[BYAN] Investor sells off entire stake in Bayan Resources, presumably to controlling shareholder

Investor Sold Off 5.96% Stake in Bayan Resources

In filings made to the Indonesian stock exchange, it has been revealed that Engki Wibowo, an investor who owned a 5.96% stake (over 198 million shares) in Bayan Resources, has sold all his shares in the company on March 15th, 2022. The purpose of the transaction as stated in the filing was simply “divestasi” (divestment).

Interestingly, the price at which he sold his stake was much lower than the current market price of BYAN. As stated in the documents, the investor sold his shares at a price of IDR 6,488 per share, a discount of over 84% compared to the current market price of BYAN at IDR 40,900 per share.

The relatively low liquidity of Bayan’s shares in the market could be a possible explanation for the deep discount at which the investor sold off his shares.

Shares Presumably Sold to Controlling Shareholder

Presumably, Engki Wibowo sold his shares to Bayan Resources’ President Director and controlling shareholder, Dato’ Dr. Low Tuck Kwong. In a separate filing, the controlling shareholder reported that he purchased 198,707,500 shares, exactly the same number of shares that Engki Wibowo sold. The purchase was made on the same day (March 15th, 2022), and at the same price (IDR 6,488 per share) as Mr. Wibowo’s transaction.

As of March 16th 2022, there were no fillings or reports to suggest that Jenny Quantero, one of Bayan’s directors and wife of Engki Wibowo, sold her shares in Bayan Resources along with her husband. Reportedly, she owns a 2.98% stake (99,497,500 shares) in BYAN, as of February 28th, 2022.

Bayan Resources' Performance Until Q3 2021

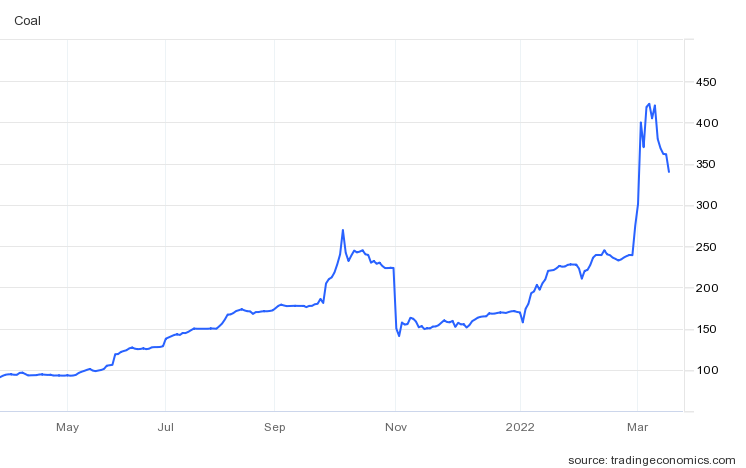

Similar to most coal mining companies, Bayan Resources benefited greatly from coal’s climb to all time high prices.

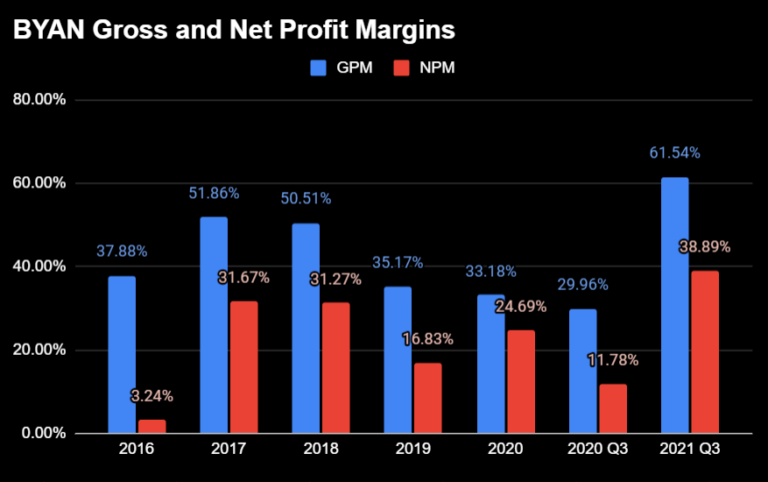

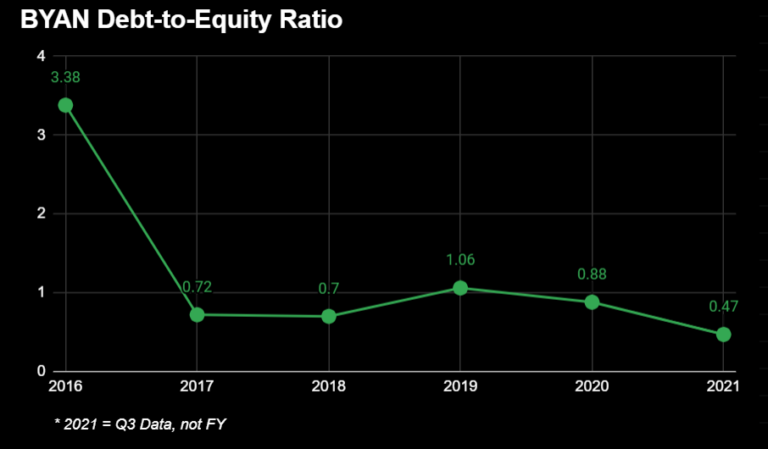

In Q3 2021, Bayan Resources reported that revenue grew by 74% to USD 1.74 billion, compared to 1 billion in Q3 2020. In the same period, its gross and net profit grew by 258% and 475%, respectively. Also, the company’s gross and net profit margins improved drastically, to 61.54% and 38.89% in Q3 2021. As of Q3 2021, Debt-to-Equity ratio stands at 0.47x, compared to 0.88x in 2020.

What to Read Next

How The Ukraine Conflict May Impact Mark Dynamics Indonesia

Mark Dynamics Indonesia [MARK]: Profits Rose by 171% in 2021; Revenue Up 111%

Mitrabara Adiperdana [MBAP]: Profits Increased Over 266% In 2021; Revenue Up 54%

Cisarua Mountain Dairy [CMRY]: Profits Up 346% in 2021; Revenue Up 119%

Indo Tambangraya Megah [ITMG] Announces Final Dividend For 2021

Disclaimer & Disclosure

As of March 17th, 2022, I own a small number of shares in BYAN.

Although I try to be as objective as possible in my analysis, some bias may nevertheless be present.

Please seek advice from a finance professional before making any investment decision.

Readers are fully responsible for their own investment decisions, and must do their own due diligence.

I take no responsibility for any losses you may incur based on the information provided.

![Mark Dynamics Indonesia [MARK]: Profits Rose by 171% in 2021; Revenue Up 111%](https://chasingcuan.com/wp-content/uploads/2022/04/gloves-medical-gloves-medical-supply-5083792.jpg)

![Mitrabara Adiperdana [MBAP]: Profits Increased Over 266% In 2021; Revenue Up 54%](https://chasingcuan.com/wp-content/uploads/2022/03/industry-dumper-minerals-2023592.jpg)

![Cisarua Mountain Dairy [CMRY]: Profits Up 346% in 2021; Revenue Up 119%](https://chasingcuan.com/wp-content/uploads/2022/03/strawberry-dessert-strawberries-blackberries-2191973.jpg)

![Indo Tambangraya Megah [ITMG] Announces Final Dividend For 2021](https://chasingcuan.com/wp-content/uploads/2022/02/mining-excavator-electric-bucket-wheel-excavator-1736289.jpg)