintain its earnings during this period.

However, there is a risk that ARNA’s earnings may decrease if the government decides to raise gas prices after 2024, and potential investors should be aware of this fact.

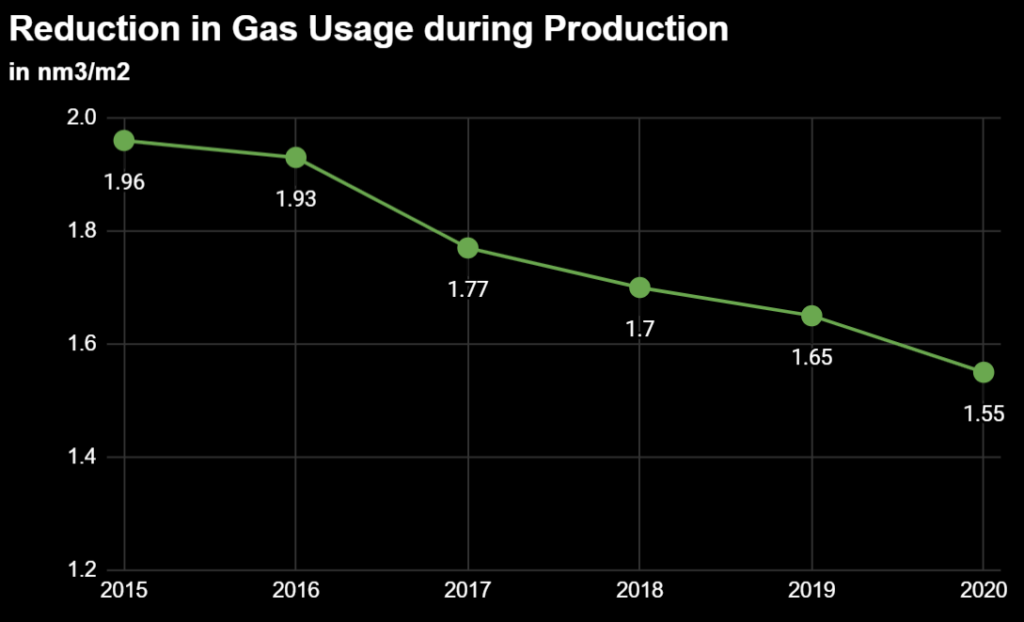

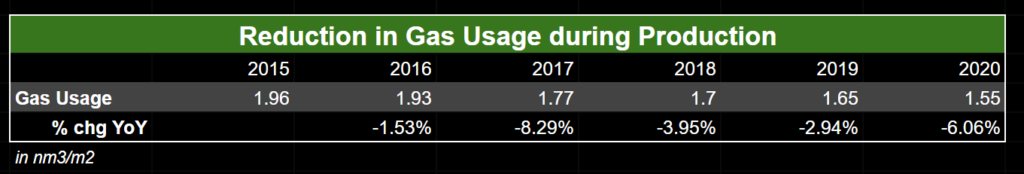

One of the ways that Arwana Citramulia has mitigated the impact of expensive gas costs is by reducing gas usage in its production process. According to the company, a reduction of 0.1 nm3/m2 of gas used would yield an estimated IDR 27.1 billion in savings. From 2015 to 2020, ARNA has reduced its gas usage from 1.96 nm3/m2 to 1.55 nm3/m2.

88% of Net Sales Come From One Buyer: CSAP

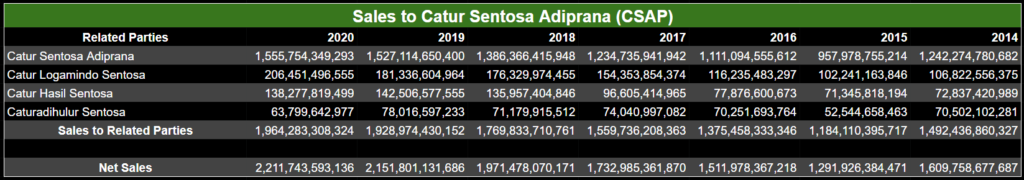

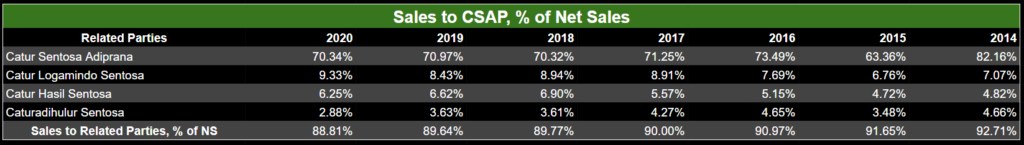

A factor that may concern some investors is that the majority of Arwana Citramulia’s net sales come from PT. Catur Sentosa Adiprana Tbk. [IDX: CSAP], the operator of Mitra10 and Atria retail stores and one of the largest distributors of building materials in Indonesia.

In 2020, sales to CSAP accounted for 88% of Arwana Citramulia’s Net Sales.

Although the portion of revenue from CSAP has shown a slow and steady decline over the years, they still make up the bulk of Arwana’s sales.

Naturally, this raises some questions, such as:

- How did CSAP become such a large buyer?

- What if CSAP stops buying from ARNA?

- What is the probability that they will stop buying from ARNA?

- What if CSAP faces financial difficulties?

In 2001, the two companies signed an agreement where CSAP (and its subsidiaries) were appointed sub-distributors for ceramic tiles produced by ARNA.

My understanding of the arrangement is that CSAP’s distribution arm buys the tiles from ARNA’s subsidiary Primagraha Keramindo (PGK), then sells them to smaller retailers and stores around the country, who then sell it to the end customer.

This distribution agreement between the two companies was extended multiple times, with the latest extension ending in December 31, 2021.

Since the agreement was extended multiple times, it would be reasonable to infer that the arrangement has been profitable for both companies. As they have been business partners for around 20 years (from 1995 according to this article), it’s likely that the two companies have built a good relationship.

It may be the case that the partnership allows each company to do what they do best: ARNA can focus on manufacturing ceramic tiles, while CSAP can focus on distribution and retail.

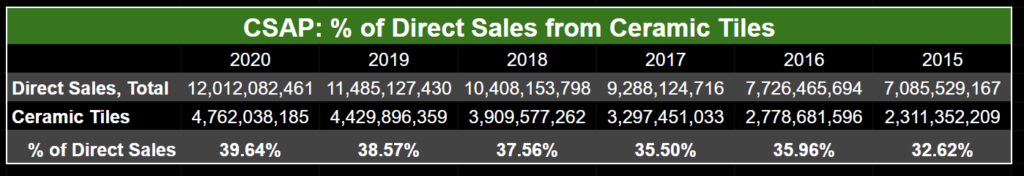

According to the 2020 Annual Report for CSAP, direct sales of ceramic tiles amounted to 4.7 trillion rupiah, or 40% of the company’s total direct sales. Whereas in 2015, the portion of direct sales from ceramic tiles was around 32.62%, indicating that CSAP has only leaned more onto ceramic tiles for revenue.

Since ceramic tiles form the majority of revenues for CSAP, it’s obviously unlikely that the company would stop selling them. Rather, CSAP will likely continue to need a steady supply of ceramic tiles for the foreseeable future.

As ARNA has one of the largest production capacities for ceramic tiles in Indonesia and demand for the company’s products remains high, not to mention that the two companies have been working together for decades, they would probably continue their partnership in the future.

Another factor that sort of cements this partnership is that, as stated in Arwana Citramulia’s 2020 annual report, CSAP and its subsidiaries are “controlled by the same key management personnel with PGK”. Primagraha Keramindo (PGK) is one of Arwana’s subsidiaries and the sole distributor of its ceramic tiles (while CSAP acts as sub-distributor).

All of this makes it extremely unlikely for CSAP to decide not to renew its distribution agreement with ARNA (which could pose short-term problems for Arwana’s revenues, profits and cash flow if it happened).

However, there is an incentive for CSAP to develop its own line of products: the company receives higher margins (15-17%) from private label products than from simple distribution (10-11%).

Although CSAP is in fact making efforts in developing its own products (private label), it seems like the company is focusing on granite tiles for now, and this has not negatively impacted ARNA (so far, at least).

What if CSAP faces financial difficulties?

CSAP represented around 90% of ARNA’s trade receivables in Q3 2021. Trade Receivables from CSAP accounted for nearly 50% of ARNA’s current assets, and around 30% of total assets.

Taking this into account, If CSAP runs into some tough times, ARNA would probably be affected as well. So how likely is it for CSAP to be unable to pay ARNA?

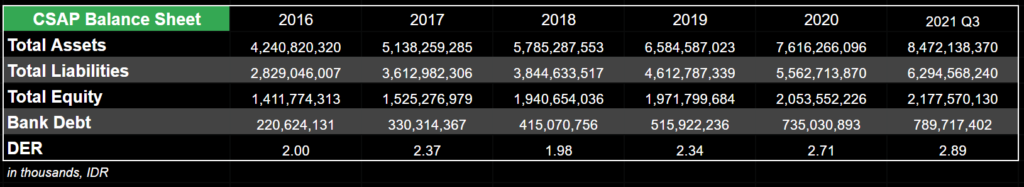

We can see from the balance sheet that between 2016 and Q3 2021, the amount of bank debt for CSAP has increased significantly, from IDR 220 billion to around 790 billion. Meanwhile, its debt-to-equity ratio has risen from 2.00x to 2.89x during the same period.

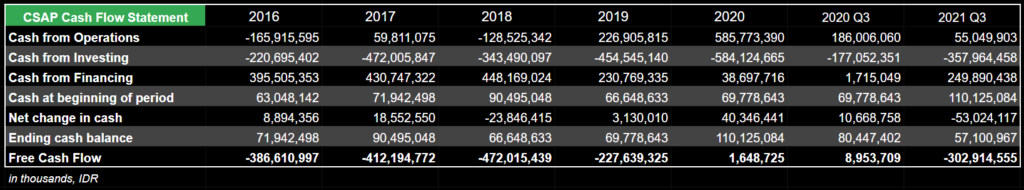

From the cash flow statement, we can see that CSAP has had negative free cash flow from 2016-2019, which explains the rise in debt. In short, the company is spending more on CapEx than it earns.

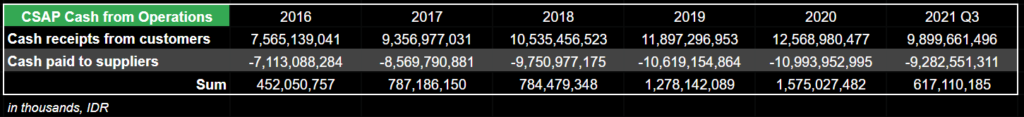

These factors may raise some concerns, but if we look at the company’s cash from operations, cash from customers has always covered cash to suppliers. This means the company has been able to pay off its trade payables to suppliers like ARNA using the cash it receives from customers.

So unless CSAP faces some sort of crisis, it’s reasonable to believe that the company will be able to pay off its trade payables to ARNA in the future as well.

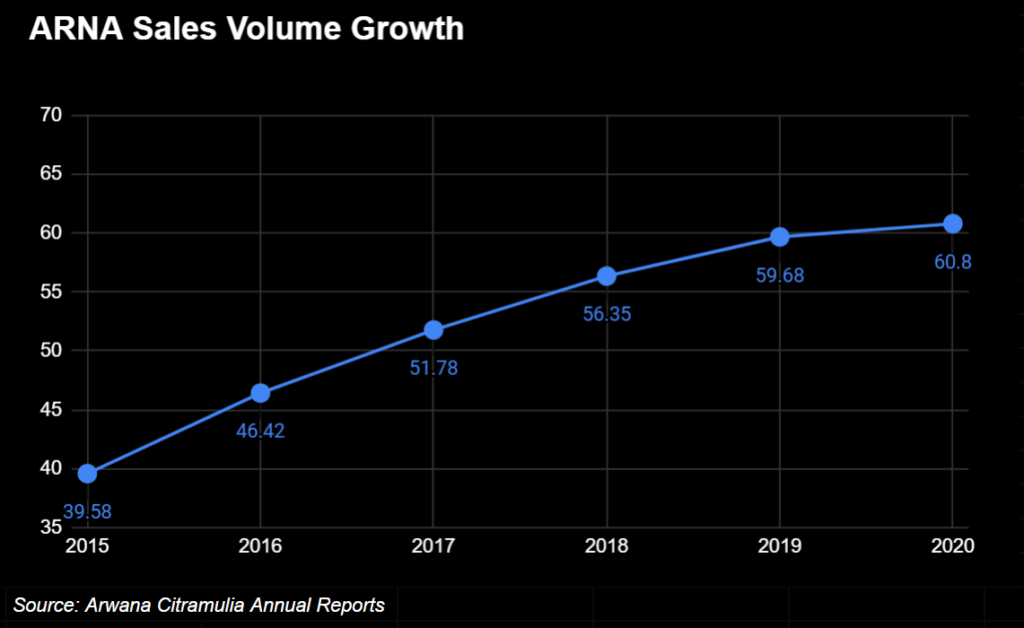

Declining Sales Volume Growth?

Since 2016, the company’s sales volume growth has been steadily declining, to a low of 1.88% in 2020. This suggests that although the company is doing better than the average company in the ceramic tile industry, it also has been suffering from imports flooding the market.

However, the large decline in sales volume growth for the year 2020 is likely to be a result of the pandemic more than anything else. The company’s performance in 2021 provides evidence for this theory: management reported YoY sales volume growth of 12.5% and ASP growth of 4% for Q3 2021.

Thanks to the company’s entry into the glazed porcelain tile market, management estimates a sales volume growth of 10% for the FY 2021, which would be the highest for the company since 2017.

Keeping in mind that Arwana is building an expansion to add even more capacity, it would not be unrealistic to expect similar levels of sales volume growth for 2022 and the years beyond.

Future: Plans and Possibilities

What factors may affect Arwana Citramulia’s earnings in the future?

Focus on More Expensive Products

I talked about this a few times before, so I will keep it short. Focusing on products targeted towards the middle-upper segment helps Arwana Citramulia in multiple ways such as providing better margins and higher earnings.

If the company continues to focus on higher margin products, then its average selling price will improve even further, and this will increase earnings.

In the past 5 years, the company shifted focus from the cheaper Arwana brands (Best Buy and Regular) of tiles to the more expensive Digi-Uno brand, which has improved its profitability

Then in 2021, it started selling glazed porcelain tiles (also known as homogeneous tiles), a product of even higher quality (and margins) than its Digi Uno line of ceramic tiles.

Prospects for this market seem promising: domestic demand for homogeneous tiles is estimated to be around 150 million sqm per year, while domestic supply is substantially lower at around 70 million sqm per year. Reportedly, as local supply is insufficient, imports have been dominating the domestic homogenous tile market.

Meanwhile, ARNA’s first HT-producing plant 5B has a capacity of 3 million sqm per year or just about 2% of demand. Clearly, there’s potential for expansion, and the company is likely to head in this direction for future growth.

Continuing its focus on products like these that offer better profitability per square meter will greatly help Arwana Citramulia to keep increasing its earnings in the years to come.

Opening New or Expanding Existing Plants

Contrary to the trend felt by other Indonesian ceramic tile manufacturers, Arwana Citramulia has actually reported that demand for its products are rising.

Management stated that it has been running at 100% production capacity (even going beyond 100% capacity in 2020) to meet demand, which explains the recent expansions to its plants. For comparison, the Indonesian ceramic industry’s utilization of its production capacity hovered around 65%-75% in 2021.

It’s not stopping there, either.

Still sensing excess demand, Arwana is currently building another expansion, plant 5C, that will be able to produce an additional 4.5 million sqm of tiles per year when it is finished in 2023.

Management reports the expansion will bring total production capacity to around 74 million m2 per year.

With continued rising demand and an increasing production capacity, ARNA will see growth in its revenues in the coming years. It’s encouraging news, as it means the company will probably experience both top-line and bottom-line growth.

Cutting Costs

As stated earlier, cost cutting fueled by lean manufacturing practices and newer technologies has been driving Arwana Citramulia’s consistently high earnings growth for the past several years.

Management believes that it can continue to cut costs in the future, targeting a reduction in gas usage from 1.55 nm3/m2 in 2020 to 1.50 nm3/m2 in 2021. For 2022, it has set a target of 1.45 nm3/m2.

As a reminder, the company estimates that a reduction of 0.1 nm3/m2 of gas used would yield about IDR 27.1 billion in savings.

Besides gas usage, the company is also targeting reductions in the usage of glaze. In 2020, the company managed to decrease the amount of glaze used by 3.34% (0.86 to 0.83 kg/m2), while in 2019, it reduced glaze usage by 7.2%.

Government Projects and Policies

Various government projects and policies lend additional support for Arwana and the domestic ceramic tile industry.

Government contracts provide a source of revenue exclusive to Indonesian tile manufacturers, as the government has recently banned the use of imported ceramic goods in government property and construction projects.

Additionally, Initiatives such as the Village Fund (Dana Desa), the 1 Million Houses (Sejuta Rumah), and the government housing (Rumah Swadaya) programs will help increase sales of ceramic tiles.

Along with the import tariffs and the reduction in gas prices discussed previously, policies and initiatives like these demonstrate the support the government has given the ceramic tile industry.

Increase in Exports?

Although management has declared their desire to increase exports since prices for ceramic tiles are much higher overseas, it seems that at least for now, Arwana’s focus is mostly on the domestic market.

When I first started learning about Arwana, I initially thought that the company would lean towards exports in the coming years as a source of growth. But the more I learn about the situation, the less likely it seems.

Having only started exporting its products in 2017, Arwana’s export volume remains fairly small and most of the company’s revenues still come from the domestic market.

Despite exports growing by 129% YoY in 2020, the segment only contributed about 1% of total revenues in 2019, and the number is similarly low for 2020.

And it does not seem like this would change any time soon: since Arwana has been operating at virtually full capacity to meet domestic demand, they are not aggressively pursuing exports.

Besides prioritizing local demand, there are other challenges associated with exports. In the January-August 2021 period, national ceramic exports fell by 13% YoY, with exporters citing factors such as expensive shipping fees and lockdowns in target countries. Reportedly, shipping fees have become more expensive than the products being shipped.

Unless Arwana decides to lean more toward exports, and given that it makes up such a small part of sales, it is unlikely to significantly increase the company’s earnings in the near future.

Increase in Per Capita Consumption?

When compared to Malaysia and Thailand, Indonesia has a lower per capita consumption of ceramic tiles and a lower median salary per month. Per capita consumption in Malaysia and Thailand is more than 3 sqm, while in Indonesia it is only around 1.4 sqm.

As wages rise and the standard of living improves, it is expected that consumption of ceramic tiles will follow.

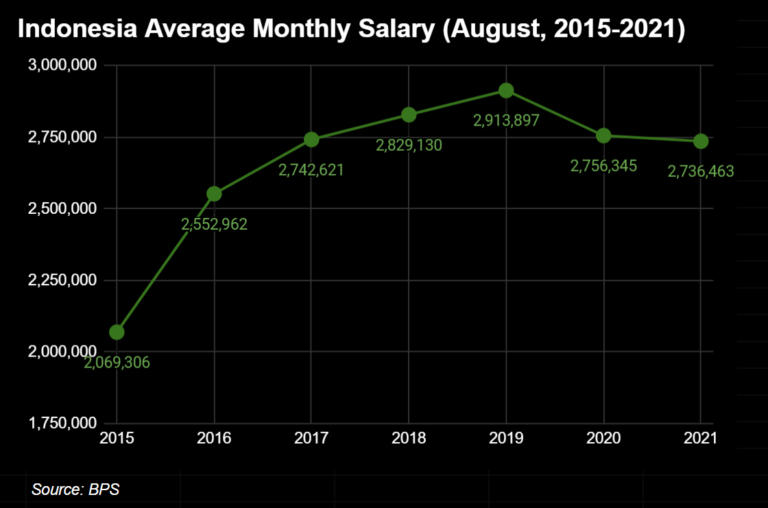

But according to Statistics Indonesia (BPS), ever since COVID, the average monthly salary for the whole of Indonesia has understandably decreased.

Unless wages rise significantly and catch up to current levels in Malaysia or Thailand, per capita consumption of ceramic tiles is unlikely to increase. So it seems for the near future, the impact of this factor on demand for Arwana Citramulia’s products and the company’s earnings may be negligible.

Price and Valuation

As of January 17th, 2022, ARNA is trading at IDR 875 per share (PER = 13.7x forward earnings).

Taking into account the strengths of and risks faced by Arwana Citramulia, I think the company should be valued at a PER of 18-20x forward earnings.

With an estimated EPS of 63.8 for 2021, this means the company should be trading at IDR 1,148 to 1,276 per share, and implies a discount of 31% to 46%.

Meanwhile, through a DCF with moderate inputs, I calculated ARNA’s intrinsic value to be around IDR 1,259 per share.

Closing Remarks

One of the largest ceramic tile manufacturers in Indonesia, Arwana Citramulia has been consistently growing since it was founded. Through rigorous cost-cutting, well-planned expansions, and strategic shifts in product offerings, the company has been able to increase earnings at high rates.

While facing challenges such as cheap imports and expensive gas prices, the company has generally been able to weather the storm thanks to both favorable government policies and its own efforts in improving efficiency.

Although potential investors should be aware of the risks that the company faces, I think ARNA is a worthwhile investment mostly thanks to its capable management, solid track record, and fair prospects.

What to Read Next

Mark Dynamics Indonesia: An Attractive Investment?

Indo Tambangraya Megah [ITMG] Q4 Full Year 2021 Financial Statements

Industri Jamu Dan Farmasi Sido Muncul [SIDO] Q4 Full Year 2021 Financial Statements

5 Companies Aggressively Buying Back Shares

Arwana Citramulia [ARNA] Q4 And Full Year 2021 Results

7 Stocks That Should Be On Your Watchlist And Why

Disclaimer & Disclosure

As of January 17th, 2022, I own a small number of shares in ARNA.

Although I try to be as objective as possible in my analysis, some bias may nevertheless be present.

Please seek advice from a finance professional before making any investment decision.

Readers are fully responsible for their own investment decisions, and must do their own due diligence.

I take no responsibility for any losses you may incur based on the information provided.