How Arwana Citramulia Stacks Up Against the Competition

Hint: It's doing pretty well

Arwana Citramulia vs. Domestic Players

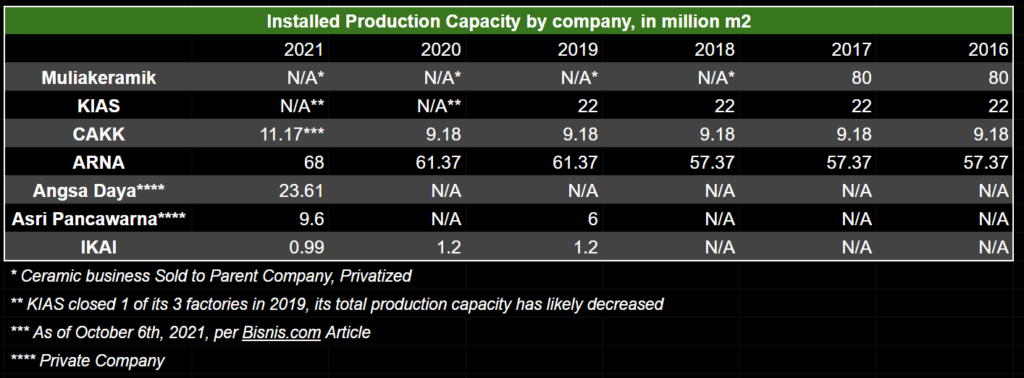

Production Capacity

Arwana Citramulia [Ticker IDX: ARNA] is one of the largest ceramic tile producers in Indonesia. I will cover the company more comprehensively in a future post.

But right now, I wanted to examine how it fares versus its competitors.

Able to produce 68 million m² of ceramic tiles, Arwana Citramulia is one of the largest ceramic tile producers in Indonesia, and the largest among publicly traded companies in the industry. Its production capacity has been growing consistently every year since 1996.

On the other hand, companies like Muliakeramik Indahraya, Keramika Indonesia Asosiasi [KIAS], and Intikeramik Alamasri [IKAI] have faced difficulties, especially in recent years.

IKAI used to have a capacity of 6.6 million m², but is now operating only a small part of it, while KIAS closed 1 of its 3 factories in 2019.

Mulia Industrindo divested its ownership of ceramics subsidiary Muliakeramik Indahraya in 2017 and sold the business to parent company Eka Gunatama Mandiri, citing difficulties amidst tough competition. The performance of the ceramics business is no longer reflected on Mulia’s newest financial statements.

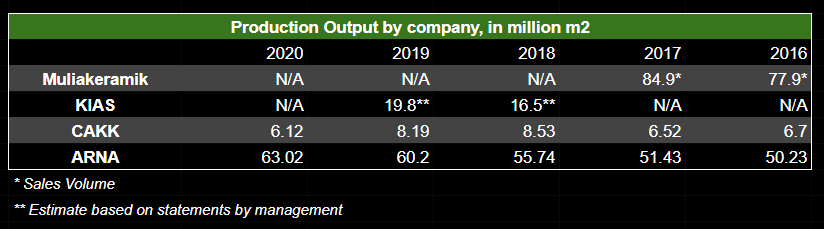

Production Output

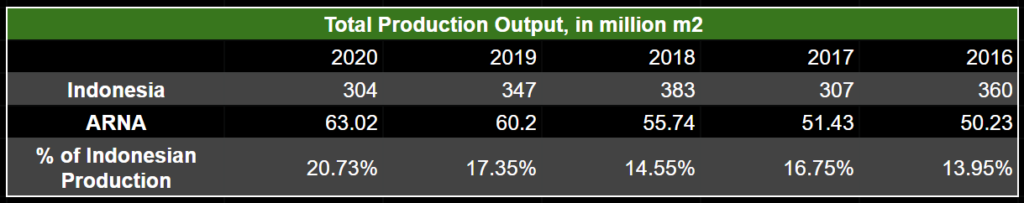

Arwana Citramulia’s growth is also evident when we look at its historical yearly production output, and how it has consistently increased.

Although not shown here, the company’s output has actually risen every year since 1996 (just like its capacity), except for 2015. In 2020, Arwana Citramulia produced 63.02 million m² of ceramic tiles, roughly 20% of all tiles produced in Indonesia that year.

However, other companies may have not enjoyed the same success. Just take a look at Cahayaputra Asa Keramik [CAKK]’s output, which decreased substantially in 2019 and 2020.

Of course, large production capacities and output does not necessarily translate to large profits. Let’s then compare the revenues and earnings of the companies within the Indonesian ceramic tile industry.

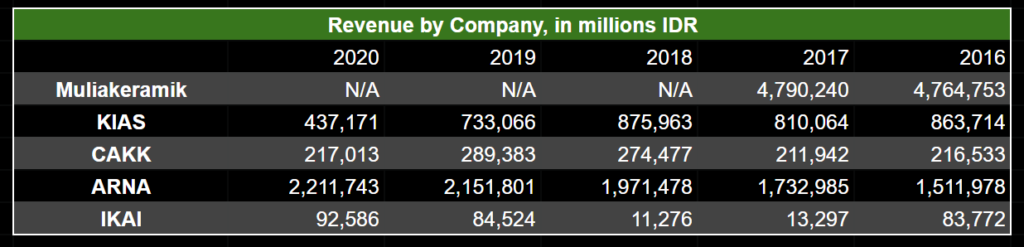

Revenues and Profits

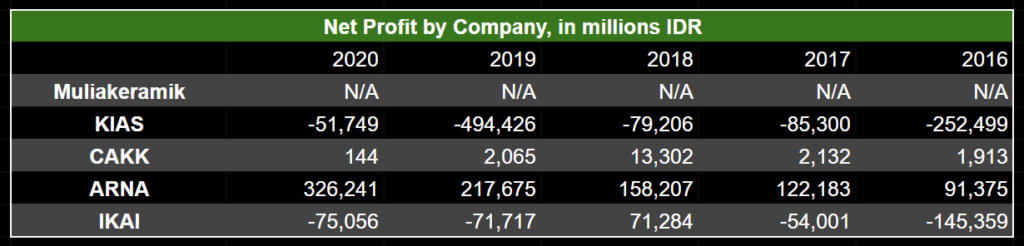

Before it was divested and privatized, Muliakeramik had the largest revenues among public companies, followed by ARNA, KIAS, CAKK, and lastly IKAI.

Again, Arwana Citramulia shows its quality by managing to grow its revenues every year. Compared to ARNA, KIAS for example has struggled to maintain its revenues, which has decreased substantially since 2018. CAKK also could not maintain consistency in growing its sales, with revenue severely declining in 2020.

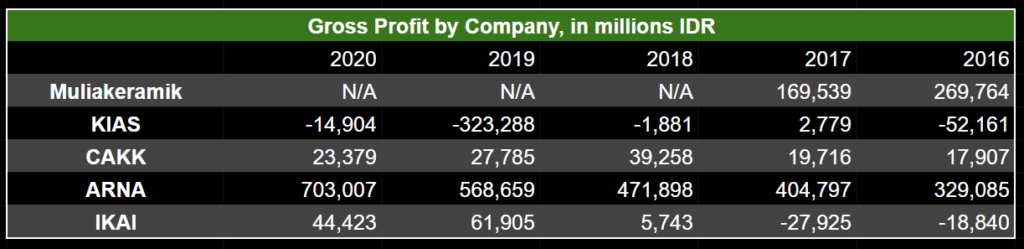

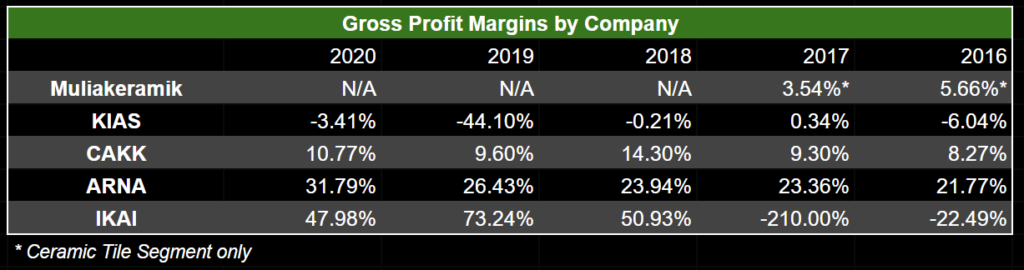

Although Muliakeramik had the highest revenues in 2017 and 2016, Arwana Citramulia was much more profitable and had the highest gross profit in the industry. From 2018 onwards though, IKAI’s gross profit margin surpassed that of ARNA.

Notably, ARNA’s gross profit margin steadily improved every year, while other companies were much less consistent. Despite having substantial revenues, Muliakeramik and KIAS had the lowest gross profit margins of the group. KIAS in particular has been struggling to be profitable and is still losing money as of 2020.

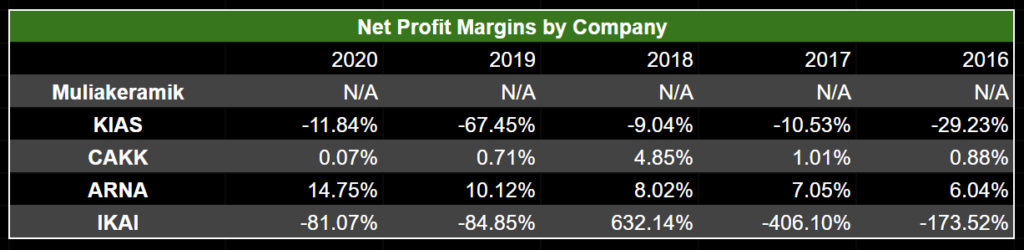

Interestingly, although IKAI had the highest gross profit margins, it has the lowest net profit margins in the industry (-81% in 2020). This is mainly due to the company’s General and Administrative Expenses being abnormally enormous (almost twice as large as its production costs in 2020).

Similarly, the net margins of KIAS are poor, as the company has lost money every year for the past 5 years. CAKK has fared better than these firms only by a slight margin, with an NPM of 0.07% in 2020.

And what about ARNA?

For the past 5 years, The company’s net profit margins have continued to grow, have always been positive, and reached a good level of 14.7% in 2020, well above the closest competitor CAKK.

Challenges for the Indonesian Ceramic Tile Industry

Flood of Cheap Imports

There are several reasons why domestic competitors have experienced downturns in the last few years. The ceramics industry as a whole is facing stiff competition from a wave of foreign products flooding into the Indonesian market.

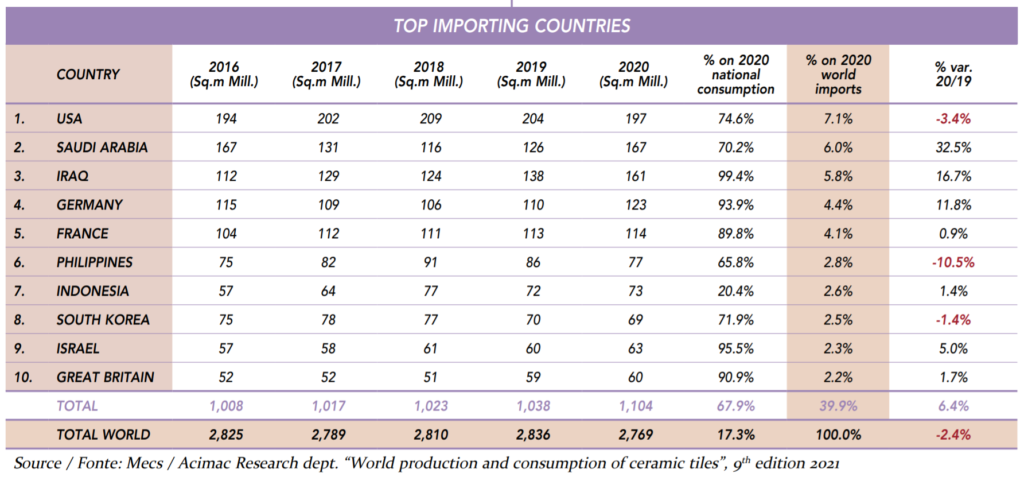

Even though imports make up just 20.4% of ceramic tiles consumed in the country in 2020, Indonesia ranks 7th in the list of top importing countries globally.

High Domestic Gas Prices

As a result of cheaper gas costs overseas, foreign companies have been able to offer lower prices and push domestic manufacturers into an unprofitable price war.

Domestic tile manufacturers had reportedly at one point paid gas prices as high as USD $9 per mmbtu, while foreign companies paid only $4-$6 per mmbtu.

Government response

Fortunately for Arwana Citramulia (and other Indonesian ceramic tile producers), the government took steps to address the issue by implementing severe import tariffs.

Additionally, the government also lowered gas prices for the ceramics industry, which had been higher than the gas prices that foreign competitors enjoyed in their countries. Along with the import tariffs, this gave domestic players some artificial advantages to compete with foreign manufacturers, especially those from China and India.

Arwana Citramulia: Dominant

But I think the most important takeaway from this is that even though Arwana Citramulia was facing such stiff competition from imports, it was able to not just maintain profitability levels, but actually grow its earnings. This is something local peers could not quite accomplish, and a sign that the company has set itself apart from the competition.

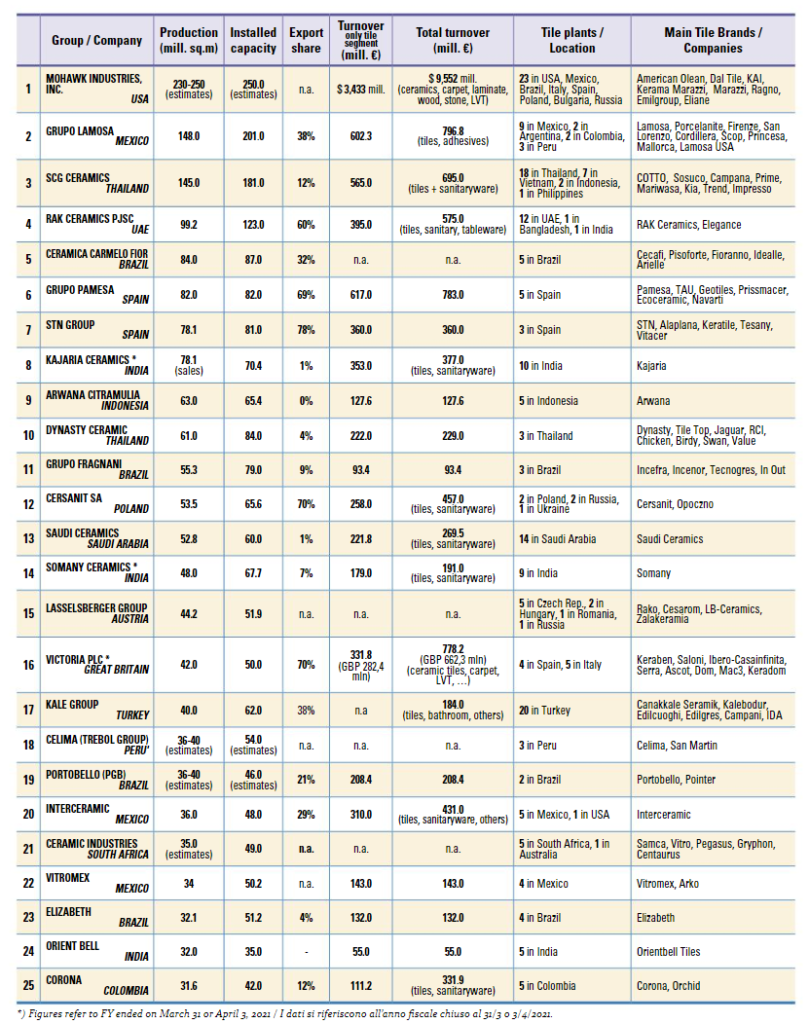

Further proof of Arwana Citramulia’s dominance is the company’s position in the list of top producing ceramic tile companies. It ranks 9th globally, and is the only Indonesian manufacturer within the top 25 (though this list notably excludes Chinese manufacturers).

Closing Remarks

In conclusion, Arwana Citramulia is one of the leading companies in the ceramic tile industry, globally and locally, with a very large production capacity and output.

It has been able to consistently grow its high-quality earnings, and is one of, if not the, most profitable tile manufacturers in Indonesia with profit margins that ranks among the highest in the country.

Even though it had to weather a flood of cheap imports, it has come out better than before, and its performance inspires confidence in the company’s future.

What to Read Next

Mark Dynamics Indonesia: An Attractive Investment?

Indo Tambangraya Megah [ITMG] Q4 Full Year 2021 Financial Statements

Industri Jamu Dan Farmasi Sido Muncul [SIDO] Q4 Full Year 2021 Financial Statements

5 Companies Aggressively Buying Back Shares

Arwana Citramulia [ARNA] Q4 And Full Year 2021 Results

7 Stocks That Should Be On Your Watchlist And Why

Disclaimer & Disclosure

As of December 24th, 2021, I own a small number of shares in ARNA.

Although I try to be as objective as possible in my analysis, some bias may nevertheless be present.

Please seek advice from a finance professional before making any investment decision.

Readers are fully responsible for their own investment decisions, and must do their own due diligence.

I take no responsibility for any losses you may incur based on the information provided.

Pingback: The Watchlist: PT. Cita Mineral Investindo Tbk. [IDX: CITA] - Chasing Cuan

What do you think of ARNA biggest sales portion is through CSAP pak? Is it good or not so good sign?

Hello! Sorry it took a while for me to respond, but I covered ARNA’s relationship with CSAP in a new post: https://chasingcuan.com/would-arwana-citramulia-be-a-good-investment/

Hope that answered your question! Happy Investing!