Arwana Citramulia [ARNA] Q4 and Full Year 2021 Results

“Increasingly Profitable”

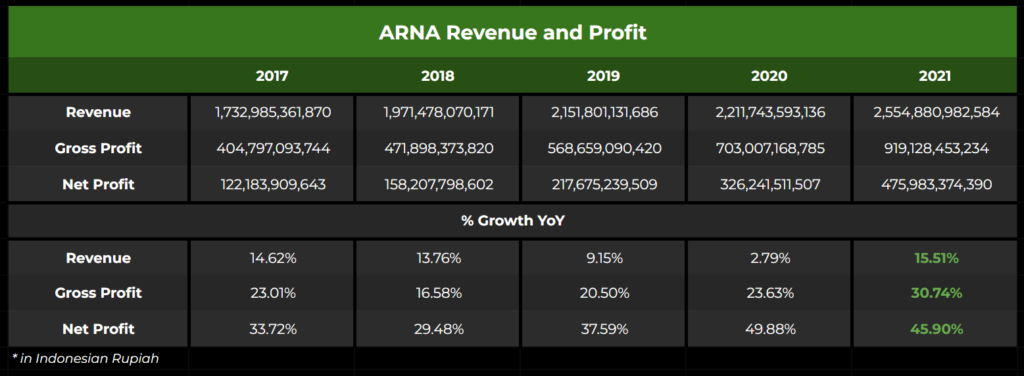

Revenue and Profits

In 2021, Arwana Citramulia reported that revenues increased by 15.51% YoY to IDR 2.55 trillion, compared to an increase of 2.79% YoY in 2020. Gross Profit grew by an impressive 30.74% to IDR 919.12 billion, compared to a growth of 23.63% in 2020. This is the highest growth in revenue and gross profit for the company since at least 2017.

Meanwhile, Net Profit grew by a whopping 45.9% to IDR 475.98 billion in 2021, continuing the company’s streak of high earnings growth from previous years.

Profit Margins

Profitability continues to improve, as Arwana reports a gross profit margin of 35.98% and a net profit margin of 18.63% for the year. These figures represent a significant improvement over 2020, when gross profit margin was 31.79% and net profit margin was 14.75%. Both gross and net profit margins have consistently improved every year since 2016.

Profit growth was exceptionally high in 2020 and 2021, perhaps reflecting reduced gas costs and the company’s switch towards selling more expensive tiles, among other factors.

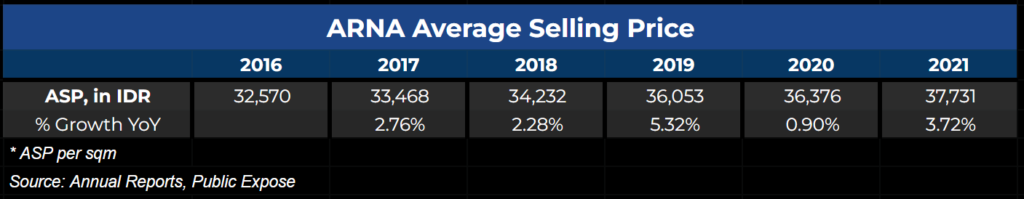

Average Selling Price

Bolstered by the sales of high margin DIGI-UNO and glazed porcelain (homogenous) tiles, ARNA has seen its average selling price grow by 3.73% in 2021 to IDR 37,731 per sqm of tiles.

As Arwana will expand its production capacity for the higher margin glazed porcelain tiles, the company’s more profitable products will make up a larger portion of revenues. As a result, we can reasonably expect the company’s average selling price to increase naturally in the future.

Growth in both production capacity and average selling price should drive future increases in revenue.

Sales Growth

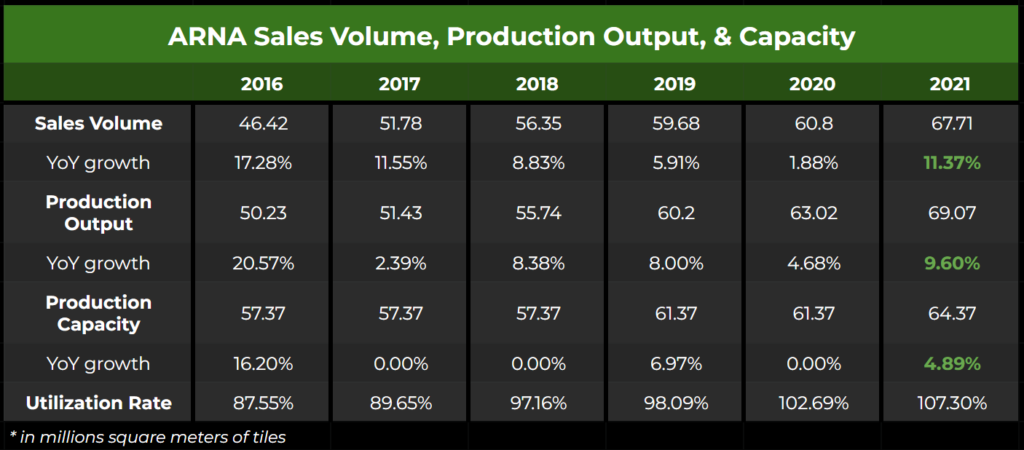

Sales Volume

In 2021, Arwana Citramulia seems to have bucked the downtrend it has been experiencing in sales volume growth for the past several years, with sales volume growing by 11.37% YoY. Along with higher average selling prices, this uptick in sales volume growth likely pushed the increase in revenues for the year.

As stated in a previous post about Arwana Citramulia, the sales volume growth slump in 2020 was most likely a result of the pandemic. The introduction of glazed porcelain tiles (homogenous tiles) to the company’s product portfolio provides another possible reason for the sizable increase in sales volume for 2021.

Production Output and Capacity

In 2021, Arwana Citramulia produced 69.07 million sqm of tiles, while production capacity stood at 64.37 million sqm of tiles, resulting in a utilization rate of 107.3%.

This is possible as installed production capacity is usually rated based on how many tiles can be manufactured by the machinery in 358 days, with 7 days set aside for maintenance and repair. If the machines are in excellent condition though, then some of those maintenance days can instead be used to extend production time, thus resulting in utilization rates beyond 100%.

Notably, ARNA consistently has one of the highest utilization rates in the industry (80-100%), which could reflect both stronger demand for its tiles over the competition and the company’s dominant market position.

After commencing operations of its new glazed porcelain tile plant in 2021, which added an additional 3 million sqm of tiles in total installed capacity, ARNA is expanding further in 2022 with Plant 5C. Slated for completion by the end of 2022, the new plant will allow the company to produce an additional 3.4 million sqm of glazed porcelain tiles per year and increase overall capacity to 67.76 million sqm of tiles per year.

As management feels that the company does not yet have enough production capacity to fulfill demand, capacity expansions should translate to increased revenues and it would not be unreasonable to expect similar growth in the future.

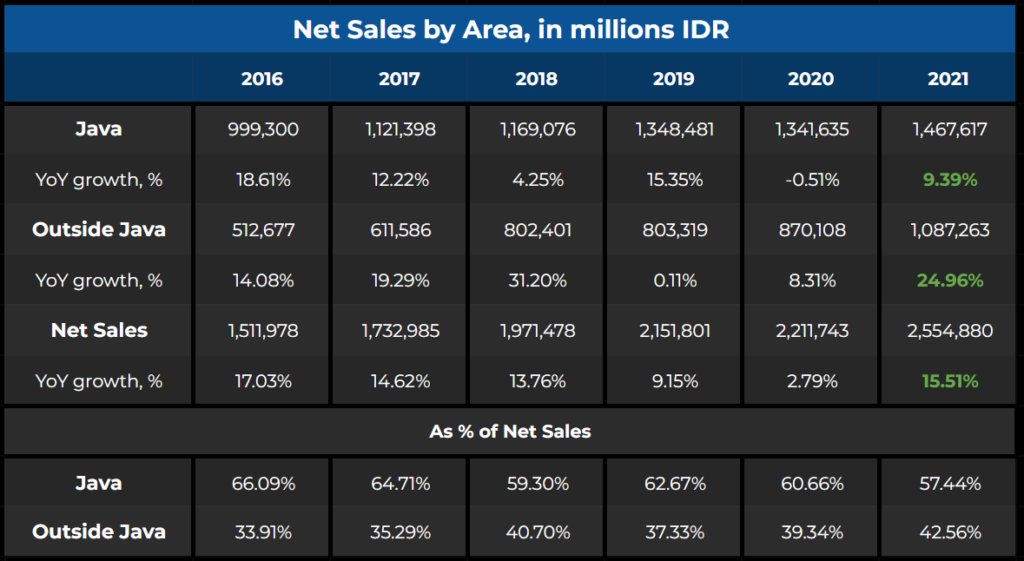

Net Sales by Area

In the past 5 years, there has been a trend where Arwana’s sales outside Java are growing faster than those on the island. That trend has continued in 2021, as sales outside Java grew by 24.96%, compared to a growth of 9.39% for sales in Java.

Overall, net sales increased by 15.51%, the highest growth seen by the company since 2016. Sales outside Java account for 42% of net sales as of 2021, the highest level in at least the past 6 years. Perhaps this signals that further expanding into markets outside Java could be key for the company’s future growth.

Exports

Although it reportedly rose by 32%, exports only accounted for 496 thousand sqm of tiles from the company’s total sales volume of 67.71 million sqm, or approximately just 0.73%.

As such, it still does not contribute a meaningful amount towards earnings. This will likely be true in the future as well, as Arwana seems to be prioritizing the domestic market over exports.

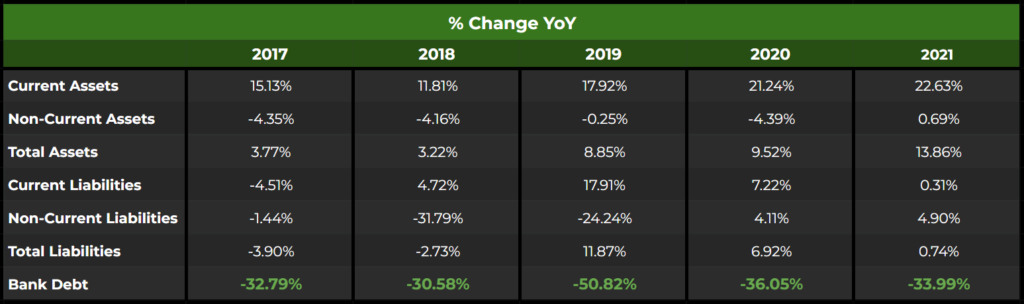

Balance Sheet

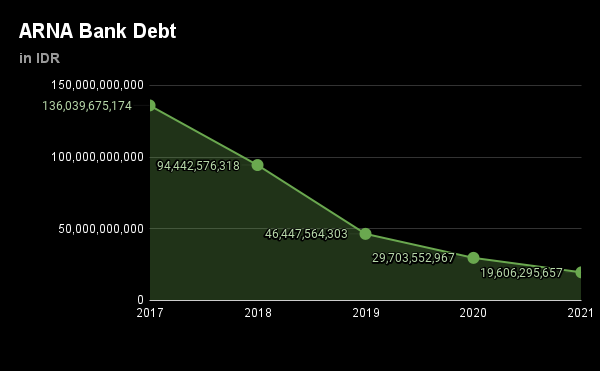

Beginning in 2019, Arwana Citramulia has been experiencing a fair amount of asset growth and has amassed a sizable cash pile of IDR 602.6 billion by the end of 2021. Thanks to management’s efforts, ARNA’s balance sheet is impeccable with bank debt being reduced down to IDR 19.6 billion in 2021 from over IDR 135 billion in 2017.

The company’s cash pile allows the company to expand capacity using purely internal funds if necessary, lowering the need for bank loans.

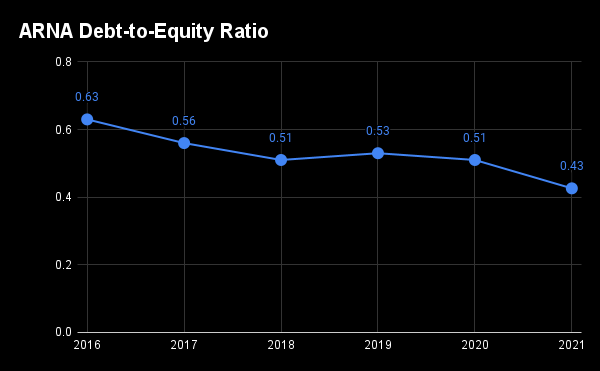

As Bank Debt was further minimized in 2021, Debt-to-Equity ratio has also been lowered to 0.43x.

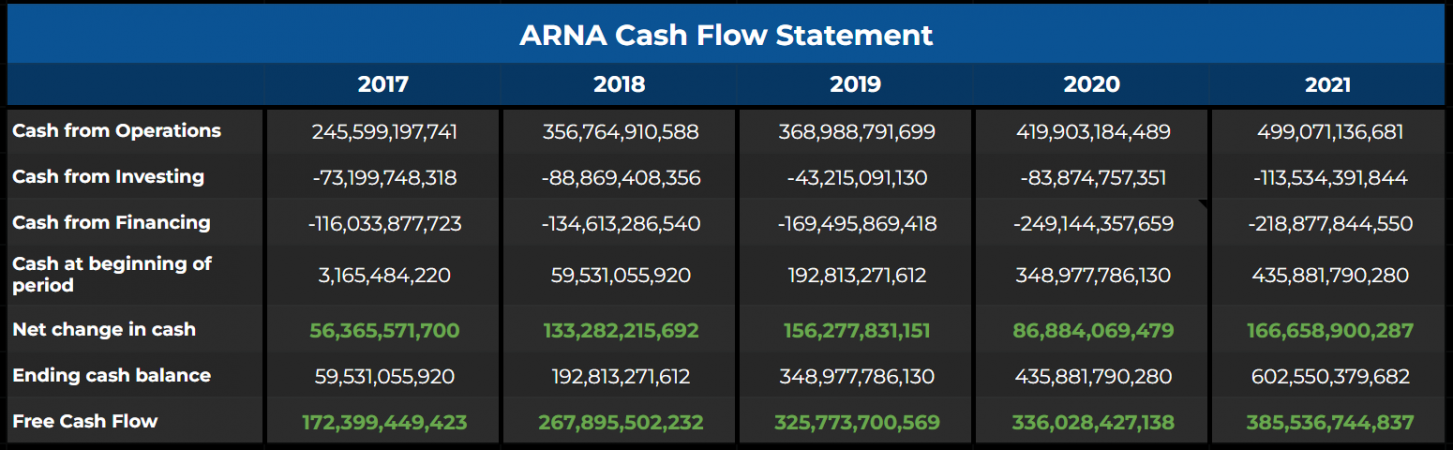

Cash Flow Statement

Another sign of its healthy business, Arwana’s cash flows remained strong in 2021. Free Cash Flow reached IDR 385.5 billion, the highest in at least the past 5 years. Net change in cash was similarly high at IDR +166.7 billion, which boosted an already sizable cash reserves to IDR 602.6 billion.

Its robust cash flows has allowed the company to internally fund the construction of Plant 5C, which will reportedly cost an estimated IDR 300 billion.

Dividends

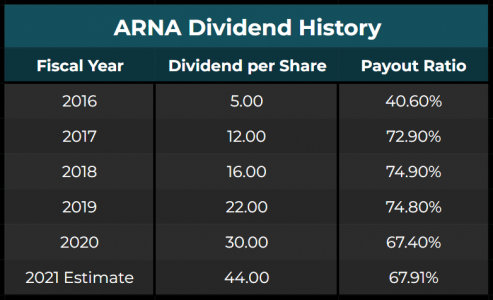

Arwana first paid dividends in 2002, and has been issuing dividends every year since Fiscal Year 2007.

Since 2017, Arwana Citramulia has paid dividends with fairly high payout ratios, ranging from 67% to 74.9%. Dividend per share has increased every year, up to IDR 30 per share for Fiscal Year 2020.

In light of its history, I estimate that the payout ratio will be around 67.91% for Fiscal Year 2021, which amounts to a dividend of IDR 44.00 per share. At a price of IDR 925 per share, this would mean a dividend yield of 4.76%.

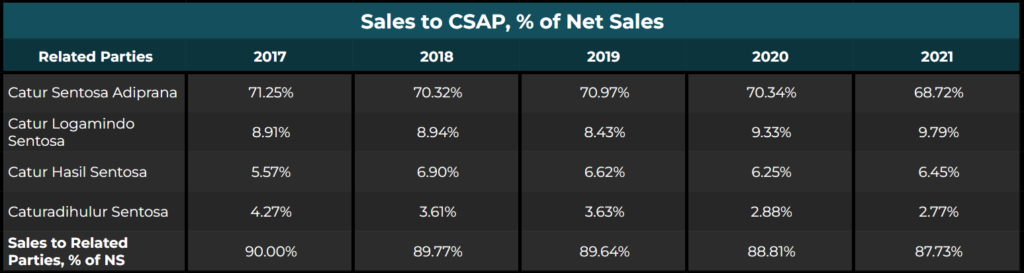

Sales to CSAP

Sales to PT. Catur Sentosa Adiprana Tbk. [CSAP] as a percentage of net sales continue to decrease incrementally (down to 87.73% in 2021 compared to 88.81% in 2020), but still form the vast majority of revenues for Arwana Citramulia.

I previously stated that it was unlikely for the two companies to end their mutually beneficial partnership and indeed, Catur Sentosa Adiprana and Arwana Citramulia have renewed their distribution agreement.

Per ARNA’s 2021 Annual Report, this agreement (which first started in 2001) has been renewed until December 31, 2026. Considering this renewal and their status as related parties (as well as other reasons outlined here), I personally am not too concerned about the company’s sales to CSAP comprising the majority of ARNA’s revenues.

However, potential investors should still take this fact into consideration.

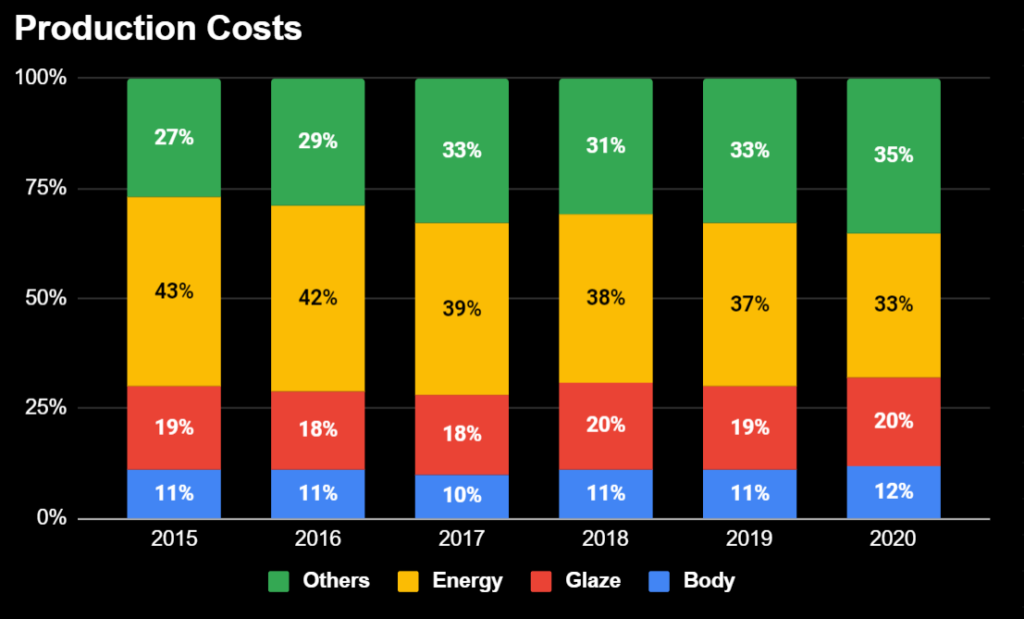

Cost Cutting/Efficiency

According to ARNA’s Annual Report, the company again managed to cut costs and increase production efficiency in 2021.

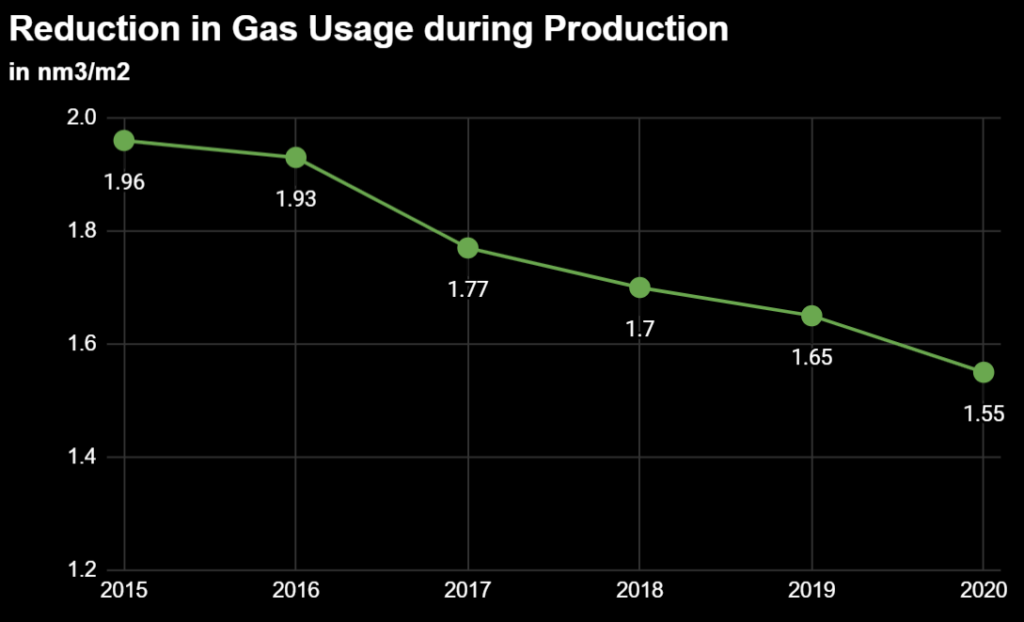

Glaze cost per square meter was 7% more efficient than in 2020, while gas cost per square meter was 19% more efficient.

This follows the reduction in glaze usage in 2020 when the company decreased the amount of glaze used by 3.34% YoY, and in 2019 when it lowered glaze usage by 7.2% YoY.

Management had targeted a reduction in gas usage from 1.55 nm3/m2 in 2020 to 1.50 nm3/m2 in 2021, while it is aiming to further minimize this number to 1.45 nm3/m2 in 2022. It is estimated that a reduction of 0.1 nm3/m2 of gas used would yield about IDR 27.1 billion in savings.

Management’s Projections for 2022

For this year, management is targeting a net profit of IDR 610 billion or a growth of 30% YoY. Revenue is expected to climb by 8% YoY, while management feels the company can achieve a sales volume of 72 million sqm (compared to 67.71 sqm in 2021). Additionally, the company estimates ASP to increase by 1.8% in 2022.

Updated Price and Valuation

On February 17th, 2022 ARNA closed at a price of IDR 925 per share, implying a TTM PER of 14.28x.

Considering its strengths and risks, I think that the company should be valued at a forward PER of 16-18x, which translates to IDR 1,329 – 1,495 per share. This means an upside of 43% to 61%, plus an estimated 4.76% dividend yield at current market price.

Using a fairly basic and moderate DCF valuation, I arrived at an intrinsic value of IDR 1,678 per share for ARNA.

Disclaimer & Disclosure

As of February 17th, 2022, I own a small number of shares in ARNA.

Although I try to be as objective as possible in my analysis, some bias may nevertheless be present.

Please seek advice from a finance professional before making any investment decision.

Readers are fully responsible for their own investment decisions, and must do their own due diligence.

I take no responsibility for any losses you may incur based on the information provided.