Mark Dynamics Indonesia [MARK]: Profits Rose by 171% in 2021; Revenue Up 111%

"An Exceptional Year"

Balance Sheet

Bolstered by record-high demand for its hand formers, 2021 was a stellar year for Mark Dynamics Indonesia. As the need for disposable gloves rose globally due to COVID, so did the need for hand formers, the molds used in producing gloves. Fortunately for the company, Mark Dynamics Indonesia was able to capture that spike in demand and profited handsomely.

In 2021, Mark Dynamics Indonesia recorded a high level of growth in its assets. Specifically, cash/cash equivalents grew to over IDR 104 billion from 39.7 billion in 2020, while total assets reached over 1 trillion.

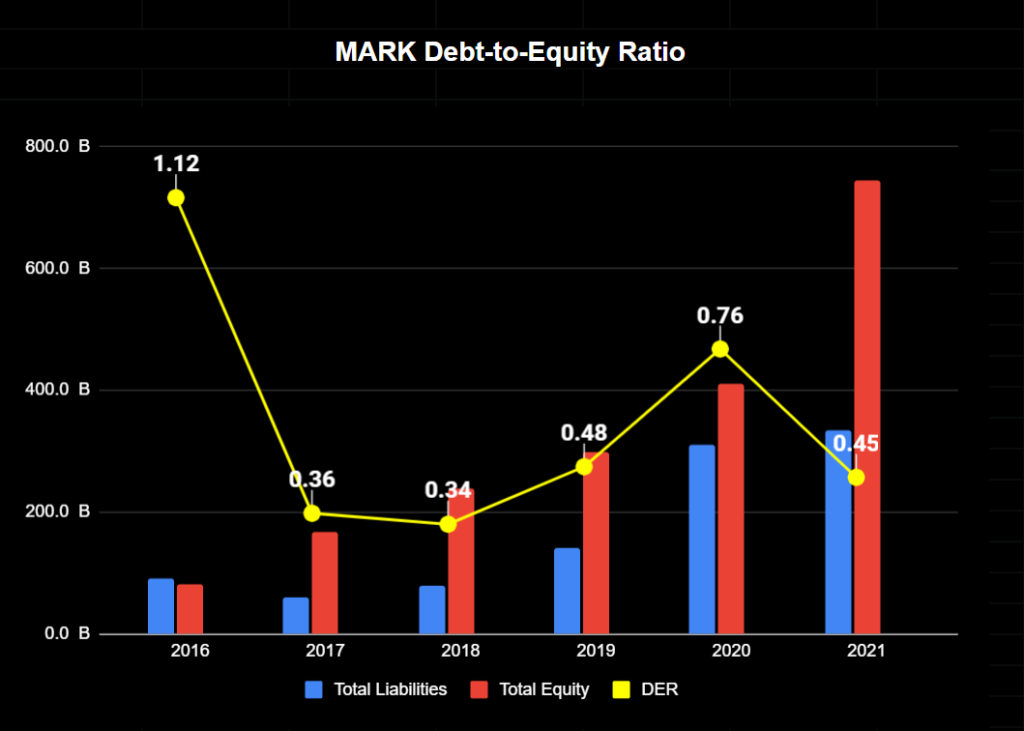

Since the company had to rapidly grow its production capacity to fulfill demand, total liabilities increased significantly in 2020. Last year, management diligently used some of the company’s rising cash flows to pay off part of its bank debt. This is despite the company raising capex again in 2021.

As a result, Mark Dynamics Indonesia’s debt to equity ratio improved significantly to 0.45 from 0.76 in the previous year. The company’s current and quick ratios also improved.

Income Statement

Due to the unprecedented demand for hand formers in 2021 and Mark Dynamics’ successful ramp-up in production capacity, the company was able to increase its sales by 111% YoY. Earnings grew by an impressive 171% to over IDR 392.1 billion, compared to 63% in 2020.

As a result, Mark Dynamics’ return on assets rose to 36%, a great improvement from 2020 (20%). Since the company managed to decrease the amount of liabilities it had while increasing its assets, its return on equity grew to over 52% in 2021.

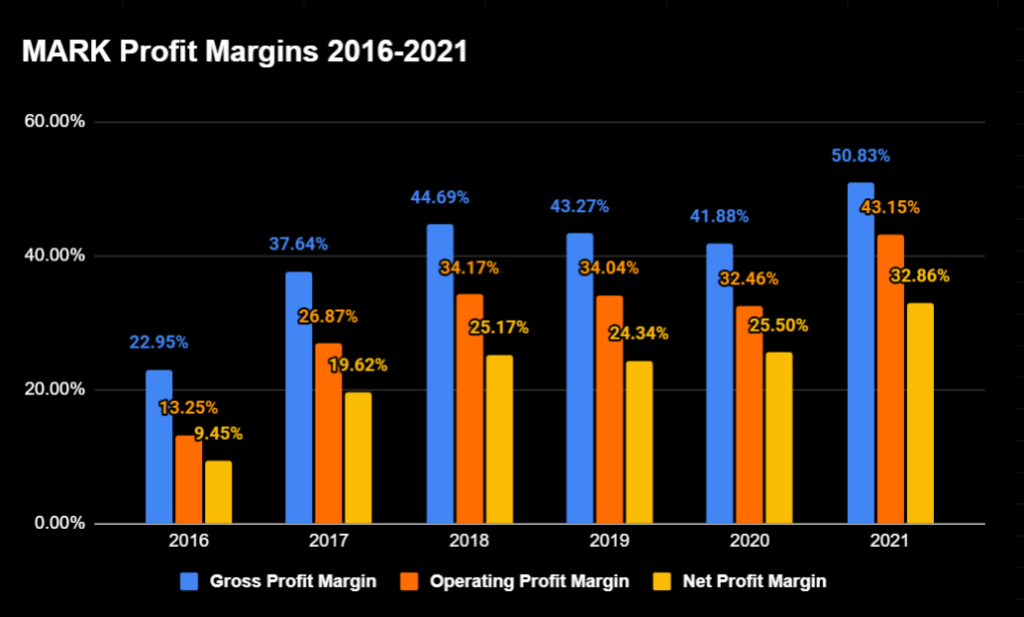

In addition, Mark Dynamics saw a tremendous improvement in its profit margins during the year. In fact, MARK’s profit margins reached peak historical level in 2021. Gross profit margin rose to 50%, while operating margin increased to 43%. Net profit margin stood at an impressive 32% compared to 25% in 2020.

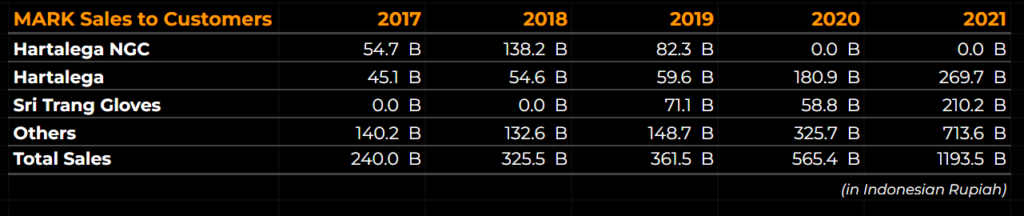

Sales Breakdown

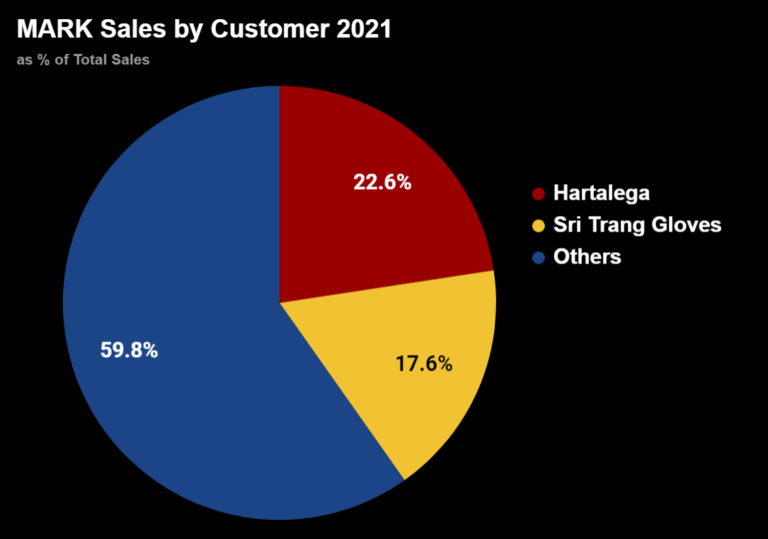

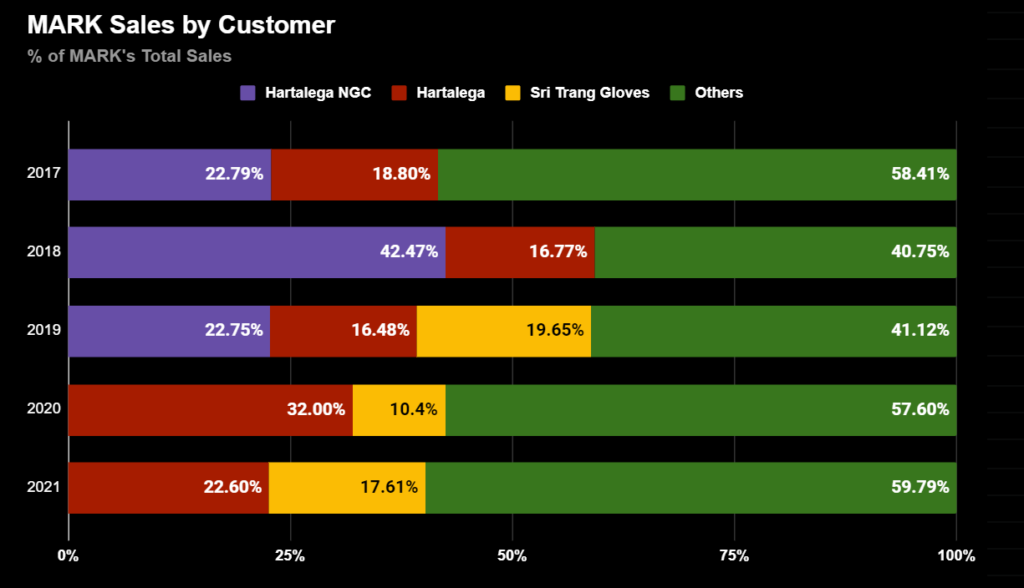

Comprising 22.6% and 17.6% of Mark Dynamics’ sales for 2021 respectively, Hartalega (Malaysia) and Sri Trang Gloves (Thailand) remain the company’s biggest customers. Together, they make up roughly 40% of total sales for Mark Dynamics.

However, these two companies accounted for smaller portions of total sales compared to 2019, when together they formed around 59% of sales for Mark Dynamics. In particular, despite sales to Hartalega increasing in 2020 and 2021, its portion of Mark Dynamics’ total sales decreased in both years.

In 2018, around 60% of Mark Dynamics’ revenues came from Hartalega, while in 2019, it dropped to roughly 40% of total sales. The figure decreased further in 2020 to 32%, and to 22.6% in 2021.

While Hartalega and Sri Trang remains its largest customers, we can reasonably conclude that Mark Dynamics has been successful in diversifying its customer base. Since these two companies are the only customers that represent 10% or more of total sales for MARK, we can assume that Mark Dynamics has at least 6 other customers.

This is consistent with previous statements by the company’s management, which claimed that Mark Dynamics acquired clients in China, India, and the US.

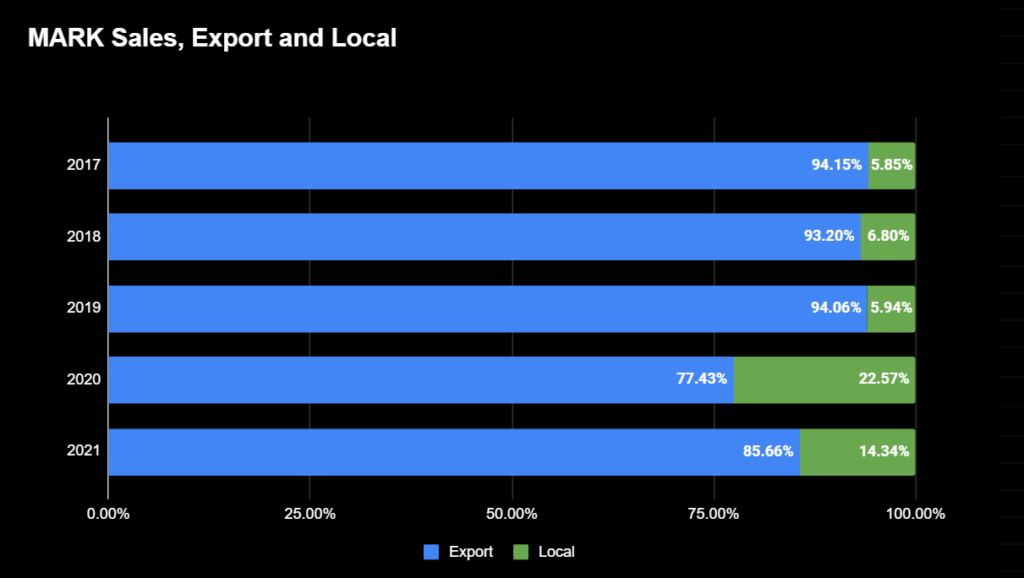

Most of the revenues for Mark Dynamics still come from exports, with the domestic market comprising 14% of total sales in 2021. However, this figure may be a bit misleading as it includes non-hand former revenues (Mark Dynamics also sells toilets). Similar to previous years, virtually all of the company’s hand formers are exported.

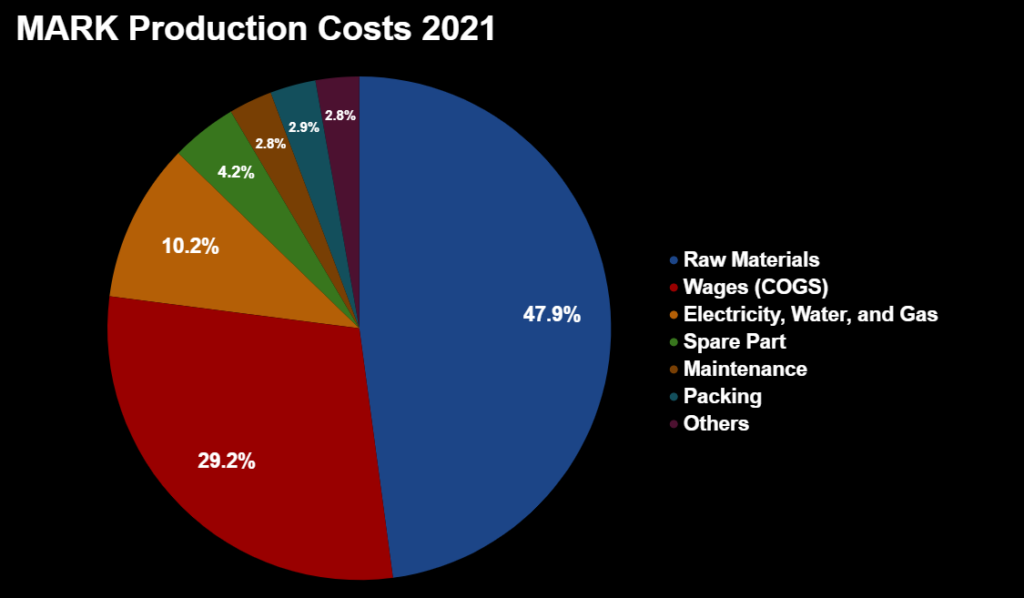

Production Costs

Like previous years, the three major components of production costs for Mark Dynamics Indonesia are: Raw Materials, Wages, and Electricity, Water, and Gas Costs. These costs comprise similar portions of total production costs as previous year.

However, the cost of Spare Parts have increased in proportion in 2021, accounting for an estimated 4.2% of total production costs (at 26.3 billion). Previously, Packing was the fourth largest cost behind Electricity, Water, and Gas. Spare Part cost likely rose as a result of the rapid expansion of the company’s production capacity in 2021.

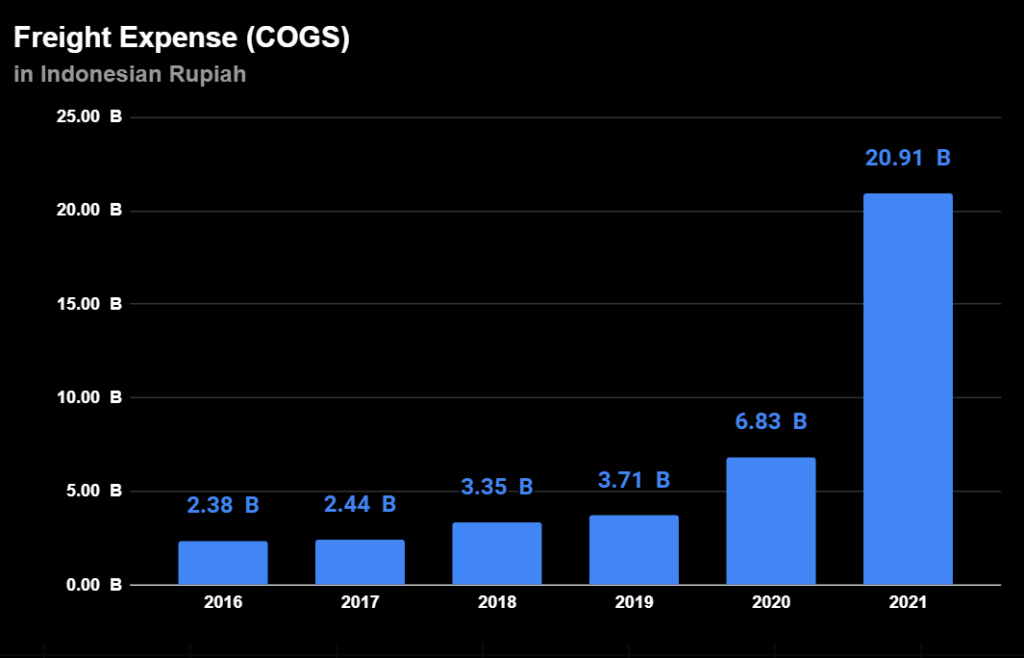

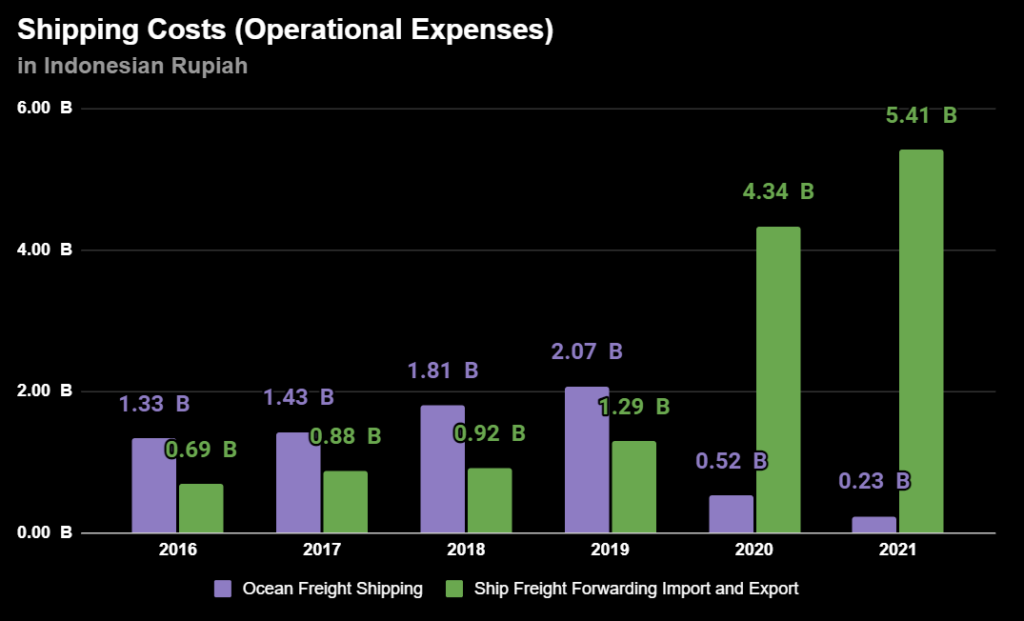

Shipping Costs

Despite freight expense increasing by over 200% in 2021, it still represented just a small portion of total production costs for Mark Dynamics Indonesia (3.48%).

Meanwhile, Ocean Freight Shipping costs continued to decrease in 2021, forming 0.25% of total operational expense. Ship Freight Forwarding Import and Export costs, on the other hand, increased to 5.41 billion. Although it may sound like a large amount, it made up only 5.91% of total operational expenses.

While rising shipping fees will likely impact the company’s profitability, larger costs such as Raw Materials and Wages are still far more influential to Mark Dynamics Indonesia’s bottom line. As such, I do not consider increases in shipping costs to be a significant risk for Mark Dynamics Indonesia.

Subsidiary Performance

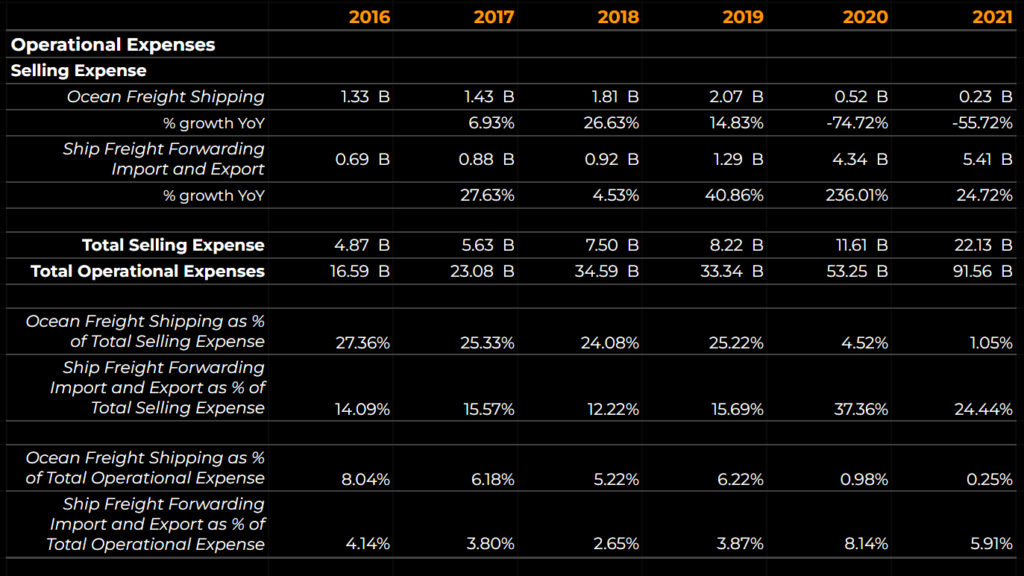

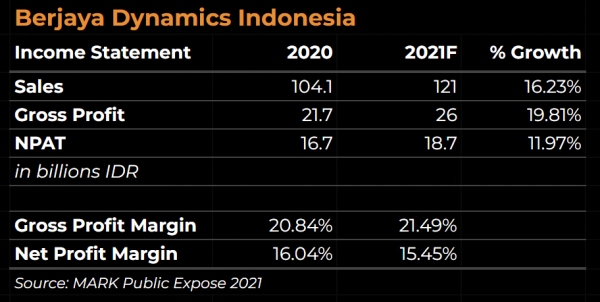

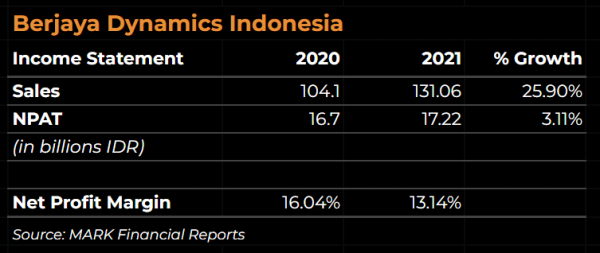

Berjaya Dynamics Indonesia, the subsidiary that Mark Dynamics Indonesia acquired in 2020, recorded 131.06 billion in sales in 2021. This is a much higher number than the company had forecasted, representing a 25.9% growth YoY.

However, the subsidiary’s net profits grew at a much lower rate than anticipated, rising by just 3% compared to 2020. Berjaya Dynamics Indonesia’s net profit margin fell to 13.14% in 2021.

Despite the subsidiary’s slower than expected growth, the acquisition is likely to reach its break-even point in the next two years at this rate. Mark Dynamics Indonesia had acquired Berjaya Dynamics Indonesia and BDI’s subsidiary, Agro Dynamics Indonesia in 2020 for IDR 70 billion.

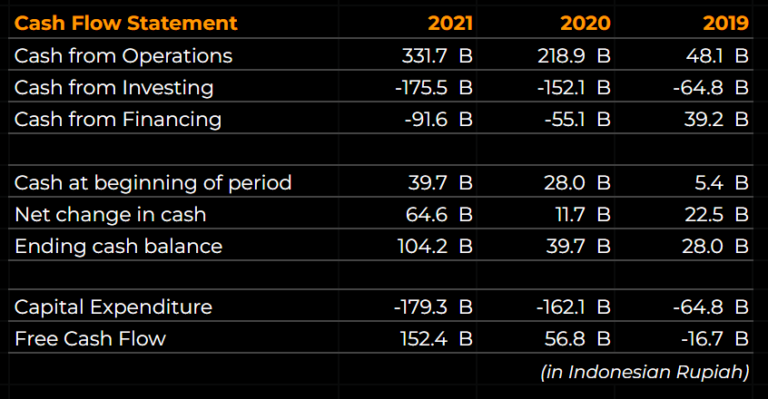

Cash Flow Statement

If we look at the amount of cash Mark Dynamics Indonesia received from its customers, we can see that the company is generally able to collect all of its earnings. From 2019 to 2021, CFO has consistently increased annually.

Likewise Free Cash Flow, which had been negative in 2019, has continuously risen. Mark Dynamics Indonesia recorded free cash flow of 152.4 billion in 2021, despite a rise in capital expenditure.

Looking ahead, free cash flow is likely to improve further in 2022, as Mark Dynamics Indonesia announced a much smaller CapEx budget of 20 billion for the year.

The larger capital expenditures in 2021 and 2020 were necessary to fund the company’s rapid expansion in production capacity, which allowed Mark Dynamics to capture the increase in demand for hand formers caused by COVID.

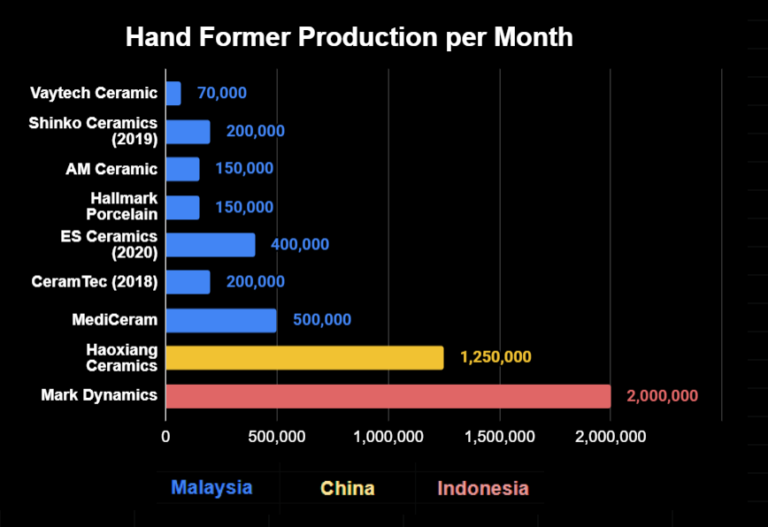

As demand for gloves and hand formers are expected to normalize by the end of 2022, it would make sense if Mark Dynamics does not increase its capacity further. It is already the largest hand former producer in the world by a significant margin, after all.

However, this lower Capital Expenditure budget raises a crucial question: how will Mark Dynamics Indonesia grow in the future?

If in the future it cannot simply increase production capacity to grow its earnings, the company must find other ways to fuel growth. Perhaps Mark Dynamics Indonesia will try to grow its earnings in a similar way to Arwana Citramulia: by improving production efficiency and cutting costs.

Dividend History

Previously, I had expected Mark Dynamics Indonesia to give out roughly 29.07% of its 2021 earnings as dividends (IDR 30 per share). This is more in line with the company’s payout ratio for the last few years.

However, the company has announced its dividend payment for fiscal year 2021 as I am writing this, and the payout ratio is higher than I anticipated. Mark Dynamics Indonesia will give out IDR 51 per share as dividends, or roughly 50% of its earnings for 2021.

At the current price of IDR 1150 per share, this represents a 4.43% yield, an above average figure for the Indonesian stock market. It is a massive improvement over dividends for fiscal year 2020 (IDR 15 per share).

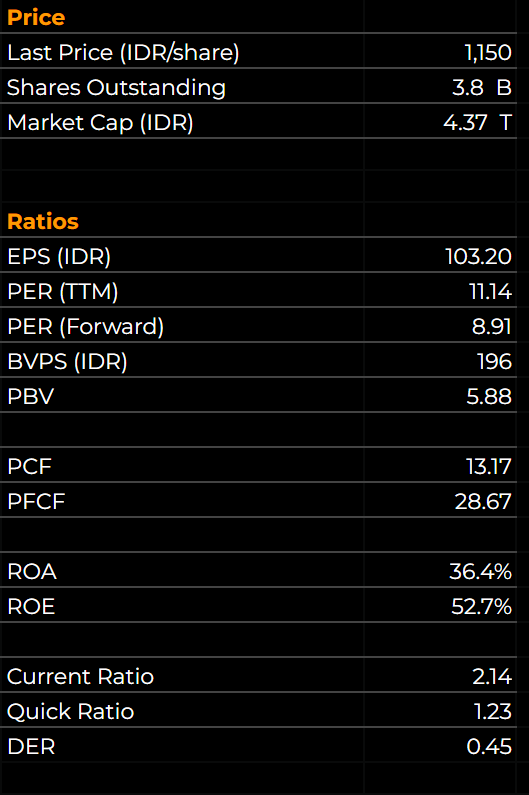

Price and Ratios

On April 7th 2022, Mark Dynamics Indonesia closed at a price of IDR 1,150 per share. At this price, Mark Dynamics Indonesia has a trailing price to earnings ratio of 11.14.

Assuming that earnings will grow by 25% in 2022 (Management is targeting earnings growth of 30%), Mark Dynamics Indonesia is currently trading at a forward PER of 8.91.

I think the company should trade at forward PER of 12 or IDR 1,548 per share. This implies a discount of 34.6% at current price.

Using a DCF valuation with moderate inputs, I arrived at an intrinsic value of IDR 1,819 per share for Mark Dynamics Indonesia. (Discount of 58%)

Closing Remarks

With high earnings growth, great profitability, improving cash flows, and rising dividends, Mark Dynamics Indonesia seems to be an attractive investment. As the largest hand former manufacturer in the world, the dominant players in the global glove industry are likely to continue relying on the company in the future.

Despite a bulk of its revenues still coming from Malaysia, Mark Dynamics Indonesia has made strides in acquiring customers from other countries. This diversification not only reduces the risk of overexposure, but also provides avenues for future growth and expansion.

Although Mark Dynamics Indonesia will likely be able to achieve its target earnings growth of 30% for 2022, whether the company will experience similarly fast growth in the years after is a bit unclear.

It is no secret that the COVID pandemic (along with MARK’s expansion in response to the coronavirus) revitalized the company’s growth in 2020 and 2021. The big question is how the company will maintain this high growth as demand for hand formers normalize.

Perhaps, this uncertainty is why the stock currently trades at a discount.

What to Read Next

How The Ukraine Conflict May Impact Mark Dynamics Indonesia

Mark Dynamics Indonesia [MARK]: Profits Rose by 171% in 2021; Revenue Up 111%

Mitrabara Adiperdana [MBAP]: Profits Increased Over 266% In 2021; Revenue Up 54%

Cisarua Mountain Dairy [CMRY]: Profits Up 346% in 2021; Revenue Up 119%

Indo Tambangraya Megah [ITMG] Announces Final Dividend For 2021

Disclaimer & Disclosure

As of April 5th, 2022, I own a small number of shares in MARK.

Although I try to be as objective as possible in my analysis, some bias may nevertheless be present.

Please seek advice from a finance professional before making any investment decision.

Readers are fully responsible for their own investment decisions, and must do their own due diligence.

I take no responsibility for any losses you may incur based on the information provided.

![Mark Dynamics Indonesia [MARK]: Profits Rose by 171% in 2021; Revenue Up 111%](https://chasingcuan.com/wp-content/uploads/2022/04/gloves-medical-gloves-medical-supply-5083792.jpg)

![Mitrabara Adiperdana [MBAP]: Profits Increased Over 266% In 2021; Revenue Up 54%](https://chasingcuan.com/wp-content/uploads/2022/03/industry-dumper-minerals-2023592.jpg)

![Cisarua Mountain Dairy [CMRY]: Profits Up 346% in 2021; Revenue Up 119%](https://chasingcuan.com/wp-content/uploads/2022/03/strawberry-dessert-strawberries-blackberries-2191973.jpg)

![Indo Tambangraya Megah [ITMG] Announces Final Dividend For 2021](https://chasingcuan.com/wp-content/uploads/2022/02/mining-excavator-electric-bucket-wheel-excavator-1736289.jpg)