Industri Jamu Dan Farmasi Sido Muncul [SIDO] Q4 Full Year 2021 Financial Statements

"Revitalized Growth"

Income Statement

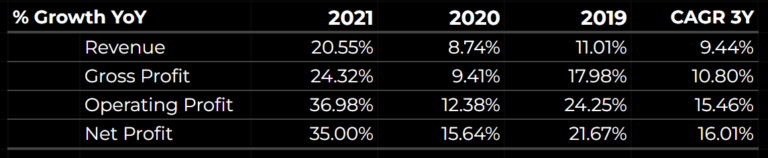

In 2021, Sido Muncul managed to grow its earnings by 35% YoY, from IDR 934 billion in 2020 to IDR 1.26 trillion. The growth in earnings this year was far higher than in 2020 (15.64%) and in 2019 (21.67%). For the last three years, CAGR for earnings stand at a solid 16.01%.

Meanwhile, revenue had increased from IDR 3.34 trillion in 2020 to over IDR 4 trillion in 2021, representing an increase of 20.55% YoY. Revenue growth in 2021 was particularly high, when compared to 2020 (8.74%) and 2019 (11.01%). CAGR for revenue for the last 3 years stand at 9.44%.

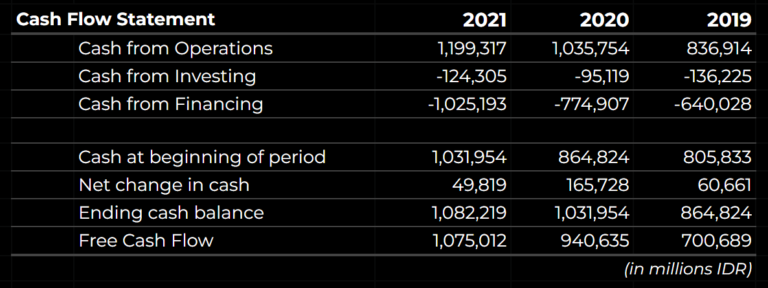

Cash Flow Statement

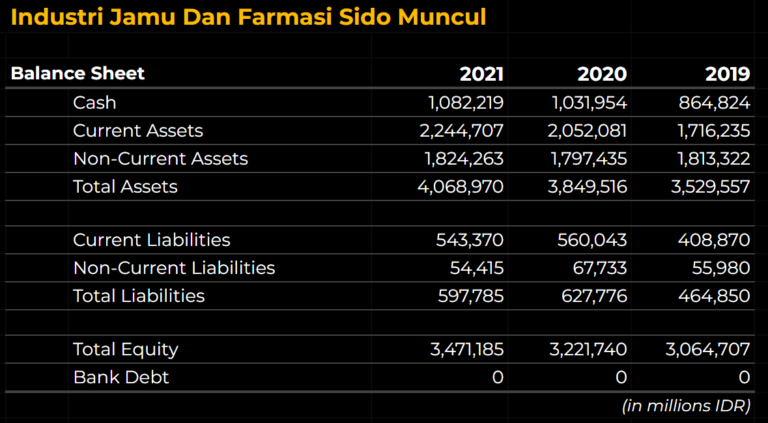

In 2021, Cash from operations increased to IDR 1.2 trillion from IDR 836.9 billion in 2019. Free cash flow stood at IDR 1.075 trillion, while net change in cash in 2021 was IDR 49.8 billion.

Sido Muncul has particularly strong cash flows, with robust, consistently increasing cash from operations and comparatively low CapEx. As a result, the company’s free cash flows are often large and allows it to distribute equally large dividends.

In fact, most of the company’s cash from financing consist of dividend payments, as SIDO’s dividend payout ratio ranges between 80% to 100%.

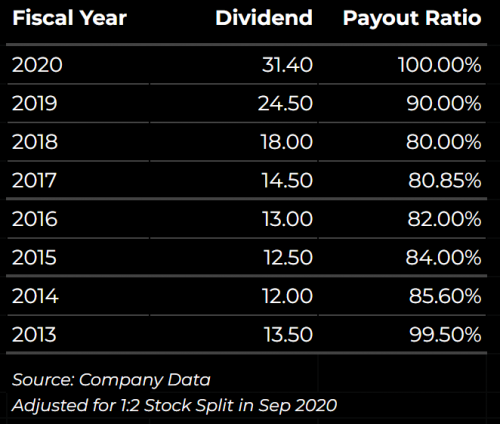

Dividend History

As previously stated, Sido Muncul has a history of paying out dividends with incredibly high payout ratios. Since fiscal year 2014, dividend per share consistently increased every year.

For fiscal year 2020, the company issued dividends totaling IDR 31.4 per share, with a payout ratio of 100% (highest since 2013). At current market prices, SIDO has a good dividend yield of 3.31%.

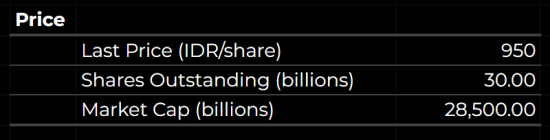

Price and Ratios

As of February 23rd, 2022, Sido Muncul closed at a price of IDR 950 per share. With 30 billion shares outstanding, the company has a market cap of 28.5 trillion.

In 2021, EPS reached IDR 42.03 per share, which translates to a Price-to-earnings ratio of 22.6. Price-to-book value ratio stands at 8.21.

Trailing Price-to-Earnings-to-Growth ratio is fairly low at 0.65, but assuming an earnings growth of 15% YoY for 2022, forward PEG is much higher at 1.31.

Similar to previous years, Debt-to-Equity ratio remains very low at 0.17x.

Closing Remarks

As proven by its financial statements, there’s a lot to like about Sido Muncul. From good earnings growth to strong cash flows, a sizable cash pile, low debt, and large dividends, SIDO looks like an attractive buy from many angles.

Perhaps one drawback to the stock is its current price, which could arguably be seen as expensive using traditional metrics. Currently, SIDO has a high price-to-book value ratio of 8.21x and a PER of 22.6x. Though, given its status as a “wonderful company”, the high price is rather understandable.

What to Read Next

Disclaimer & Disclosure

As of February 23rd, 2022, I do not own any shares in SIDO. However, this may change at any time in the future.

Although I try to be as objective as possible in my analysis, some bias may nevertheless be present.

Please seek advice from a finance professional before making any investment decision.

Readers are fully responsible for their own investment decisions, and must do their own due diligence.

I take no responsibility for any losses you may incur based on the information provided.