How The Pandemic Is Fueling Growth For Mark Dynamics Indonesia

"Supply shortage + Rising Prices = High Profits"

Background

As a result of the COVID pandemic, the need for personal protective equipment (PPEs) such as disposable gloves has dramatically increased worldwide.

Gloves are especially important for frontline medical workers, many of whom use two pairs at once and switch the outer pair when treating new patients. In addition, demand for PPEs have also surged in many other industries, from hotels to restaurants and cafes.

While the COVID pandemic may soon transition to an endemic, there remains the possibility for new strains of the virus to emerge. As we have seen with Delta and Omicron, new variants have a chance of triggering more waves of infections, which would induce spikes in demand for PPEs.

Thus, protective measures such as wearing masks and disposable gloves would probably continue to be implemented indefinitely.

COVID's Positive Impact

Demand Spike Led to Glove Shortages

As previously stated, the global demand for disposable gloves, especially medical gloves, has risen sharply as a result of the COVID pandemic. In 2020, MARGMA estimated that global demand was around 460 billion gloves, but supply was only around 360 billion. Thus, there was an estimated shortage of 100 billion gloves, even with many companies rushing to ramp up production.

In 2021, it is estimated that global demand would be around 500 billion gloves, with a shortage of 80 billion, as glove manufacturers are still struggling to fulfill demand. Gloves currently in production have already been bought and paid for by customers, and there is a long waiting line, despite manufacturers producing at 100% capacity.

Notably, experts estimate that the shortages experienced in the glove industry will only subside after 2022.

Even after the pandemic is over, demand for gloves is expected to grow at a rate of 12-15% per annum, higher than pre-pandemic rates of 8-10%. Among the factors that would drive this higher growth rate is the likely increase in glove usage for businesses such as Cafes and Restaurants.

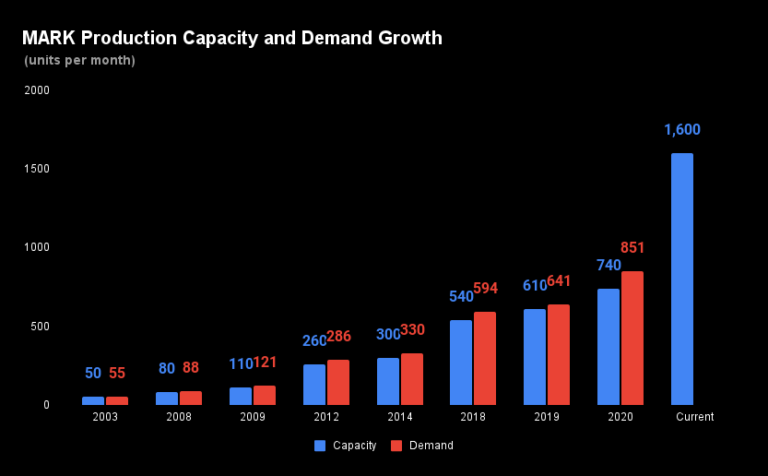

For Mark Dynamics Indonesia, this demand spike for gloves has also meant increased demand for hand formers, which are the molds used to produce gloves. As a prominent manufacturer of hand formers, Mark Dynamics was well positioned to benefit from the sudden growth in demand in 2020 and 2021.

How Mark Captured the Increase in Demand

Largest Production Capacity in the World

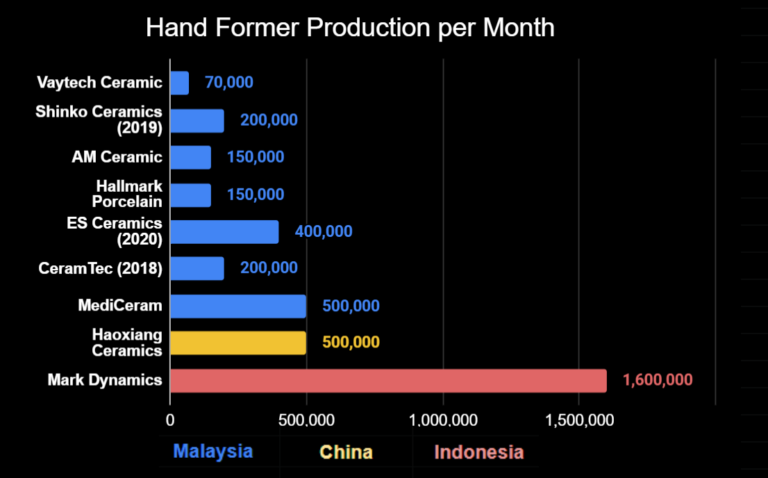

[the graph above shows some of the largest companies in the industry, by production capacity. There are Malaysian SME manufacturers not listed on the graph, each with estimated production capacities of 10,000 to 100,000 per month, however it’s hard to say how many of these companies there are. ]

To capitalize on the COVID-induced demand boom for hand formers, Mark Dynamics rapidly increased its production capacity by expanding its factories during the pandemic. Previously, the company already had an impressive production capacity of 740,000 units per month in 2020.

Being the largest company in the industry, Mark Dynamics now has a production capacity of 1.6 million hand formers per month, as of late 2021. Moreover, It is targeting a capacity of 1.8 million pieces per month by the end of 2021.

As Mark Dynamics has a production capacity more than triple its closest competitor, along with 50% market share for nitrile glove hand formers, it’s reasonable that many glove manufacturers are likely to depend on MARK to supply hand formers.

Expanding to More Countries

Aside from increasing its production capacity, the company has also successfully attracted new clients overseas.

Reportedly, Mark Dynamics gained 3 new customers in China in 2020 and the country represented 15% of total revenues for the company. It predicts that China will form 20-25% of total revenues in the future, as it seeks to expand its business in that region.

In 2021, MARK continued to diversify its customer base and started to export to India and the US. According to management, the company will fulfill orders from 13 US-based customers in 2022, up from 3 the previous year.

The Results

High Growth in Revenues and Profits

As the disposable glove and hand former industries experienced a boom, the surge in demand resulted in soaring prices for both products. According to their 2020 Annual Report, Mark Dynamics’ average selling price for their hand formers rose by around 15% in 2020.

Driven by shortages and rising ASPs, Mark Dynamics reported record high revenues and profits in 2020. That year, revenue grew by 56.4% YoY to IDR 565.4 billion, while net profit rose by 63.85% to 144.2 billion. Compared to 2019, where revenues grew by only 11% and net profit by just 7.44% YoY, the company’s performance in 2020 represented a vast improvement in growth.

In the last 5 years, Mark Dynamics has performed incredibly well. Revenues grew at a 5Y CAGR of 22.23%, while its 5Y CAGR for net profits stands at an impressive 49.07%.

Continuing that performance in Q3 2021, the company’s revenue increased by 141.57% to IDR 832.1 billion, while profits increased by 203.68% YoY to 276.2 billion. According to their Public Expose, management predicts that revenues will grow by 100% and profits by 127% for the year 2021.

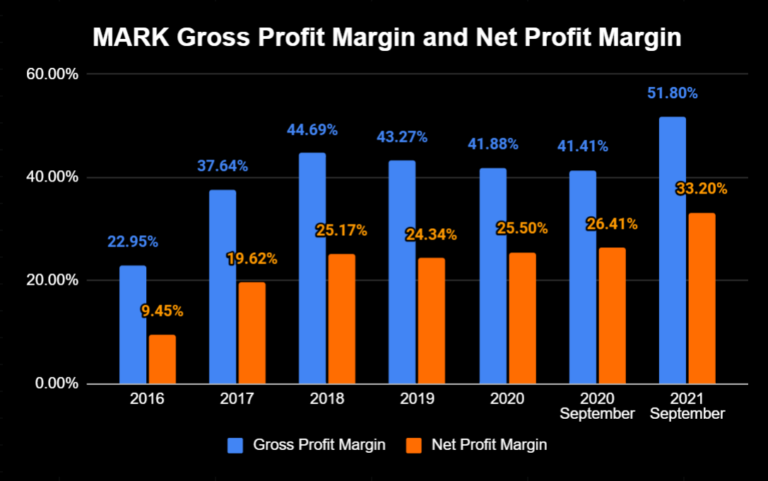

Higher Profit Margins

In addition to its growth in revenues and profits, the company’s margins have also risen thanks to the rising demand for PPEs during the pandemic. Gross profit margin increased to 51.8% in Q3 2021, while net profit margin rose to 33.2%.

Prior to the pandemic, the company’s margins were already great.

Although in 2016 its Gross profit margin was just around 22% and its net profit margin was a little under 10%, the company made significant advances. From 2017 to 2020, the company’s margins were consistently high. Gross profit margin ranged from 37.6% to 44.69%, while net profit margin ranged from 19.6% to 25.5%.

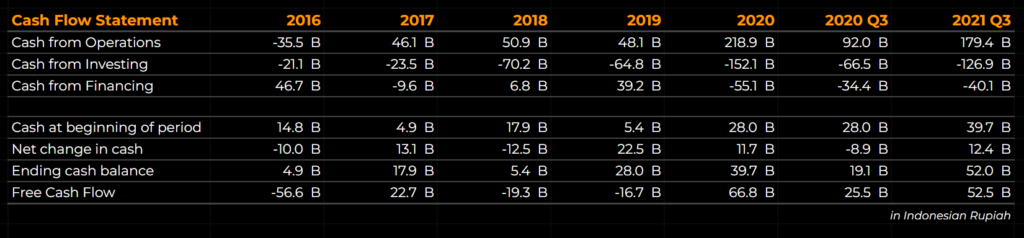

Improved Cash Flows

Although Mark Dynamics reported negative free cash flow in 2018 and 2019, the increase in revenues in 2020 and 2021 have improved the company’s cash flows. Despite CapEx rising significantly during the pandemic as Mark Dynamics rushed to increase its production capacity, the company had positive free cash flow of IDR 66.8 billion in 2020, while in Q3 2021 it reported a positive FCF of 52.5 billion.

Higher Dividend Payout Ratio

Since its IPO in 2017, Mark Dynamics Indonesia has paid out dividends every fiscal year. Issued in 2021, the dividends for fiscal year 2020 were IDR 15 per share, representing a payout ratio of 40% and a yield of around 1.4% at current market prices (as of February 24, 2022).

The increase in payout ratio from 30% in fiscal year 2019 to 40% in fiscal year 2020 probably reflects the high increase in revenues and growth that Mark Dynamics experienced during the first year of the pandemic. As the company is expected to report even higher earnings growth for 2021, it’s reasonable to expect a similarly high dividend payout ratio for the year.

Assuming that MARK issues dividends for fiscal year 2021 with a payout ratio of 40% and that it has an estimated EPS of 96.93 for the year, the dividend per share would reach IDR 38.77. This would imply a yield of 3.73% at the current price of IDR 1040 per share (February 24, 2022).

Closing Remarks

With a strong catalyst behind it, Mark Dynamics is a fast-growing company and market leader among hand former manufacturers.

Quick to seize the sudden surge in demand arising from the pandemic, it has enjoyed impressively high growth in earnings in 2020 and 2021. With rising average selling prices pushing profit margins higher than ever and its improved cash flows, Mark Dynamics is in its prime.

While it is incredibly unlikely for the company to repeat the sky-high growth levels it saw in the last two years as supply in the glove industry is catching up with demand, the company’s earnings should still grow at a fast rate in 2022 and at a decent rate in 2023 and beyond.

Disclaimer & Disclosure

As of March 4th, 2022, I own a small number of shares in MARK.

Although I try to be as objective as possible in my analysis, some bias may nevertheless be present.

Please seek advice from a finance professional before making any investment decision.

Readers are fully responsible for their own investment decisions, and must do their own due diligence.

I take no responsibility for any losses you may incur based on the information provided.