7 Stocks That Should be on Your Watchlist and Why

Table of Contents

- 1 BYAN - PT Bayan Resources Tbk

- 2 MARK - PT Mark Dynamics Indonesia Tbk

- 3 SIDO - PT Industri Jamu Dan Farmasi Sido Muncul Tbk

- 4 ARNA - PT Arwana Citramulia Tbk

- 5 PRDA - PT Prodia Widyahusada Tbk

- 6 CITA - PT Cita Mineral Investindo Tbk

- 7 CMRY - PT Cisarua Mountain Dairy Tbk

- 8 Closing Remarks

- 9 Disclaimer & Disclosure

With hundreds of companies on the Indonesian Stock Exchange, it can be fairly tough just knowing where to look for viable companies to invest in, never mind the difficulty of actually analyzing those companies once you find them.

That’s why I put together this short list of companies that have recently reported stellar performance and may continue to perform well in the future. Compared to my previous posts, this one will be fairly light on the research.

Rather than just taking my word for it, when you see the stocks on this list, I hope that it encourages you to look deeper into each company. Think of it as a starting point. You should try to deduce the reasons behind their performance, and whether these companies will be able to produce similar or better results in the future.

BYAN - PT Bayan Resources Tbk

Business: Coal Mining

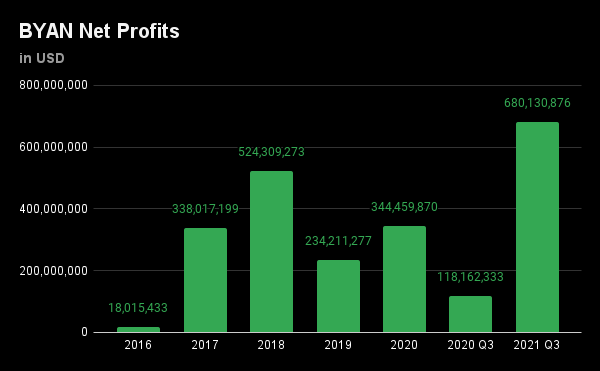

- High Earnings Growth from 2016-2020, except for 2019.

- +47% growth in 2020

- Extremely high earnings growth in Q3 2021 (+475% YoY)

- Profit margins have historically tended to be high, and have greatly improved in 2021.

- Q3 2021: Gross profit margin = 61.54%, Net Profit Margin = 38.89%

- FY 2020: GPM = 33.18%, NPM = 24.69%

- As of Q3 2021, DER is at a good level of 0.47x, much lower than historical levels.

- Historically high levels of positive FCF

- Large Insider Ownership (as of December 31, 2021)

- President Director Dato’ Dr. Low Tuck Kwong as controlling shareholder owns 55.2% of the company. He steadily bought shares in 2021, and is still buying shares as of January 19, 2022.

- Director Jenny Quantero owns 2.98% of the company

- Director Lim Chai Hock owns 3.2% of the company

- Catalyst: All time high coal prices

MARK - PT Mark Dynamics Indonesia Tbk

Business: Ceramic Molds for Disposable Gloves (Hand Formers)

- Largest manufacturer of hand formers in the world, by production capacity.

- Capacity has continuously grown since the company was founded, due to increasing demand.

- As of August 2021, MARK can produce 1.6 million hand formers per month.

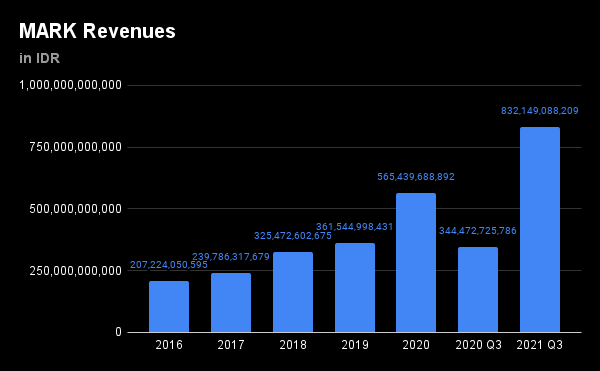

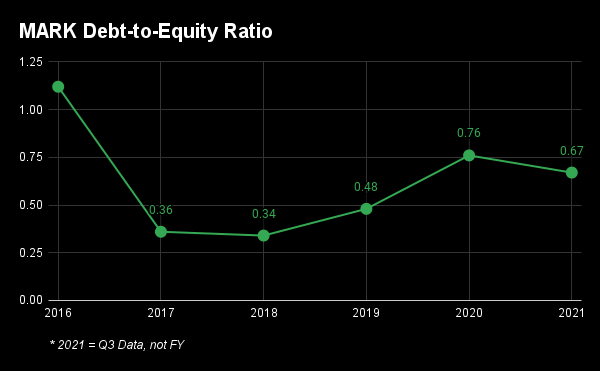

- High Revenue growth for the past 5 years.

- +56.4% for FY 2020

- +141.57% for Q3 2021 YoY

- Earnings have grown at high rates for the past 5 years.

- +63.85% growth for FY 2020

- +200% earnings growth for Q3 2021 YoY.

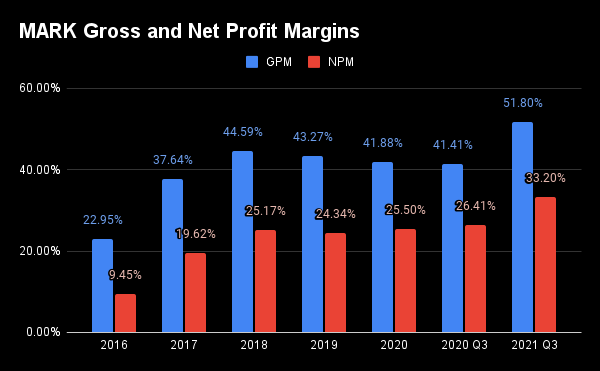

- Margins have steadily improved since 2016

- GPM grew from 22.95% in 2016 to 51.8% in 2021 Q3.

- NPM grew from 9.45% in 2016 to 33% in 2021 Q3.

- Demand for gloves (and hand formers) is much greater than supply, resulting in shortages.

- Catalyst: Increased demand for gloves as a result of the pandemic should also mean increased demand for hand formers

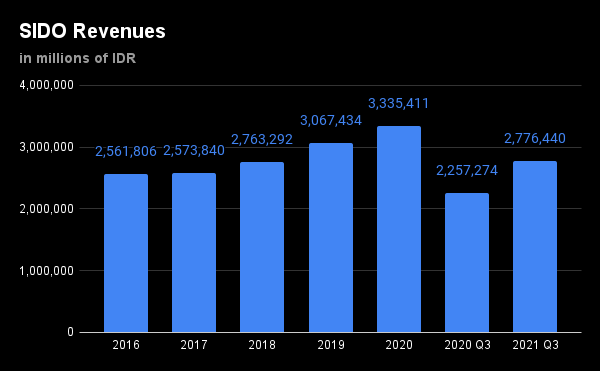

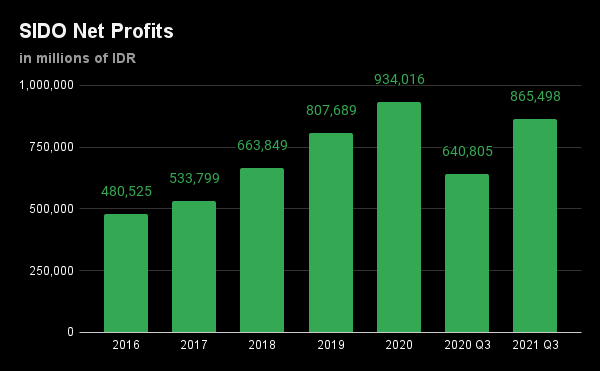

SIDO - PT Industri Jamu Dan Farmasi Sido Muncul Tbk

Business: Herbal Medicine and Food Products

- Strong, consistent earnings growth for past 5 years

- +15.6% in 2020 YoY

- Growth of 35% in Q3 2021 YoY

- Consistently high margins

- GPM at 55% in 2020 and 56.3% in Q3 2021

- NPM at 28% in 2020 and 31.17% in Q3 2021

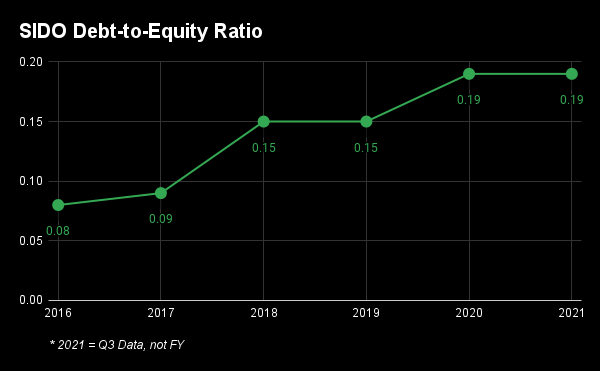

- Consistently low DER

- 0.19x in 2020

- 0.19x in Q3 2021

- Large positive FCF every year since 2016

- Allows company to grow using internal cash

- Allows company to regularly issue dividends

- Market leader in industry with a hard to challenge position

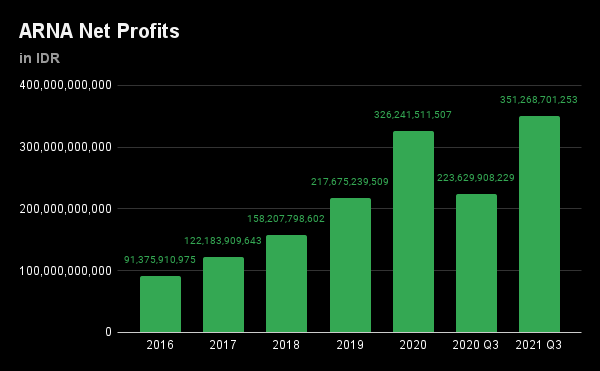

ARNA - PT Arwana Citramulia Tbk

Business: Ceramic Tiles

- High Earnings Growth for the past 5 years

- +50% growth in 2020 YoY

- +57% growth in Q3 2021 YoY

- DER consistently at manageable levels

- 0.51x as of Q3 2021

- Large positive FCF since 2017

- Increasing levels of cash allowed the company to reduce its bank debt

- Large amount of cash as of Q3 2021: IDR 511.6 billion

- Company can fund future expansions internally

- Great profit margins relative to industry average

- Margins have been consistently improving every year.

- One of the largest manufacturers of ceramic tiles in Indonesia

- Largest public company in the industry

- Utilization rate of production capacity is consistently close to 100%, rare in the industry (average is around 65%).

- This means demand for its products is much stronger than for the competition.

PRDA - PT Prodia Widyahusada Tbk

Business: Clinical Laboratory (Healthcare)

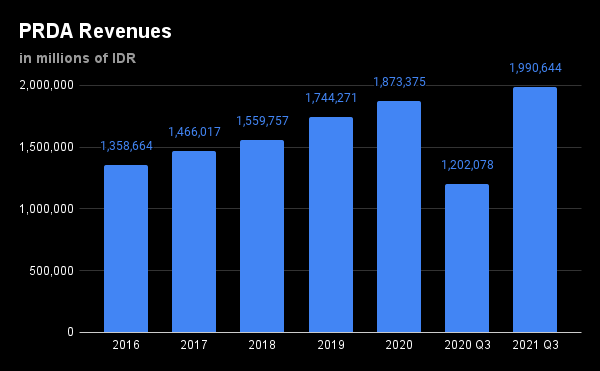

- High earnings growth for the past 5 years

- +27.82% growth for FY 2020

- +317% growth in Q3 2021 YoY

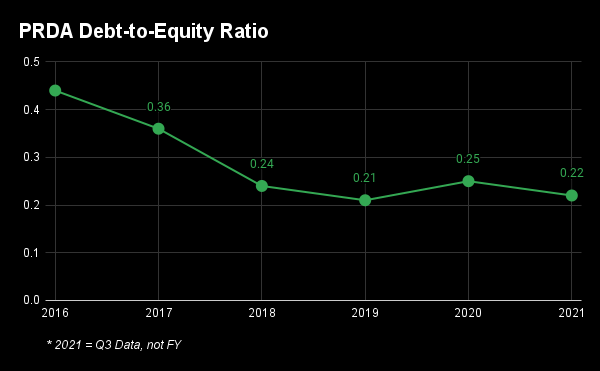

- DER consistently at low levels for past 5 years

- 0.22x as of Q3 2021

- Large amount of cash and timed deposits, very liquid

- Cash = IDR 679 billion as of Q3 2021

- Time Deposits = IDR 799.9 billion as of Q3 2021

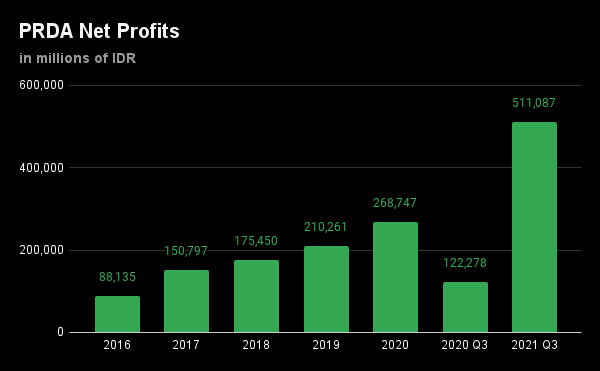

- Good profit margins

- Stable gross profit margins, 55.65% for FY 2020 and 61.93% as of Q3 2021

- Improving net profit margins. 14.35% for FY 2020 and 25.67% in Q3 2021.

- Catalyst: COVID Pandemic

CITA - PT Cita Mineral Investindo Tbk

Business: Bauxite Mining

At the time of writing, CITA is the only bauxite mining company with an operational Smelter Grade Alumina Refinery.

President Joko Widodo has stated that bauxite exports will be banned by 2023, to induce bauxite miners to accelerate construction of their SGARs.

According to CITA, the company should be able to refine and sell 2 million tons of SGA per year by late 2021/early 2022, when it finishes the expansion to its SGAR.

“We have access to large bauxite deposits with total reserves of 144.3 million WMT, resources of 333.2 million WMT as at March 2021 and with 11.0 million WMT of production in 2020, we are the eleventh largest bauxite producer globally and also the largest bauxite producer in both Southeast Asia and Indonesia according to AME. “

- CITA, Business Update October, 2021

I have written a much more detailed post about this company before, you can read it here.

CMRY - PT Cisarua Mountain Dairy Tbk

Business: Dairy Products

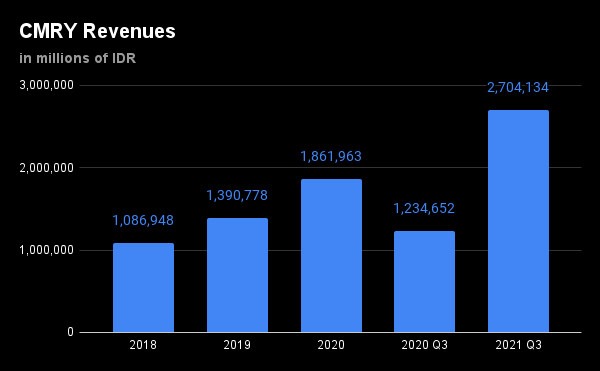

- High revenue growth

- +33.88% in 2020

- +119% in Q3 2021

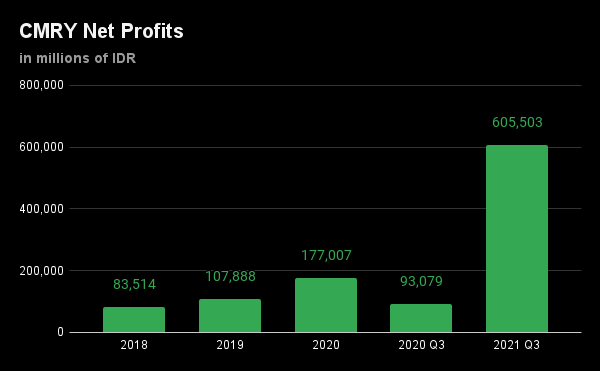

- High earnings growth

- 64% growth in 2020

- 798% growth in Q2 2021 YoY

- Market Leader for Yoghurt

- High margins

- GPM at 41% in 2020 and 48% in Q2 2021

- NPM at 9.5% in 2020 and 23% in Q2 2021

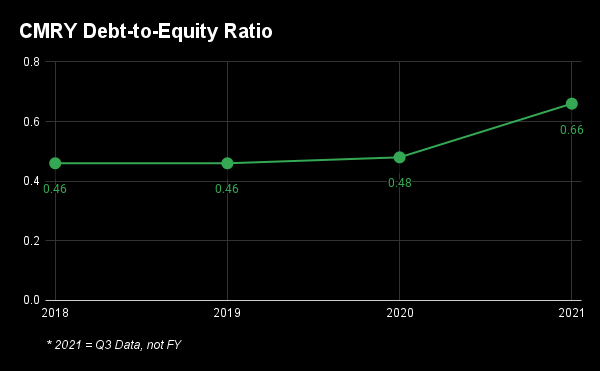

- Good DER at 0.66x as of Q3 2021

- Please Note: CMRY is a recent IPO, and may be more risky than other stocks on this list due to limited available data.

Closing Remarks

I hope this list has introduced you to companies you may have not been considering and that you find it useful. Again, this should be treated as more of a starting point and readers should research more about each company.

If you are particularly interested in ARNA or CITA, I have written about those two companies in detail before. You may click the links below to read them:

How Arwana Citramulia Stacks up Against the Competition

Disclaimer & Disclosure

As of January 23, 2022, I own a small number of shares in BYAN, MARK, ARNA, PRDA and CITA. Also, I have owned shares in SIDO and CMRY in the past, but do not currently own any shares in these companies.

Although I try to be as objective as possible in my analysis, some bias may nevertheless be present.

Please seek advice from a finance professional before making any investment decisions.

Readers are fully responsible for their own investment decisions, and must do their own due diligence.

I take no responsibility for any losses you may incur based on the information provided.