Baramulti Suksessarana [BSSR]: Profits Increased by a Staggering 572% in 2021

"A Mispriced Gem?"

Balance Sheet

In 2021, the amount of cash/cash equivalents and current assets in general on the balance sheet of Baramulti Suksessarana increased significantly. As of December 31, 2021, the company has USD 165.8 million in cash/equivalents (38% of total assets). Compared to the previous year (25.4 million), this represents a growth of 551%.

Although total liabilities increased significantly and pushed the debt to equity ratio to 0.72x, Baramulti Suksessarana’s bank debt amounted to only USD 14.9 million. We also see a very slight improvement in the company’s current ratio (1.6x) and quick ratio (1.48x).

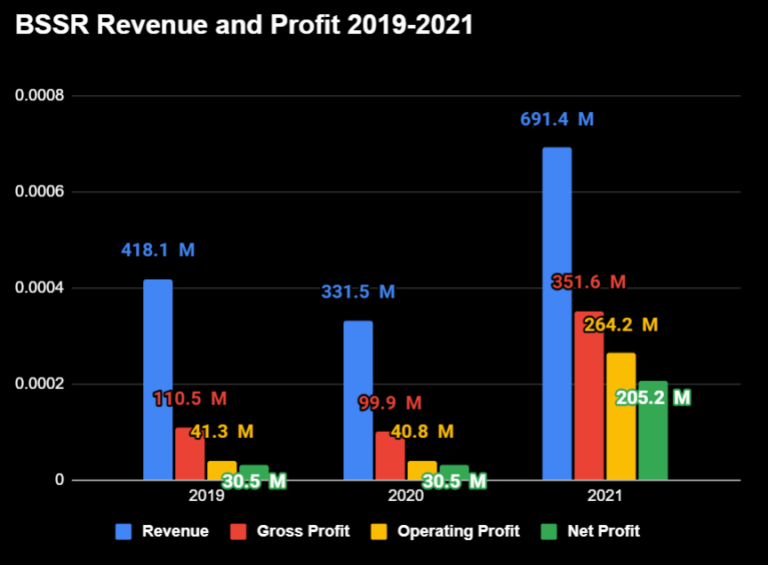

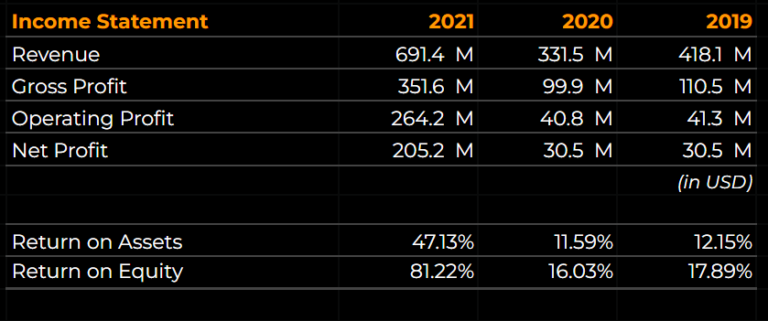

Income Statement

In 2021, Baramulti Suksessarana’s revenue grew by an impressive 108% year-over-year, to USD 691 million. Even more impressively, gross profit grew by 251%, rising from 99.9 million in 2020 to over 351.6 million in 2021. Meanwhile, net profit rose by an incredible 572% YoY, to over 205 million.

As a result of this remarkable growth in profits (and the previously mentioned increase in total liabilities), Baramulti Suksessarana’s Return on Equity rose to 81.22% from 16% in 2020. The company’s return on assets also experienced a sharp rise to 47.13% from 11.59% the previous year.

Baramulti Suksessarana’s net profits has grown at a CAGR of roughly 20% over the past 5 years.

In addition, Baramulti Suksessarana’s profit margins saw significant improvement. In 2021, its operating and net profit margins rose to 38.22% and 29.67%, respectively. Just a year before, operating and net profit margins stood at just 12.32% and 9.21%, respectively. Gross profit margin also significantly improved, from 30.14% in 2020 to 50.86% in 2021.

Compared to the growth in margins seen in 2019, it’s clear that 2021 was a a particularly spectacular year for Baramulti Suksessarana.

Cash Flow Statement

In 2021, cash from operations rose significantly to USD 237 million from just 37.6 million the previous year. Coupled with a much smaller increase in CapEx, the increase in CFO resulted in a large spike in free cash flow for Baramulti Suksessarana. As a result of its large free cash flow, the company ended 2021 with its cash balance being much higher than the year before, at USD 165.8 million.

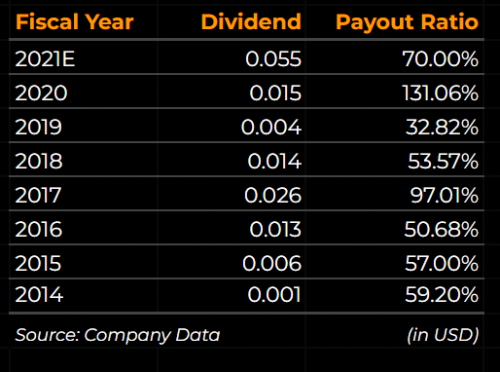

Dividend History

Since fiscal year 2014, Baramulti Suksessarana has been paying dividends annually with varying payout ratios. So far, for fiscal year 2021, Baramulti Suksessarana has issued 2 interim dividends amounting to a total of USD 103 million or approximately 50% of its net profits for the year.

Including the upcoming final dividend, I estimate the total payout ratio for fiscal year 2021 to be around 70%. Total dividend per share should be around USD 0.055 per year, or roughly IDR 783.2 per share. This means final dividend is estimated to be IDR 221.73 per share, for a yield of 6.34% at the current market price of 3,500.

In total, the estimated dividend yield for fiscal year 2021 is a staggering 22.38%, at a price of 3,500 per share.

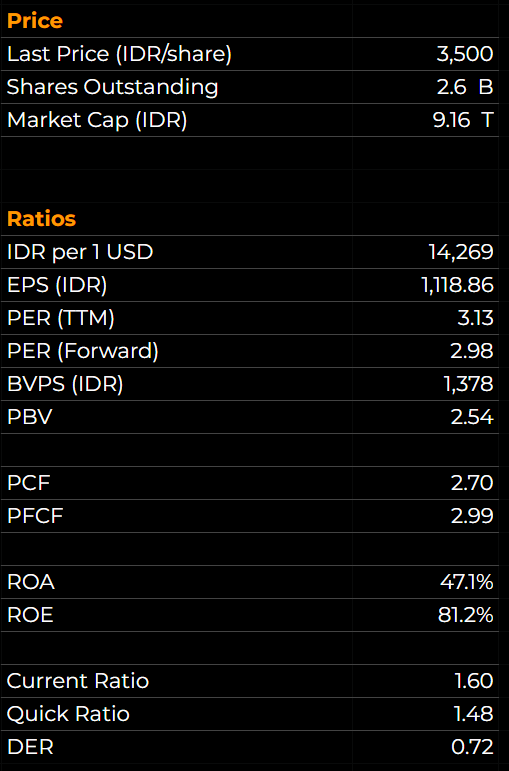

Price and Ratios

As of March 23rd, 2022, Baramulti Suksessarana closed at a price of IDR 3,500 per share. With 2.6 billion shares outstanding, the company has a market cap of 9.16 trillion.

In 2021, Baramulti Suksessarana’s earnings per share reached IDR 1,118.86 , resulting in a trailing price to earnings ratio of just 3.13x. If we estimate that Baramulti Suksessarana’s earnings would grow by just 5% in 2022, then the company would have a forward PER of just 2.98x.

At the current price, Baramulti Suksessarana has a price to book value of 2.54x and a price to free cash flow of only 2.99x. Along with its price to earnings ratio, this indicates that the stock is currently trading at a sizable discount.

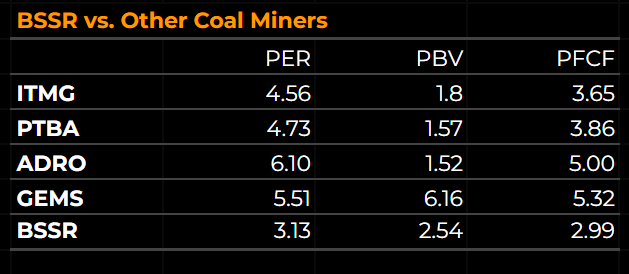

Many companies in the coal industry are currently trading at low ratios, as well. Compared to the companies shown above, Baramulti Suksessarana has the lowest price to earnings ratio and the lowest price to free cash flow ratio.

On average, the other companies trade at a trailing PER of 5.23x. If Baramulti Suksessarana was to trade at that level, the price of the stock would be roughly IDR 5,846 per share. This implies that BSSR is currently trading at a discount of 67%.

Closing Remarks

Along with some other companies in the coal mining industry, Baramulti Suksessarana is profiting handsomely from increasingly expensive coal prices. In addition to a massive rise in profits, the company has also seen an improvement to its cash flows. With a cash/equivalents balance of USD 165.8 million and a history of issuing dividends, investors seeking dividend income may find the stock attractive.

Value hunters may find themselves drawn in as well, since Baramulti Suksessarana currently has one of the cheapest valuations among Indonesian coal miners. Despite the stock already moving up quite a bit since the company released its financial statements, it remains at an undemanding trailing PER of 3.13x and extremely low PFCF of 2.99x.

What to Read Next

How The Ukraine Conflict May Impact Mark Dynamics Indonesia

Mark Dynamics Indonesia [MARK]: Profits Rose by 171% in 2021; Revenue Up 111%

Mitrabara Adiperdana [MBAP]: Profits Increased Over 266% In 2021; Revenue Up 54%

Cisarua Mountain Dairy [CMRY]: Profits Up 346% in 2021; Revenue Up 119%

Indo Tambangraya Megah [ITMG] Announces Final Dividend For 2021

Disclaimer & Disclosure

As of March 23rd, 2022, I own a small number of shares in BSSR.

Although I try to be as objective as possible in my analysis, some bias may nevertheless be present.

Please seek advice from a finance professional before making any investment decision.

Readers are fully responsible for their own investment decisions, and must do their own due diligence.

I take no responsibility for any losses you may incur based on the information provided.

![Mark Dynamics Indonesia [MARK]: Profits Rose by 171% in 2021; Revenue Up 111%](https://chasingcuan.com/wp-content/uploads/2022/04/gloves-medical-gloves-medical-supply-5083792.jpg)

![Mitrabara Adiperdana [MBAP]: Profits Increased Over 266% In 2021; Revenue Up 54%](https://chasingcuan.com/wp-content/uploads/2022/03/industry-dumper-minerals-2023592.jpg)

![Cisarua Mountain Dairy [CMRY]: Profits Up 346% in 2021; Revenue Up 119%](https://chasingcuan.com/wp-content/uploads/2022/03/strawberry-dessert-strawberries-blackberries-2191973.jpg)

![Indo Tambangraya Megah [ITMG] Announces Final Dividend For 2021](https://chasingcuan.com/wp-content/uploads/2022/02/mining-excavator-electric-bucket-wheel-excavator-1736289.jpg)