Vale Indonesia [INCO] Q4 Full Year 2021 Financial Statements

"Soaring Nickel Prices and Profits"

Balance Sheet

In 2021, Vale Indonesia has increased its cash levels to USD 508 million, or about 20.56% of total assets. The previous year, cash represented around 16.79% of total assets (at USD 388 million).

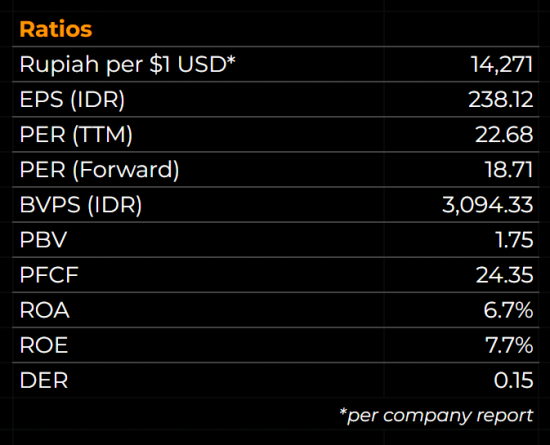

Meanwhile, total liabilities increased by 8.19% YoY to USD 318 million. With total equity at USD 2.15 billion, Debt-to-Equity ratio remains at a low 0.15x.

Income Statement

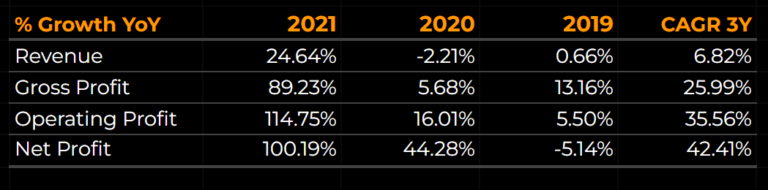

In 2021, Vale Indonesia managed to grow its earnings by 100.19% YoY, from USD 82.8 million in 2020 to USD 165.8 million. The growth in earnings this year was far higher than in 2020 (44.28%) and in 2019 (-5.14%). For the last three years, CAGR for earnings stand at a high 42.41%.

Meanwhile, revenue had increased from USD 764.7 million in 2020 to over USD 953.2 million in 2021, representing an increase of 24.64% YoY. Revenue growth in 2021 was particularly high, when compared to 2020 (-2.21%) and 2019 (0.66%). CAGR for revenue for the last 3 years stand at 6.82%.

Vale Indonesia’s profit margins experienced significant increases in 2021, with net profit margin increasing to 17.39% from 10.83% in 2020. Additionally, gross profit margin increased to 24.69% from 16.26%, while operating profit margin increased to 23.4% from just 13.58% in 2020.

Dividend History

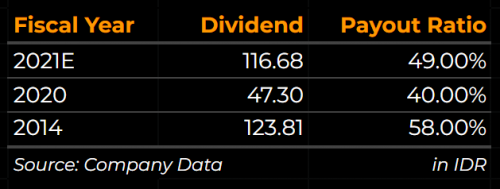

Vale Indonesia does not have an extensive dividend history. For fiscal year 2020, the company paid out a dividend of IDR 47.3 per share, which represents a payout ratio of 40%. Prior to 2020, the last time the company issued dividends was for fiscal year 2014, when it paid out IDR 123.81 per share (DPR = 58%).

If the company pays out dividends for fiscal year 2021, assuming a payout ratio of 49%, dividend per share should reach IDR 116.68.

Price and Ratios

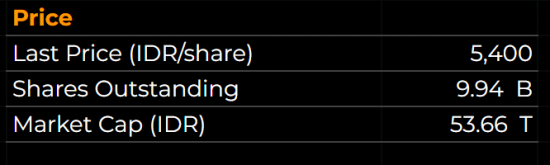

As of February 25th, 2022, Vale Indonesia closed at a price of IDR 5,400 per share. With 9.94 billion shares outstanding, the company has a market cap of 53.66 trillion.

In 2021, EPS reached IDR 238.12 per share, which translates to a TTM Price-to-earnings ratio of 22.68. Assuming 2022 EPS reaches IDR 288.62, Vale Indonesia has a forward PER for 18.71. Price-to-book value ratio stands at 1.75.

Similar to previous years, Debt-to-Equity ratio remains very low at 0.15x.

Closing Remarks

Profiting off of soaring nickel prices, Vale Indonesia [INCO] has enjoyed incredibly high earnings growth in 2020 and 2021. Its profit margins have significantly improved, and increases in free cash flow has likely allowed the company to issue dividends after many years of not doing so.

The company has also done a good job of keeping the balance sheet clean, with currently no bank debt and a low debt-to-equity ratio.

Perhaps as a result of its high earnings growth in the last two years and confidence in future demand for nickel, the market has priced the stock at IDR 5,400 per share, at a trailing PER of 22.68.

Furthermore, as some sources point out, the conflict between Russia and Ukraine could cause supply issues, which would increase the price of nickel even more.

Although the stock is seemingly priced at a premium, the above reasons, especially increasing demand from the electric battery industry, could prove the valuation to be more than reasonable.

Disclaimer & Disclosure

As of February 26th, 2022, I do not own any shares in INCO. However, this may change at any time in the future.

Although I try to be as objective as possible in my analysis, some bias may nevertheless be present.

Please seek advice from a finance professional before making any investment decision.

Readers are fully responsible for their own investment decisions, and must do their own due diligence.

I take no responsibility for any losses you may incur based on the information provided.